Want to understand how Hedge Funds vs Mutual Funds operate with simple, visual, and Plain-English explanations? After reading this article, you’ll understand:

- How Hedge Funds and Mutual Funds work.

- The difference between Going Long vs Going Short.

- How Hedge Funds lower the Volatility of their portfolios by Going Short.

- The differences between Hedge Funds vs Mutual Funds: Legal Structures, Liquidity, Investors, Fee Structures, and Long-Only vs Long/Short strategies.

- The contrast between Fundamental Investing vs Quantitative Investing.

Estimated reading time: 15 minutes

TL;DR

- Mutual Funds and Hedge Funds are Pooled Investment Vehicles that Invest Money in return for Fees.

- Mutual Fund Characteristics:

- Highly-Regulated Corporations.

- Offer high levels of Liquidity.

- Have a large number of Retail Investors.

- Charge only Management Fees.

- Typically employ a Long-Only investment strategy.

- Hedge Fund Characteristics:

- Lightly-Regulated Partnerships.

- Offer limited Liquidity.

- Have sophisticated investors.

- Collect both Management Fees and a share of the profit (called ‘Carried Interest’).

- Typically Go Long and Short to reduce the Volatility of their portfolios.

- Hedge Funds and Mutual funds typically invest based on underlying business performance (Fundamental Investing) or based on complex algorithms (Quantitative Investing).

- TL;DR

- Want To Learn More About Finance?

- Hedge Funds…A Common Source of Confusion

- Key Differences Between Hedge Funds and Mutual Funds

- How 'Going Long' Works

- How 'Going Short' Works

- Hedge Funds vs Mutual Funds: The End Goal

- Hedge Fund and Mutual Fund: Investment Types

- Hedge Funds and Mutual Funds: Investment Strategies

- Hedge Fund vs Mutual Fund: Wrap-Up

- Hedge Funds vs Mutual Funds: Full Animated Explainer Video

- Aiming for Investment Banking, Private Equity, or Investment Management?

- About the Author

- Frequently Asked Questions (FAQs)

- Related Links

Want To Learn More About Finance?

Check out all of our (free) deep-dive articles in our Analyst Starter Kit:

Hedge Funds…A Common Source of Confusion

The Finance world is filled with a variety of confusing and ambiguous terms.

The term ‘Hedge Fund‘ might be near or at the top of that list. This is because there are so many different types of Hedge Funds that it is hard to summarize their activities.

By contrast, Mutual Funds are often much more familiar to many people because they have Mutual Fund investments in their savings and retirement accounts.

As we’ll see, though, Hedge Funds and Mutual Funds take very similar approaches to Investing.

With that said, let’s start with the primary differences between a Hedge Fund and a Mutual Fund.

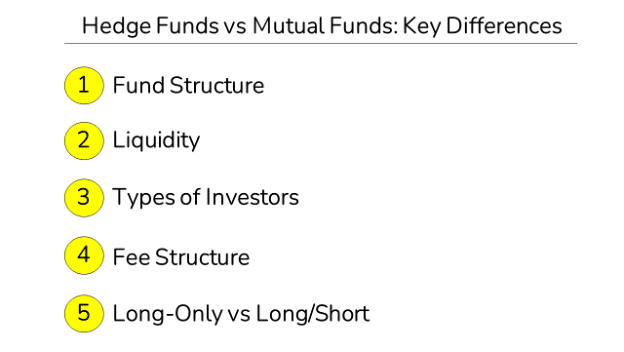

Key Differences Between Hedge Funds and Mutual Funds

There are a few major differences between Hedge Funds and Mutual Funds:

1. Fund Structure

2. Liquidity

3. Types of Investors

4. Fee Structure

5. Long-Only vs Long/Short

Once we’ve covered these differences, we’ll dive into the Investment Strategies used by Hedge Funds and Mutual Funds.

Hedge Funds vs Mutual Funds Difference #1: Fund Structure

Hedge Funds and Mutual Funds are both ‘Pooled Investment Vehicles.’

In other words, these funds both take Money from a broad group of Investors and aggregate the Money into a single ‘Fund.’

The ‘Fund Managers’ who oversee the Fund then invest the Money on behalf of the Investors.

