Master the Calendarization concept so you can use it on the job in Investment Banking, Private Equity, and Investment Management.

In this article, you will learn:

- Why Calendarization matters.

- How to Calendarize Financial data.

- Real-life example: Calendarization for Forward EV/EBITDA Multiples.

Estimated reading time: 11 minutes

- TL;DR

- Want To Learn More About Finance?

- Why Does Calendarization Matter?

- Why don't Fiscal and Calendar Years align?

- A Visual Overview of Calendarization

- How to Calendarize in 2 Steps

- On The Job Example: Calculating Forward Multiples

- Wrap-Up: Calendarization

- About the Author

- Frequently Asked Questions

- Related Links

TL;DR

- Calendarization allows us to compare Financial data for Companies with different Fiscal Year Ends.

- We need to Calendarize because companies can choose reporting periods for their Fiscal Year that do not align with the Calendar Year.

- Calendarization is frequently used to align metrics to calculate Forward Multiples.

Want To Learn More About Finance?

Ramp up faster with all of our (free) deep-dive articles in our Analyst Starter Kit:

Why Does Calendarization Matter?

You’re off to a great start with your new Finance job.

And then your VP stops by and says, ‘Can you put together the forward multiples for the target company…and make sure they’re Calendarized?‘

You give a confident nod…and then scramble to figure out the meaning of Calendarization.

Don’t sweat it! We’ve got you covered!

Calendarization is a critical concept to master if you are aiming for (or working in) Finance.

To master this concept, you will need to understand:

- The underlying meaning of ‘Calendarization’ (Go to section).

- The Calendarization Calculation (Go to section).

- Common uses of Calendarization on the Job (Go to section).

In this article, we will make the definition of ‘Calendarized’ very clear. Then, with a quick read here, you will be able to answer the common questions on this topic:

- What is Calendarization?

- How do you Calendarize Financial data?

- How do we align companies with different Fiscal Years?

Let’s start with how do we define ‘Calendarization?’

The Meaning of Calendarization

In short, a Calendarization is a process of aligning two Companies‘ Fiscal Years (FY) to create a consistent year-end for both companies.

Analysts use Calendarization because the Company Reporting Calendar for many businesses does not align with the standard Calendar Year.

A fair question to ask at this point is, ‘Why don’t all companies just report based on a Calendar Year?’

Let’s jump ahead and see.

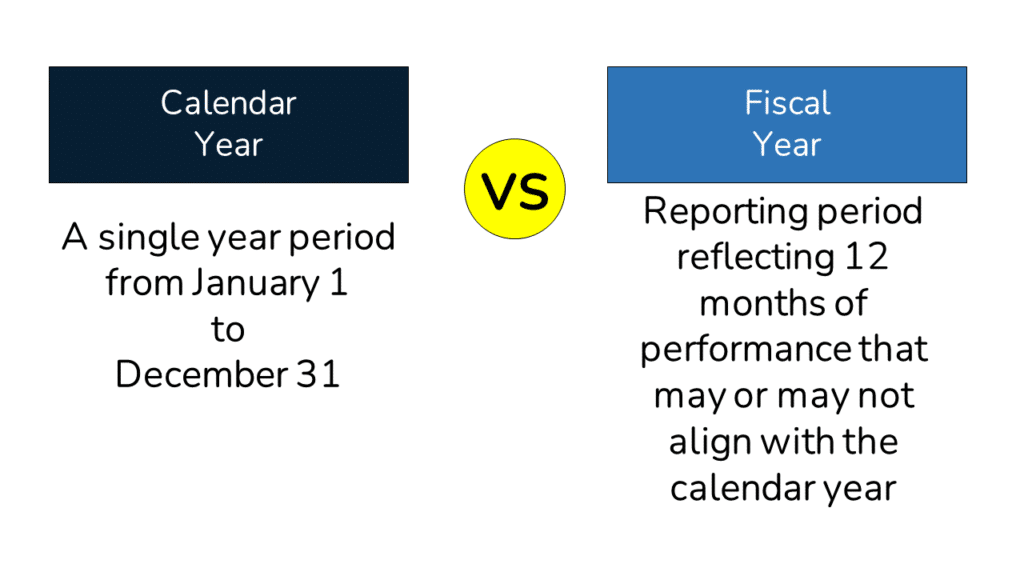

Why don’t Fiscal and Calendar Years align?