These Funds can invest in a wide range of Investments and employ various Investment Strategies, as we discuss later in this article. With that said, most Funds have a fairly narrow area of focus (e.g., US Growth Stocks, Emerging Market Bonds, etc.).

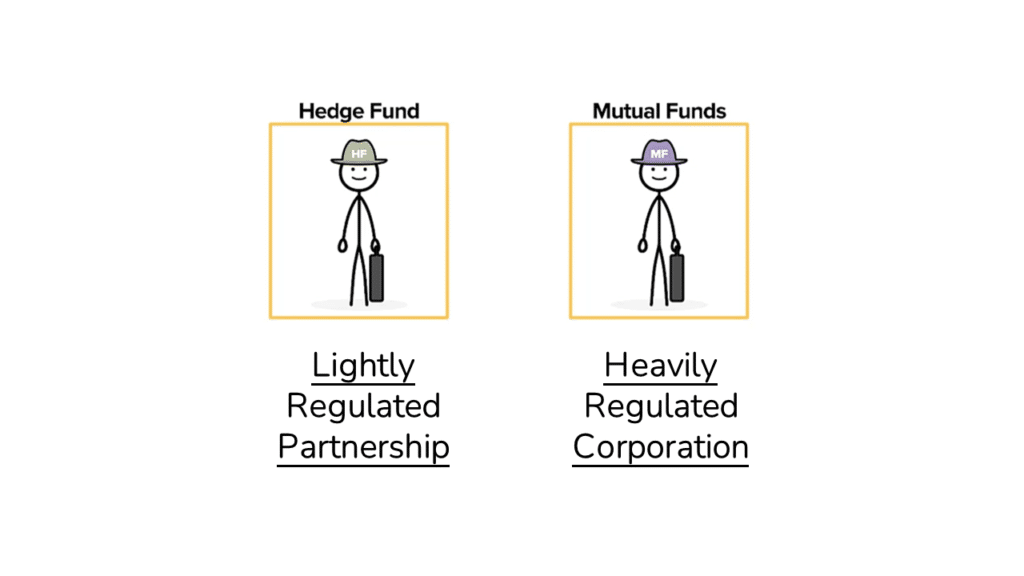

Despite these similarities, Hedge Funds and Mutual funds operate under very different Legal and Regulatory structures.

Hedge Funds typically operate as a Partnership between the Fund Manager and their Investors. Also, Hedge Funds are not heavily regulated, and so they have much more latitude to make riskier investments, as we’ll see shortly.

By contrast, Mutual Funds are typically set up as Corporations which the US Government regulates under the Investment Company Act of 1940. Mutual Funds are subject to stringent regulation.

In short, the Hedge Funds rules are very different from the rules for Mutual Funds.

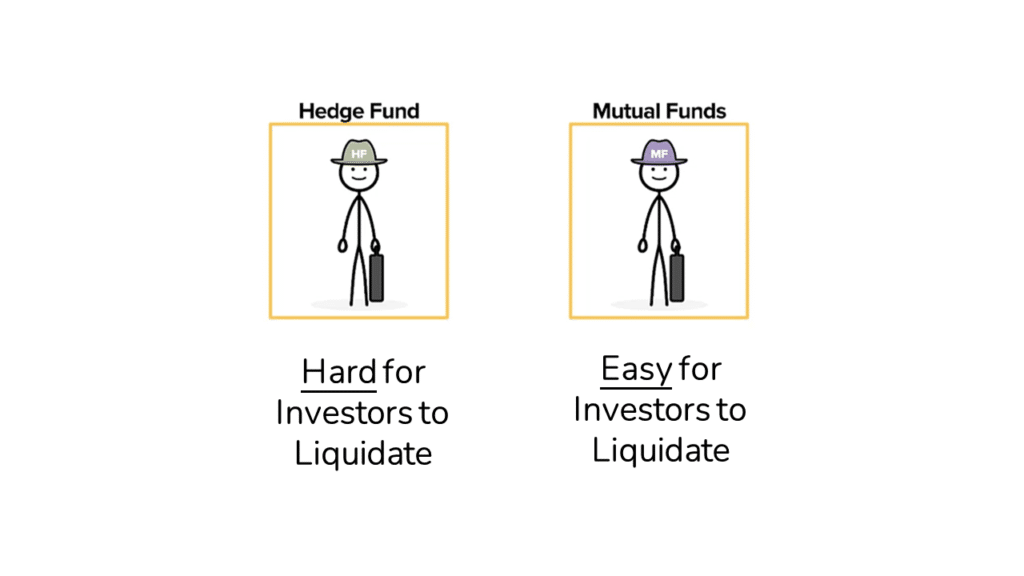

Hedge Funds vs Mutual Funds Difference #2: Liquidity

As mentioned above, Mutual Funds are heavily regulated and must provide their Investors the ability to sell on a daily basis.

Hedge Funds are lightly regulated and don’t typically have liquidity constraints. As a result, Investors in a Hedge Fund may only be able to exit their Investment quarterly or sometimes for a far longer period of time.

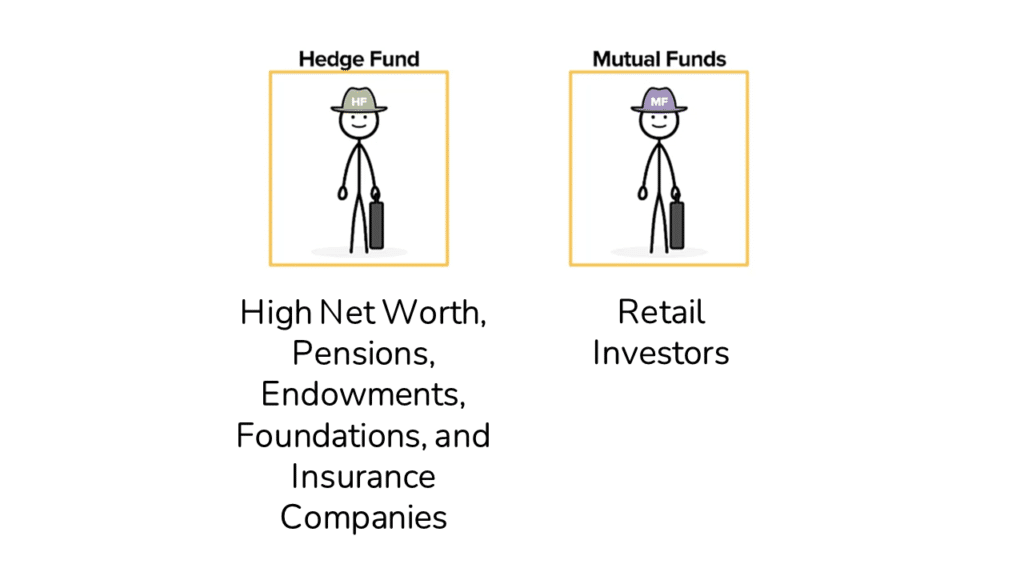

Hedge Funds vs Mutual Funds Difference #3: Types of Investors

Mutual Funds are open to the general public (i.e., ‘Retail Investors’) and typically don’t employ highly risky investment strategies. As a result, Retail Investors compose a large segment of the Mutual Fund Investor Base.

In contrast, Hedge Funds employ much riskier Investment Strategies.

As a result, Hedge Funds are typically only open to individuals with significant levels of income or savings (i.e., ‘Accredited Investors‘) or large, sophisticated institutions with significant Investment experience.

In addition, the Hedge Fund minimum Investment is very high, typically $5-10 million or more.

As such, Hedge Fund investors tend to be Wealthy Individuals (i.e. ‘High Net Worth), Pensions, University Endowments, Foundations, and Insurance Companies.