As we said above, many companies choose to report their numbers based on Fiscal Years (abbreviated as ‘FY’ in Finance) that do not align with the Calendar Year (abbreviated as ‘CY’ in Finance).

But, how do we explain Fiscal Year ends that don’t align with the Calendar Year?

The short story is that Companies typically choose a Non-Calendar Year-End to align with the flow of their business.

In short, if there are recurring, significant intra-year spikes in business within a year (i.e. Seasonality), companies often aim to report after the largest period ends.

It is also operationally difficult to compile Financial numbers amid the craziness that comes with peak Business periods.

Below are a few examples of industries and companies with non-calendar Fiscal Year Ends (often abbreviated as FYE in Finance):

- Industry-Specific Examples

- Retail (Fiscal Year End 2/1) – typically report after the Christmas holidays.

- Company-Specific Examples

- Apple (Fiscal Year End 9/30) – reports after the big product release each September.

- H&R Block (Fiscal Year End 4/30) – reports following the end of Tax Season each year.

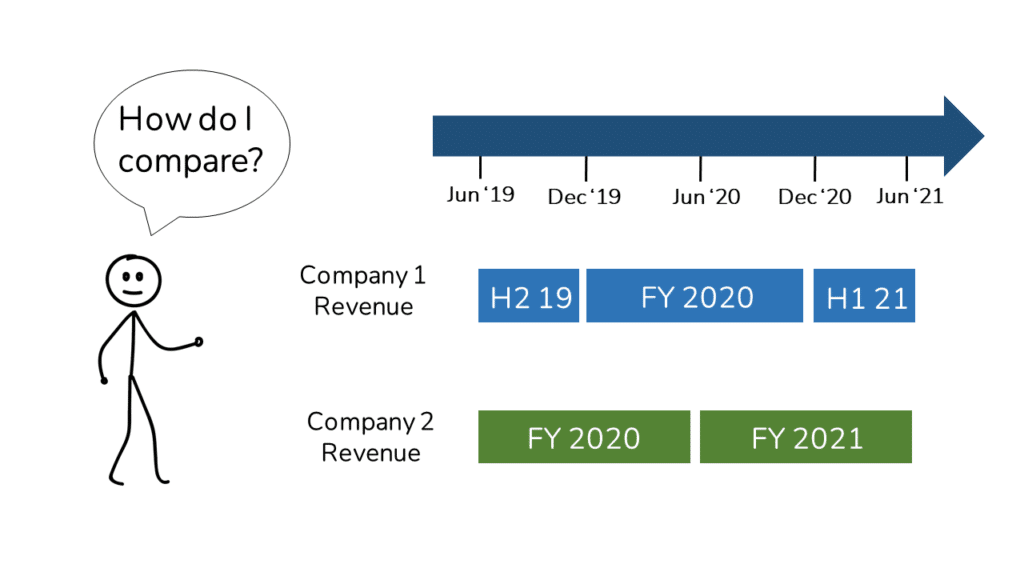

A Visual Overview of Calendarization

To begin our discussion on Calendarization, let’s revisit the example from earlier in the article.

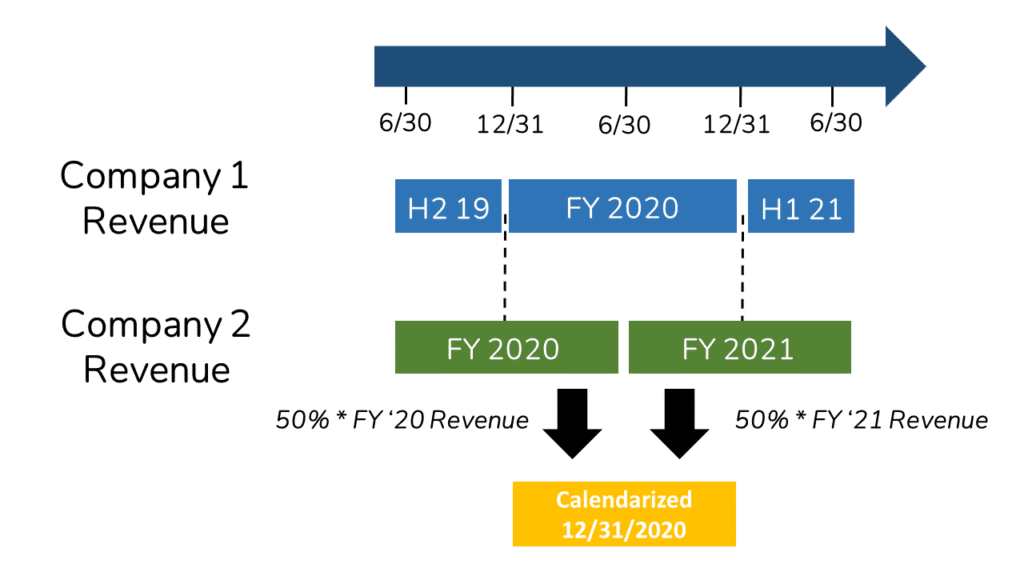

In that example, we had Company 1 with a Calendar Year-End (December 31st) and Company 2 with a Fiscal Year Ending on June 30th.

As you can see below, Company 2 has 50% overlap in each Fiscal Year with Company 1.

To Calendarize Revenue for Company 2, we would multiply the overlapping percentage of the year (50%) by FY 2020 Revenue.

We would then multiply the overlapping percentage of the year (again 50%) by FY 2021 Revenue.

The net result is a calendarized Revenue for the 12 months ended 12/31/2020.

In the next section, we boil the Calendarization process into a simple, 2-Step process.

How to Calendarize in 2 Steps

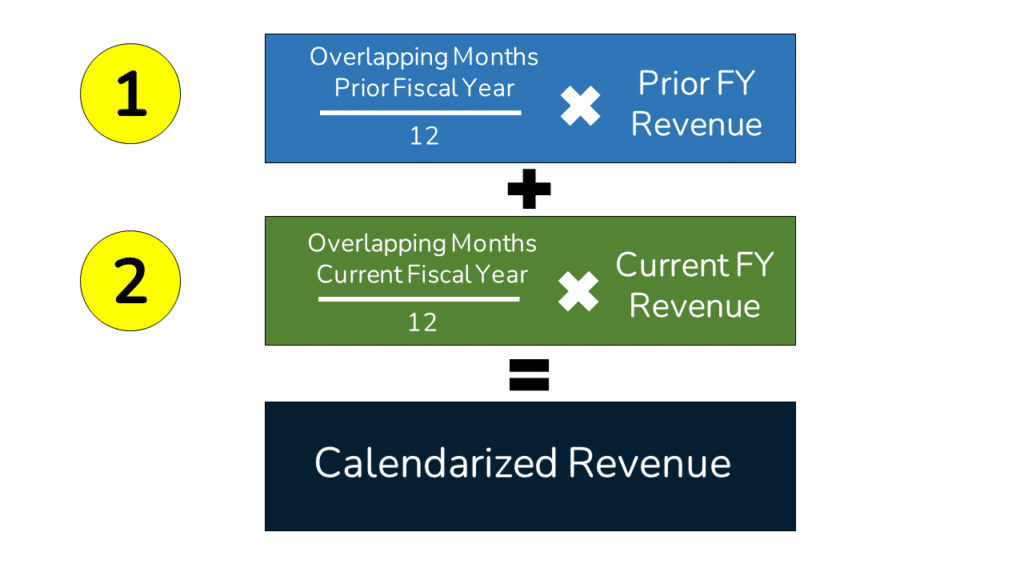

The Calendarization Formula requires just two steps.

We will Calendarize Revenue in this example.

But, note that you can use the process above to ‘Calendarize’ any item on an Income Statement or Cash Flow Statement.

How to Calendarize in 2 Steps

- Find Percentage Overlap from Prior FY and Multiply by Prior FY Revenue

Find the number of months for which the prior Fiscal Year overlaps with the year-end to which you’re aligning. Next, divide the number of months by 12.