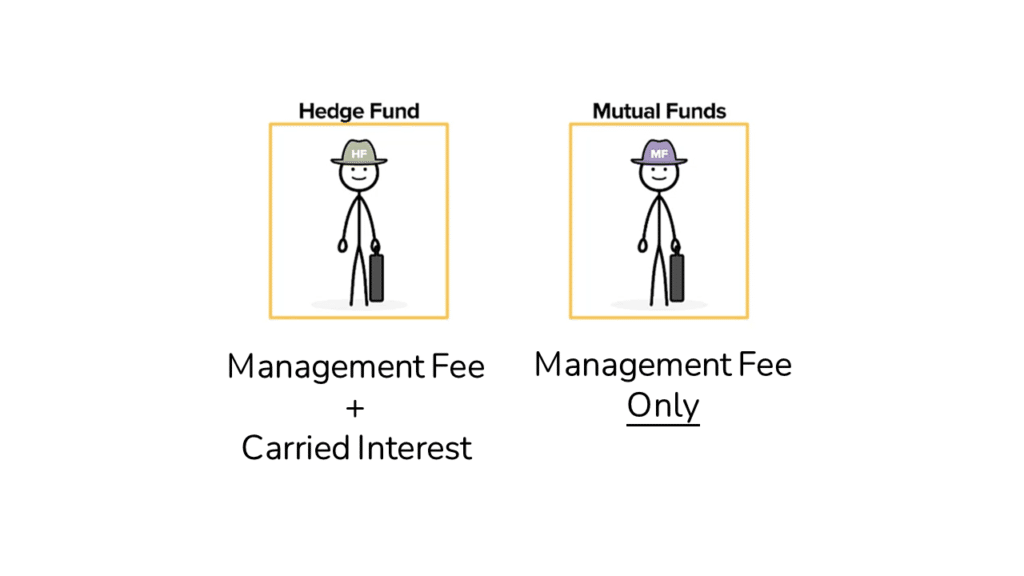

Hedge Funds vs Mutual Funds Difference #4: Fee Structures

Mutual Funds typically charge a ‘Management Fee’ based on a percentage (usually 0.5-1.0%) of the Money managed by the Fund.

Hedge Funds have much more complex investment strategies and thus charge a higher ‘2 and 20’ fee structure.

The first part of ‘2 and 20′ is a 2% annual Management Fee. In addition, Hedge Funds also take a 20% cut of the profit called ‘Carried Interest’ (or simply ‘Carry’).

Some of the best funds charge even more with Carried Interest rates of 30% or higher.

In recent years, competition in the Hedge Fund world has caused these fees to compress, so only top-performing funds still receive the full ‘2 and 20’ fee structure.

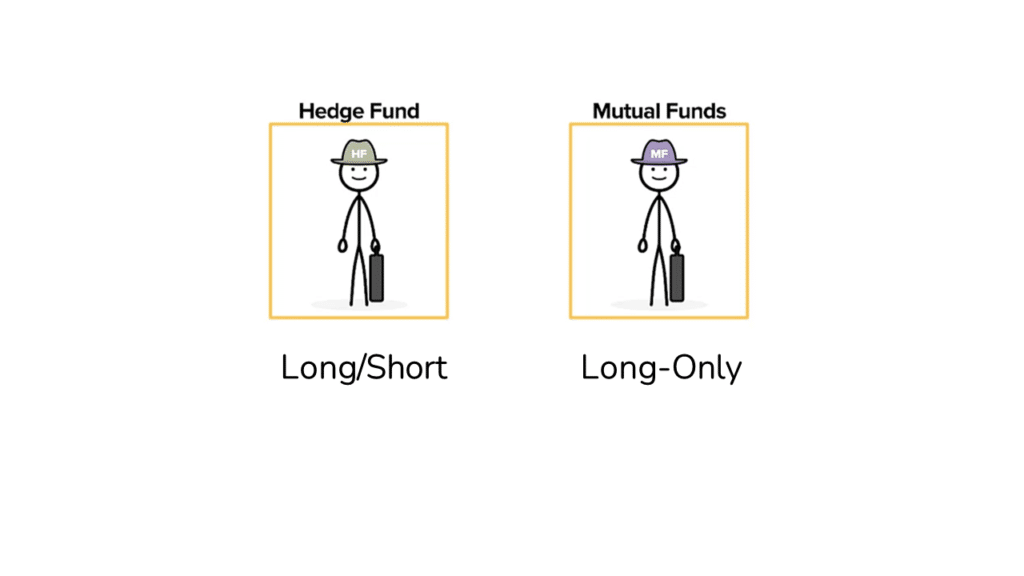

Hedge Funds vs Mutual Funds Difference #5: Long/Short vs Long-Only

If you’ve perused any articles on Hedge Funds, you’ve likely come across the terms Long-Only and Long/Short. These two distinct investment strategies are employed by these Investment Firms.