Next, find Revenue for the Prior Fiscal Year the Company. You can find this in the Company’s public financial filings (SEC Edgar Search).

If you are doing this exercise for your Company or a Privately held Client, you will likely need to ask the Accounting department or the Client respectively for the numbers.

Finally, divide the number of months by 12. Then multiply the percentage overlap by the prior Fiscal Year Revenue. - Find Percentage Overlap from Current FY and Multiply by Current FY Revenue

Find the number of months for which the current Fiscal Year overlaps with the year-end to which you’re aligning.

Next, find Revenue for the current Fiscal Year for a Company. You’ll use the same data sources for the numbers as in Step 1.

Finally, divide the number of months by 12. Then multiply the percentage overlap by the current Fiscal Year Revenue.

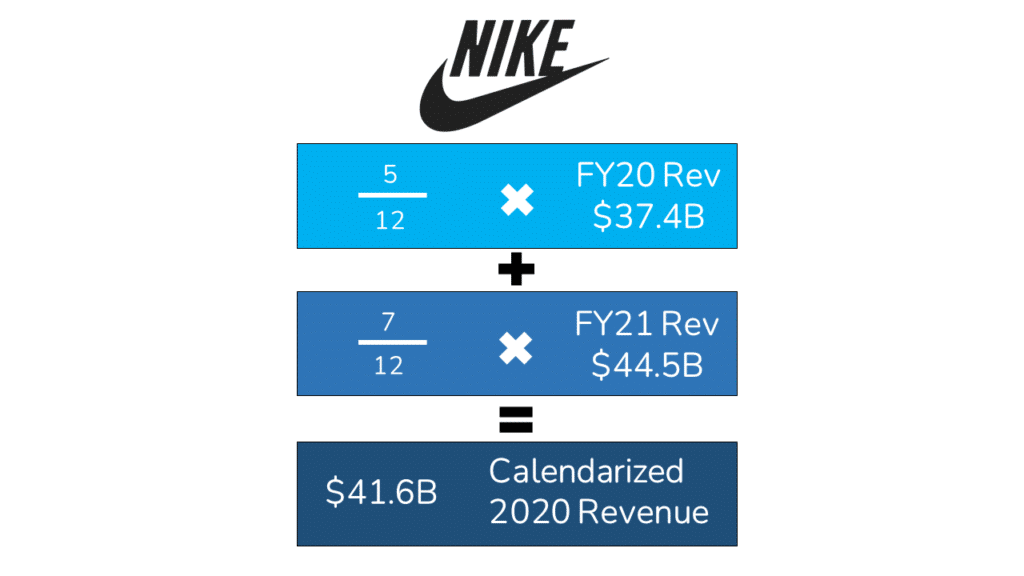

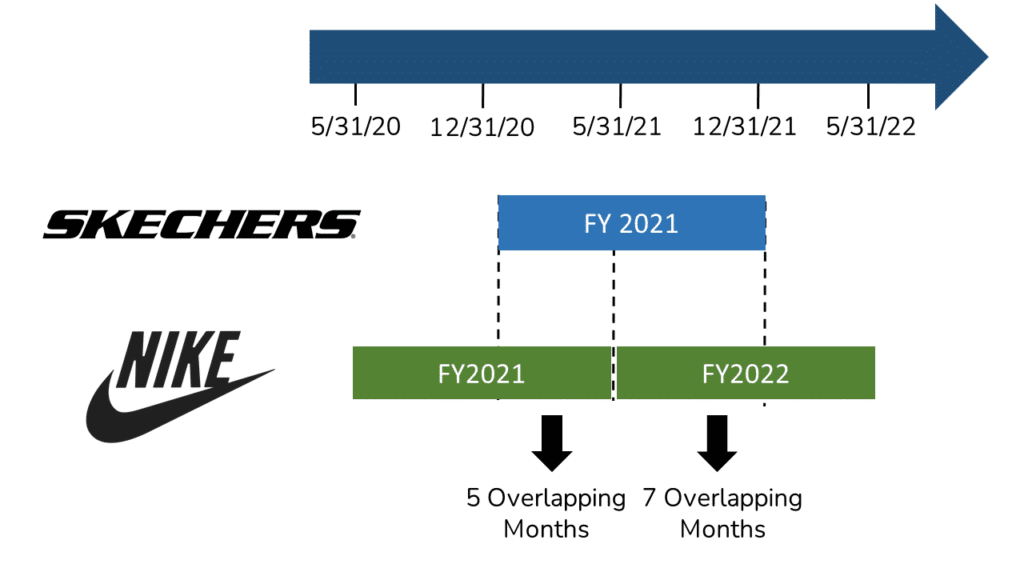

Below we walk through this process with two real companies: Nike and Skechers.

A Simple Example with Nike and Skechers

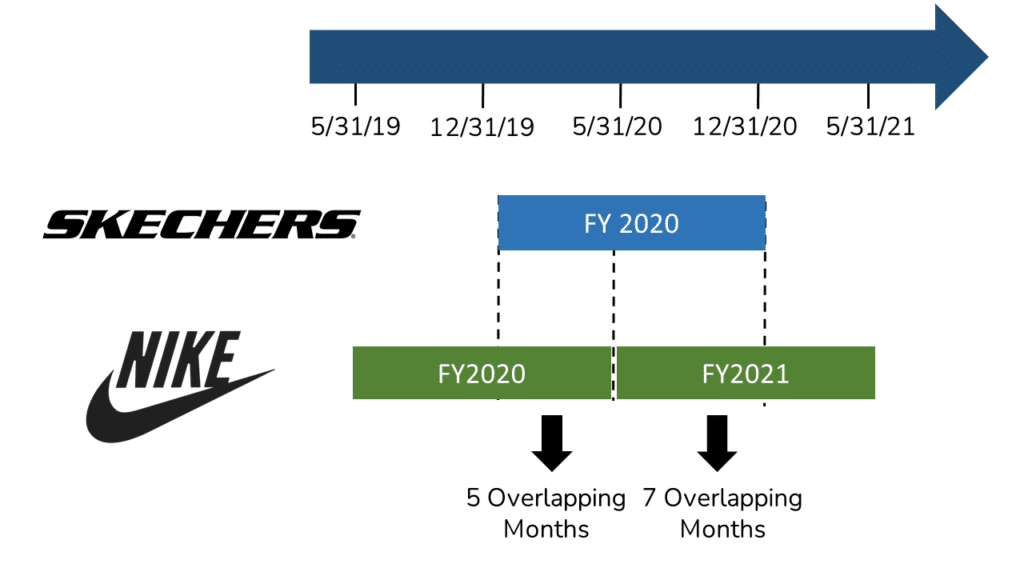

Let’s imagine that you need to compare Revenue for Nike and Skechers.

Skechers’ Fiscal Year ends on December 31st of each year. On the other hand, Nike’s Fiscal Year ends on May 31st.

So we will need to Calendarize Nike’s numbers to make them comparable to those of Skechers.

We will begin by finding the number of months for which Nike’s Fiscal Year overlaps with Skechers.

We would then divide the number of overlapping months by 12 for the current and prior fiscal years to calculate the percentage of each year for which Nike overlaps with Skechers.

Finally, we would multiply the percentage overlap by the prior and current Fiscal Year Revenue to arrive at Nike’s Calendarized Revenue for 12/31/2020.

Now let’s look at a common on-the-job application of Calendarization.