While there are some exceptions, Mutual Funds generally employ a Long-Only approach, whereas Hedge Funds also Go Short and are thus called Long/Short funds.

As we’ll discuss below, Hedge Funds reduce the Volatility of their portfolios by taking a Long/Short approach.

First though, let’s explore what the terms ‘Going Long‘ and ‘Going Short‘ actually mean.

How ‘Going Long’ Works

Going Long is what you would likely think of with the typical purchase of a Stock.

Below is an example of Going Long:

- Step 1: Buy a Stock at $100.

- Step 2: Sell the Stock at $150, which results in a $50 Gain.

Conversely, if the Stock had declined in value to $50, the Investor would have generated a $50 Loss.

Brief Explainer Video: ‘Going Long’ Made Simple (32 Seconds)

In this quick video on Going Long, we walk through a simple, animated explanation of how this process works.

How ‘Going Short’ Works

Going Short is the exact opposite of the above. It might sound strange, but you Sell your Investment at the outset and close the transaction when you Buy to Cover.

Below is an example of Going Short:

- Step 1: Sell Short a Stock at $100.

- Step 2: Buy to Cover the Stock at $50, which results in a $50 Gain.

If you’d like to dive deeper into the mechanics of Short Selling, check out this article: Short Sales.

Brief Explainer Video: ‘Going Short’ Made Simple (25 Seconds)

In this quick video on Going Short, we walk through a simple, animated explanation of how this process works.

Why do Hedge Funds Go Short?

As we explain in our Hedge Funds vs Mutual Funds in Plain English Explainer Video (video link at the end of the article below), Hedge Funds use Shorts to reduce the Volatility of their portfolios while aiming to generate gains on both their Long and Short investments.

A typical Equity (i.e., Stock) focused Hedge Fund will Go Long a group of undervalued Stocks and simultaneously Go Short a different group of overvalued Stocks.

Over time, the Fund Manager aims to generate gains on both its Long and Short Investments.

By going Short and going Long, a group of securities, the Fund Manager can reduce the Investment portfolio’s day-to-day variations (i.e., Volatility).

Volatility declines because each of the Long and Short portfolios will approximate movements of the entire market (assuming they aren’t too concentrated!) and will roughly cancel each other out.

So, while Mutual Fund (i.e. Long-Only) investors are subject to the daily ups-and-downs of the markets, Hedge Funds (i.e. Long/Short) will generally experience much less fluctuation.

The end goal is to get the best of both worlds, high returns with lower Volatility.

Brief Explainer Video: Why Do Hedge Funds Short? (1 Minute | 21 Seconds)

In this quick video, walk through a simple, animated explanation of How Hedge Funds Reduce Volatility by Going Short.

Hedge Funds vs Mutual Funds: The End Goal

Despite the differences in Structure, Liquidity, Investor Base, Fee Structures, and Long-Only vs Long/Short approaches, both Hedge Funds and Mutual Funds have the same underlying aim. They gather Money from Investors to generate a return and collect a fee in return for their services.

In fact, Hedge Funds and Mutual Funds share several common threads.

In the next section, we’ll explore the similarities between Hedge Funds and Mutual Funds, including:

1. Typical Investments

2. Fundamental Investing vs Quantitative Investing Strategies

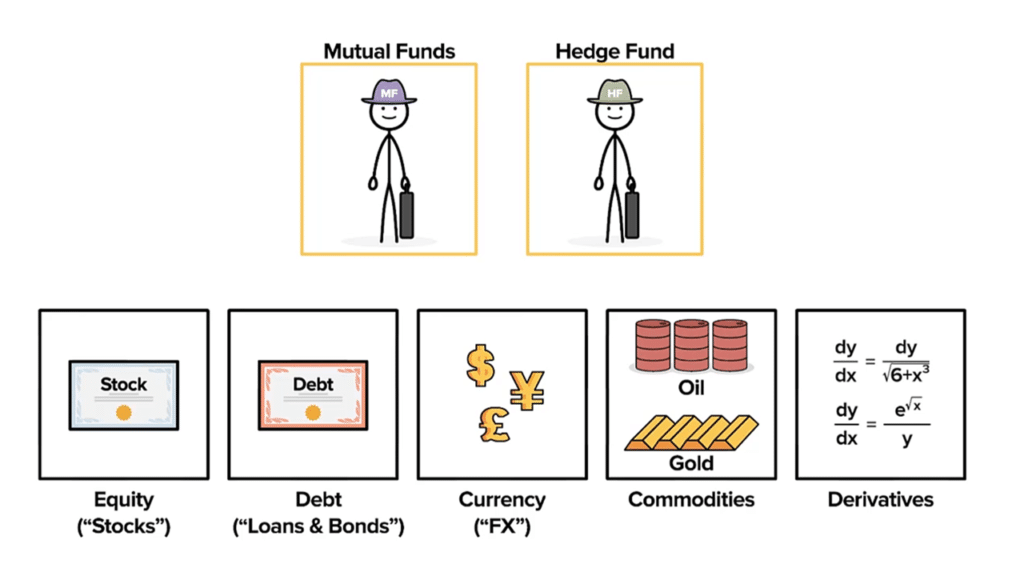

Hedge Fund and Mutual Fund: Investment Types

Hedge Funds and Mutual Funds both invest in a wide variety of Investments.

Below is a summary of some of the most common types of Investments:

- Stocks (i.e., Equity) – units of Ownership of a Company (e.g., Microsoft, Amazon, etc.).

- Bonds and Loans (i.e., Debt) – a wide variety of instruments ranging from Debt issued by Companies (‘Corporate’) to Debt issues by Governments (i.e. ‘Sovereign’).

- Commodities – any undifferentiated raw material ranging from Oil and Gas to Copper and Iron Ore

- Currencies – Money issued by governments around the world

- Derivatives – complex securities that ‘derive’ their value from any other security

Both Hedge Funds and Mutual Funds can invest in one or more of these types of investments.

However, as previously mentioned, most funds have a narrow focus on just one or two of these Investment categories.

Hedge Funds and Mutual Funds: Investment Strategies

Both Hedge Funds and Mutual Funds utilize a wide variety of strategies.

Broadly speaking, though, their investment strategies fall into two macro-level buckets: Fundamental Investing or Quantitative Investing.

Investment Strategy #1: Fundamental Investing

Funds that pursue a Fundamental Investing approach are generally Investing based on the underlying performance of their Investments.

For example, if a fund invests in a Stock, they are making a bet based on the future direction of Revenue and Profit of the underlying business.

Fundamental Investing: Value vs Growth Investing

No conversation on Fundamental Investing would be complete without discussing the highly contentious topic of Value vs Growth Investing.

Columbia Business School Professor Benjamin Graham pioneered the Value Investing approach. His most famous student, Warren Buffett, utilized his technique to become one of the wealthiest people in the world. Graham’s Value Investing approach is centered around buying undervalued businesses that would ultimately return to their underlying (or ‘Intrinsic’) Value.

By contrast, Growth Investors look for high-growth Businesses that will appreciate value by virtue of their growth over time.

Fundamental Investing: Special Situations Investing

Outside of traditional Growth or Value Investing, a Hedge Fund or Mutual Fund may Invest based on expectations around a future event (e.g., the Acquisition of the Company) that they expect to occur. Investing based on events (as opposed to underlying Revenue and Profit expectations) is typically referred to as ‘Special Situations’ investing.

Investment Strategy #2: Quantitative Investing

Alternatively, funds may pursue a Quantitative investment strategy. Quantitative Investment Funds use everything from simple, rule-based formulas to deeply complex algorithms to drive their investment decisions.

Whereas Finance majors and MBAs composed a large portion of the Fundamental Investing world, Math Ph.D.’s rule Quantitative Investing.

The inner workings of some of the top Quantitative Investment funds in the world are highly secretive, which is why Quantitative Investing strategies are often called ‘Black Box’ investing.