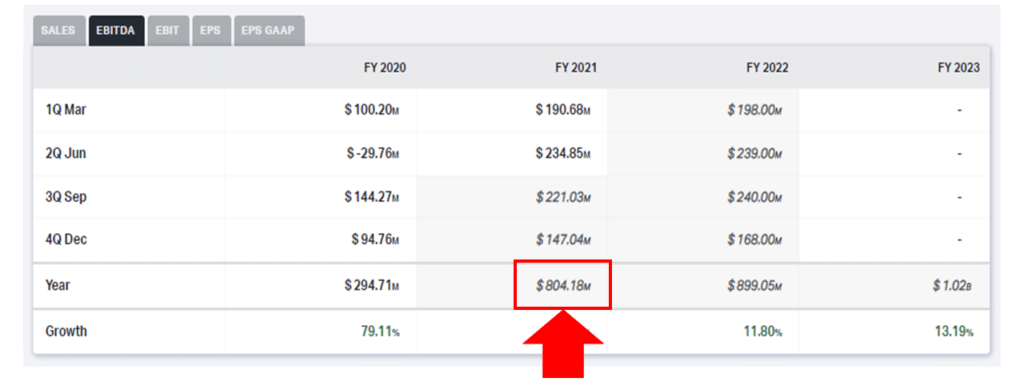

On The Job Example: Calculating Forward Multiples

Investment Bankers, Private Equity, Hedge Fund analysts often use Calendarization to align Analysts’ estimated numbers for companies with different year-ends.

For example, let’s imagine that we would like to calculate Enterprise Value / 2021 EBITDA for both Nike and Skechers.

We can quickly pull Enterprise Value from Koyfin. Both are listed below:

Enterprise Value (8/30/21)

- Nike: $265.4B

- Skechers: $8.6B

Source: Koyfin

Now we need Calendar Year EBITDA for both companies.

We directly pull the FY 2021 estimate for Skechers because the Company reports on a Calendar Year basis.

In Fiscal Year 2021 (FYE 12/31/21), Analysts estimate that Skechers will generate $0.8 billion in EBITDA.

Source: Koyfin

For Nike, however, we must Calendarize FY 2021 EBITDA ($7.7 billion) and estimated FY 2022 EBITDA ($9.2 billion) to create a Calendar Year Ended 2021 estimated EBITDA.

Source: Koyfin

To Calendarize Nike’s EBITDA, we’ll multiply the percentage overlap from FY21 (5 months / 12 months) by the FY21 EBITDA of $7.7 billion.

Then we’ll multiply the percentage overlap from FY22 (7 months / 12 months) by the FY22 EBITDA of $9.2 billion.

Source: SEC Filings

As you can see from the image above, Nike’s calendarized EBITDA is $8.6B for CY 2021.

Now we can calculate the forward Enterprise Value (EV/EBITDA) multiples for both companies:

- Nike EV/CY 2021 EBITDA: 31x

- Calculation: [EV $265B / $8.6B ’21 EBITDA]

- Skechers EV/CY 2021 EBITDA: 11x

- Calculation: [EV $8.6B / $0.8B ’21 EBITDA]

There are a variety of use cases for these calendarized multiples:

- Exit Multiple for a Discounted Cash Flow (DCF) analysis.

- Entry or Exit Multiple for a Leveraged Buyout (LB0) analysis.

- Calculating Pro Forma Multiples for a Merger Model.

As for why the multiples are so different, that’s a conversation for another day!

Wrap-Up: Calendarization

Hopefully, you now have a much better understanding of Calendarization. And also understand the underlying idea behind Calendarization.

Calendarization is important because it helps us to compare companies with different Fiscal Year Ends.

Let us know if you have any questions in the comments below. We’d love to hear from you!

About the Author

Mike Kimpel is the Founder and CEO of Finance|able, a next-generation Finance Career Training platform. Mike has worked in Investment Banking, Private Equity, Hedge Fund, and Mutual Fund roles during his career.

He is an Adjunct Professor in Columbia Business School’s Value Investing Program and leads the Finance track at Access Distributed, a non-profit that creates access to top-tier Finance jobs for students at non-target schools from underrepresented backgrounds.

Frequently Asked Questions

Calendarization is the process of aligning financial metrics for companies with different fiscal year-ends to make their numbers consistent. Analysts use Calendarization in various cases ranging from aligning estimated data to calculating pro forma numbers for an M&A analysis.

We calendarize company financials because companies do not always report based on the same Fiscal Year End. Calendarization allows us to compare companies based on the same year-end.

A fiscal year is the reporting period chosen by a business reflecting 12 months of performance. The Fiscal Year may or may not align with the calendar year.

Companies often choose non-calendar year periods for their businesses when they have significant intra-year spikes in their business.

For example, retailers generate a significant portion of their Revenue during the holiday season. As a result, they often set their Fiscal Year End to the end of January.

This gives them time to prepare their numbers after the craziness of the Holidays season has subsided.