Hedge Fund vs Mutual Fund: Wrap-Up

Hopefully, after reading this article, you have gained a much better understanding of how Hedge Funds vs Mutual Funds operate.

While these funds have several key differences, Hedge Funds and Mutual Funds both gather Money from Investors. They then invest that Money to generate gains in return for a fee.

Hedge Funds vs Mutual Funds: Full Animated Explainer Video

If you enjoyed this article, definitely check out our full Animated Explainer Video below on the differences between Hedge Funds and Mutual Funds.

You can find more videos just like this on our YouTube Channel.

Aiming for Investment Banking, Private Equity, or Investment Management?

We have created the ultimate free resource for aspiring Finance Analysts with our Finance Analyst Starter Kit.

- We have Free, Plain English articles and Animated Explainer Videos on:

- Who the core players (e.g. Investment Banks and Private Equity) are in the Finance world and how they operate.Core mental frameworks for learning Valuation and Returns Analysis.Reviews of common trouble topics like Enterprise Value vs Equity Value based on our experience training thousands of students.Detailed walkthroughs of common Interview Questions like Walk Me Through a DCF.

About the Author

Mike Kimpel is the Founder and CEO of Finance|able, a next-generation Finance Career Training platform. Mike has worked in Investment Banking, Private Equity, Hedge Fund, and Mutual Fund roles during his career.

He is an Adjunct Professor in Columbia Business School’s Value Investing Program and leads the Finance track at Access Distributed, a non-profit that creates access to top-tier Finance jobs for students at non-target schools from underrepresented backgrounds.

Frequently Asked Questions (FAQs)

Both Hedge Funds and Mutual Funds are pooled investment vehicles, but with very different characteristics.

Mutual Funds are highly regulated Corporations that offer daily liquidity to their (primarily ‘Retail’) Investor base. They typically only charge fees based on a percentage of the Assets they manage (a ‘Management Fee’) and normally employ a Long-Only investing approach.

Hedge Funds are lightly regulated Partnerships that typically offer quarterly (or sometimes annual) liquidity to their largely Institutional and High Net Worth Investor base. They usually charge fees based on a percentage of the Assets they manage (a ‘Management Fee’) and typically take a 20% cut of profit (called ‘Carried Interest’). Hedge Funds employ a Long/Short investing approach.

A Fund of Hedge Funds invests in a portfolio of hedge funds on behalf of their investors.

Like the Hedge Funds they invest in, these Funds tend to charge both a base Management Fee on the Assets they manage and a cut of profit (called ‘Carried Interest’).

Whereas the Hedge Funds they invest in are aiming to find the best (or most mispriced) securities, a Fund of Hedge Funds is looking to invest behind the best Hedge Funds managers.

Hedge Funds are very similar to other investment funds (e.g. Mutual Funds), but the key difference is that they ‘Hedge’ out risk by going short. They do this to reduce volatility and make gains on both sides of their portfolio (i.e. both Long and Short investments).

The term Hedge Fund Manager could describe one of two things: 1) a Partnership vehicle that employs a Hedge Funds investing approach or 2) the person who Manages the Partnership. Unfortunately, these terms are often used interchangeably.

There are two answers to this question because ‘Hedge Fund Manager’ could mean related, but different things:

1) Hedge Fund Manager (the Partnership entity) – this is the legal vehicle through which a Hedge Fund invests.

2) Hedge Fund Manager (a Person) – this is the Partner (often called a Portfolio Manager) who builds and maintains relationships with investors, oversees the Hedge Fund’s Investment Strategy and its operations.

To invest in most Hedge Funds, you need to be an Accredited Investor. Also, most Hedge Funds have very high minimum investment thresholds of $5-10 million or more.

A Hedge Fund is a pooled investment vehicle that aims to generate higher returns with lower volatility (i.e. create a better Risk/Reward) by Going Short in addition to Going Long.

Hedge Funds are subject to much lower levels of regulations than Mutual Funds but are still regulated in terms of the types and numbers of investors they can take in. Large US Hedge Funds are also subject to SEC regulation.

Mutual Funds are primarily regulated under the Investment Company Act of 1940

Related Links

If you’re aiming for roles in Investment Banking, Private Equity, or Investment Management, check out the articles below: