Master the Unlevered & Levered Beta Formulas so you can use them in interviews and on the job in Investment Banking, Private Equity, and Investment Management.

In this article, you will learn:

What Beta actually is and why it is important.

The differences between Levered vs Unlevered Beta.

How to source Beta and how to calculate Beta for a Private Company.

How to answer the most commonly asked interview questions involving Beta.

Estimated reading time: 11 minutes

- TL;DR

- Want To Learn More About Finance?

- What Is Unlevered vs Levered Beta?

- Why Does Beta Matter?

- The Unlevered Beta Formula

- The Root of Beta

- How to Calculate Beta for a Private Company

- How to Source Beta?

- Common Unlevered Beta Interview Questions

- Wrap-Up: Unlevered vs Levered Beta Formulas

- Video Review: Unlevered Beta Formula

- About the Author

- Frequently Asked Questions

- Related Links

TL;DR

Beta is a measure of the risk profile of a Company relative to the overall market.

Unlevered Beta measures the risk profile of a firm without taking into account its Capital Structure (i.e., not taking into account the company’s level of Debt).

- Investors use Levered Beta in the Capital Asset Pricing Model (CAPM) to calculate Investor Expected Returns (i.e, the ‘Cost of Equity’).

Want To Learn More About Finance?

Ramp up faster with all of our (free) deep-dive articles in our Analyst Starter Kit:

What Is Unlevered vs Levered Beta?

Unlevered & Levered Beta are critical concepts to master if you are aiming for (or working in) Finance.

Generally, the concepts underlying Beta are often not well understood.

In this article, we will provide a variety of illustrations to make the concept clear.

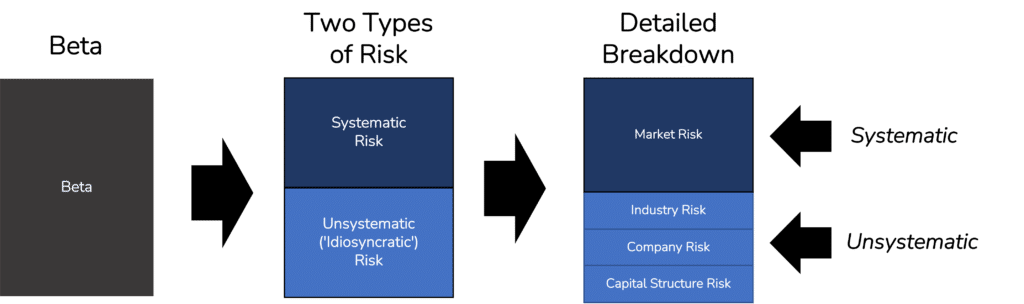

Beta: Systematic vs Unsystematic Risk

Before we dive into Unlevered Beta vs Levered Beta, let’s take a quick look at the differences between Systematic Risk and Unsystematic Risk, which is a critical concept underlying Beta.

What Is The Difference Between Systematic and Unsystematic Risk?

Systematic Risk is inherent to all companies rather than individual Companies. For example, a pandemic would be a systematic risk to all Companies.

Portfolio diversification does not mitigate Systematic Risk.

On the other hand, Unsystematic Risk is a company-specific risk.

A Company’s Levered Beta captures both Systematic and Unsystematic Risk.

Discounted Cash Flow Analysis, which is a core valuation approach, relies on the usage of Levered Beta.

So, understanding how to calculate Levered Beta from Unlevered Beta (and vice versa) is critical if you work in Finance!

Also, by understanding these concepts, you will be well-placed to better understand investing decisions in the overall stock market.

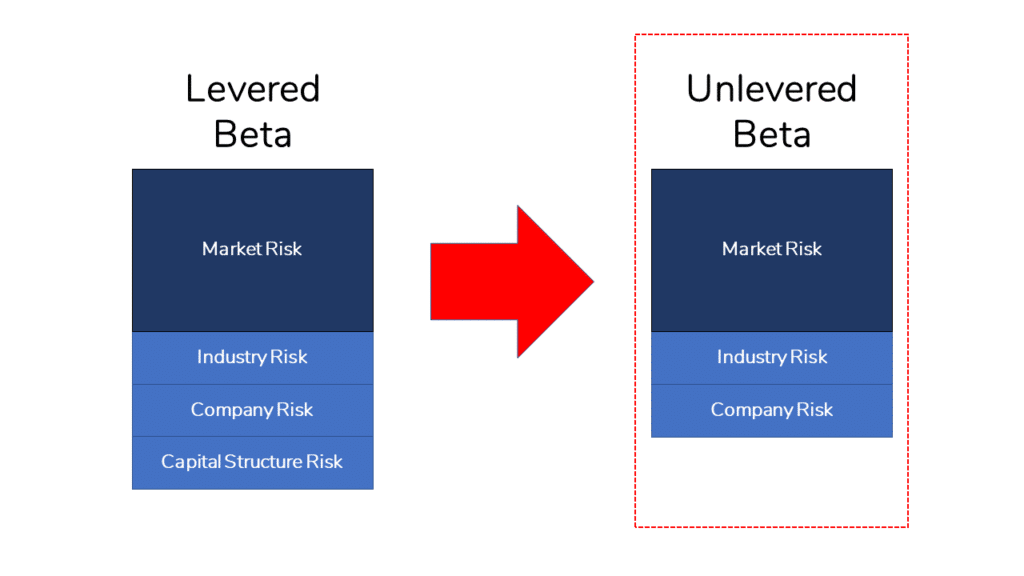

Let’s Begin With Unlevered Beta (aka ‘Asset Beta’)

Unlevered Beta does not take into account the level of Financial Leverage (i.e., Debt) and risk profile of a company.

So, if we aren’t considering the financial risk, what we are left with is the root-level Business risk of a Company (i.e. the risk of a Company’s Assets/Operations).

In fancy terms, Unlevered Beta does not take into account the firm’s ‘Capital Structure‘ (i.e., the mix of Debt vs Equity).

This ‘root-level’ view of a Company’s risk profile enables us to gauge the underlying risk of a Company, absent the impact of Debt.

Now, Let’s Look at Levered Beta

Levered Beta depicts the Beta of a Company incorporating its Debt/Equity mix.

High levels of Debt generally increase riskiness. So, Analysts typically examine this view as well. All else equal, more Debt means more risk.

Why Does Beta Matter?

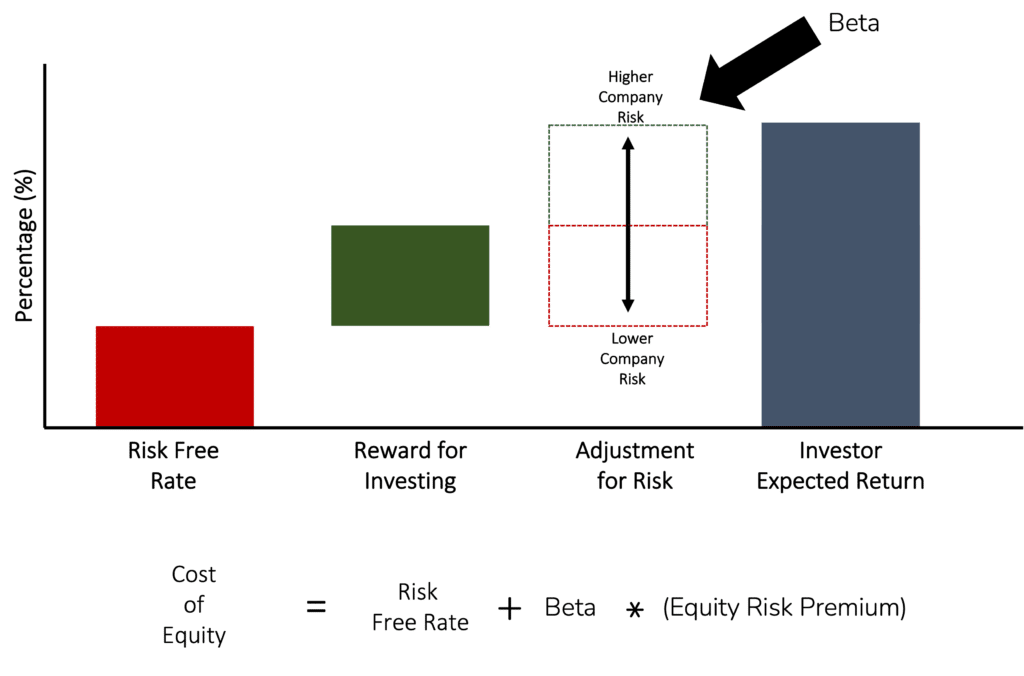

So, now you know what Beta is and the differences between Unlevered and Levered Beta, let’s take a closer look at what Beta actually is in the context of the Capital Asset Pricing Model (‘CAPM’).

Essentially, the CAPM formula captures an investor’s expected rate of return relative to the level of risk taken.

We want to calculate the Cost of Equity, so we start off with the Risk-Free Rate of Return with taking zero risk as the starting point.

Then, we add to that the reward for investing in the market above and beyond that risk-free rate. This is where Beta kicks in.

This Equity Risk Premium can be dialed up or down by the Beta, based on the level of risk inherent in the underlying Company.

For a Company with a higher Equity Beta, we would expect higher returns, because we are taking on a higher level of risk.

Conversely, for a lower Equity Beta Company, we would expect lower returns.

To keep it simple, increased risk should yield higher returns for investors.

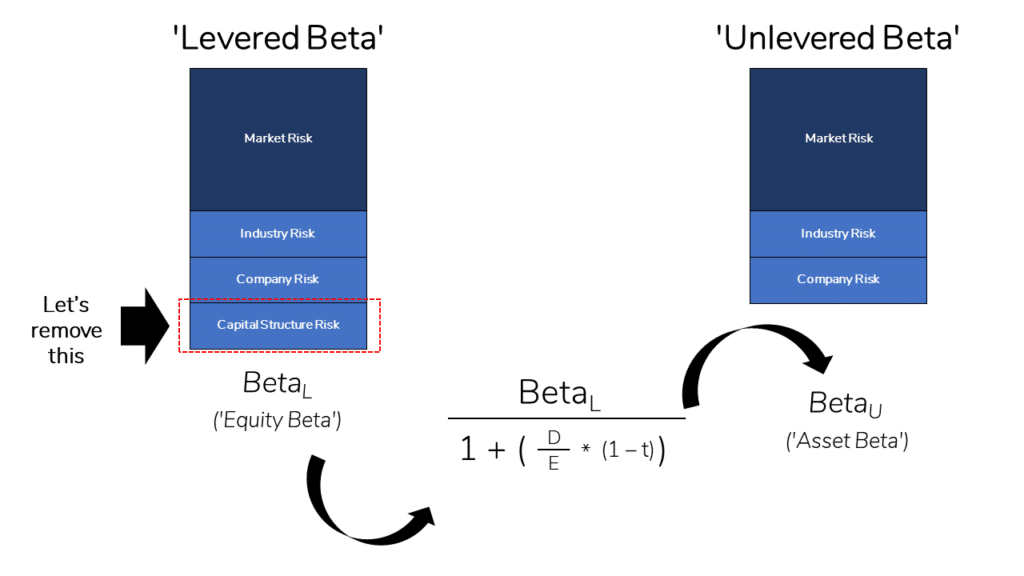

The Unlevered Beta Formula

To calculate the Unlevered Beta of a Company, we use the following formula:

Unlevered Beta = Levered Beta / [1 + (1 – Tax Rate) x (Debt/Equity)]

Don’t panic!

Although the formula may seem daunting at first, let’s take a step back and think about it for a second.

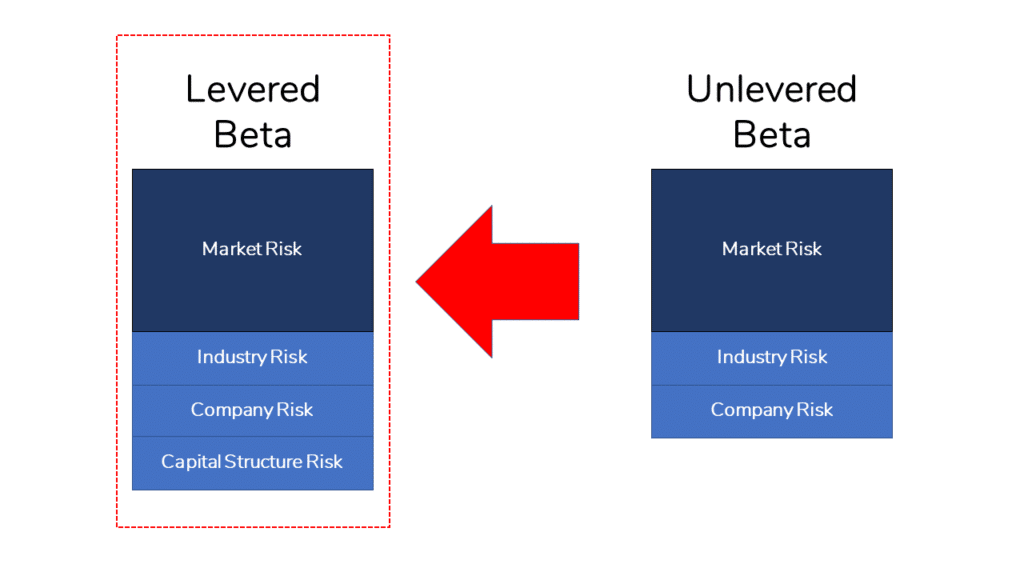

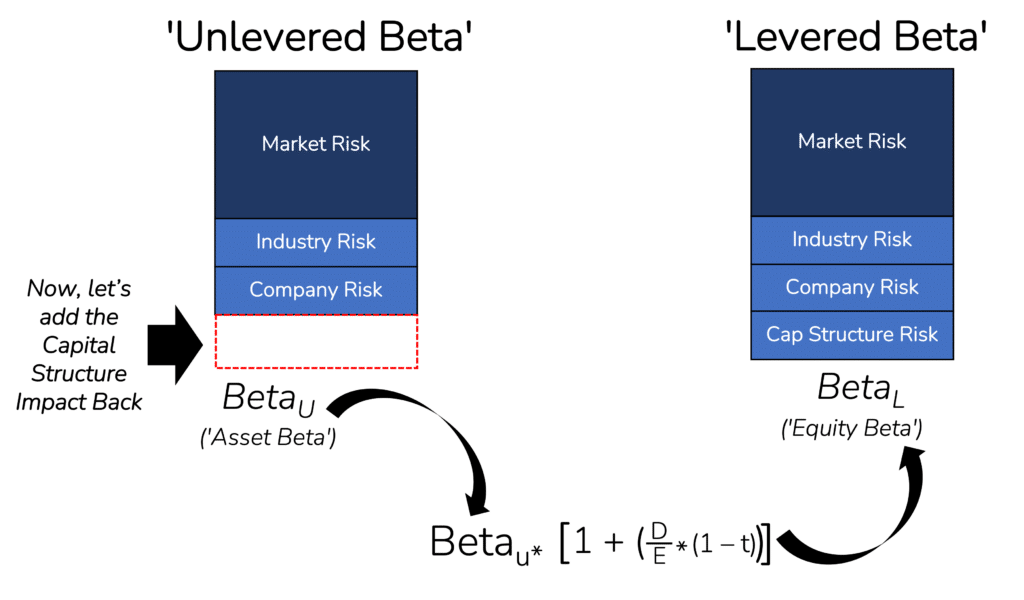

The Concept: Unlevered Beta to Levered Beta

We know that Unlevered Beta doesn’t account for any Debt (i.e., Capital Structure is ignored).

But investors need to consider the bigger picture of the Company’s situation, including the level of Debt.

So, if we want to know more about the whole picture, it’s useful to know how much of the Company is Debt and how much is Equity (or the Debt-to-Equity Ratio).

That’s what you’re seeing in the illustration above.

This formula takes you from Equity Beta by accounting for the Debt-to-Equity Ratio and the Tax Rate to arrive at Unlevered Beta.

The Formula: Unlevered Beta to Levered Beta

More mechanically, to calculate the Levered Beta, you start with the Unlevered Beta of a Company:

Levered Beta = Unlevered Beta * [1 + (1 – Tax Rate) x (Debt/Equity)]

The Levered Beta is also called the ‘Equity Beta’ of a Company.

Now, let’s talk about where Beta comes from in the first place!

The Root of Beta

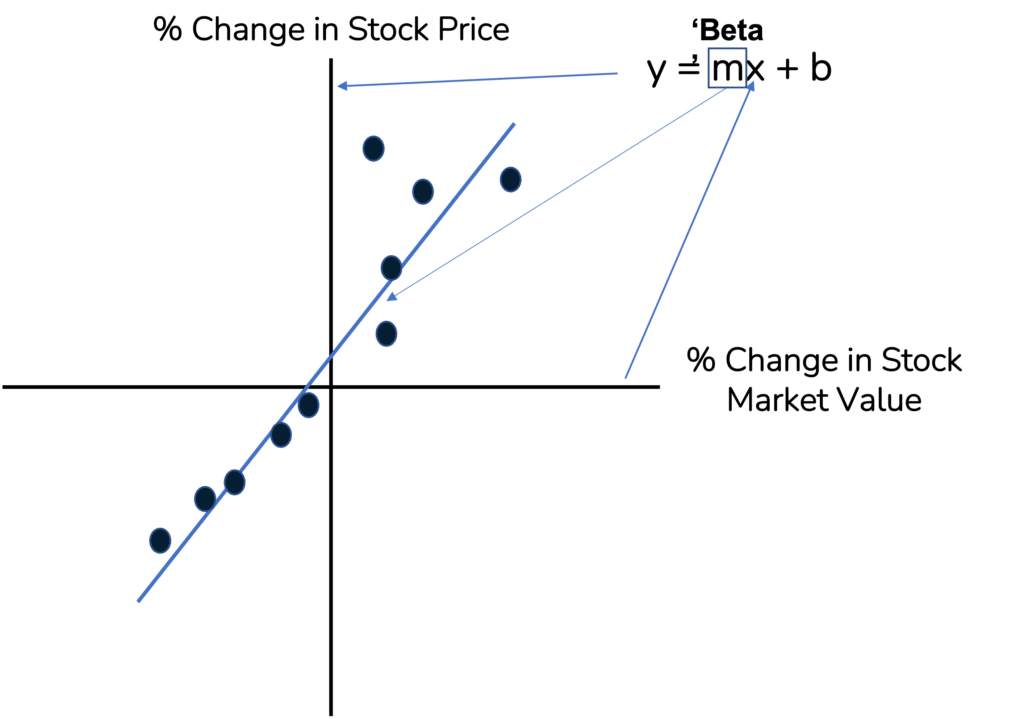

Beta is the output of a Regression Analysis that compares an Individual Company’s returns to the return of the aggregate Stock Market (typically the S&P 500).

If you’re not mathematically inclined, the above simply shows the relationship between the change in Stock Price vs the change in the value of the Stock Market.

In more mathematical terms, Beta is the slope of the line of the regression.

How to Calculate Beta for a Private Company

Everything above works great for a Publicly Listed Company.

But what happens when you are asked to find the Beta of a Private Company?

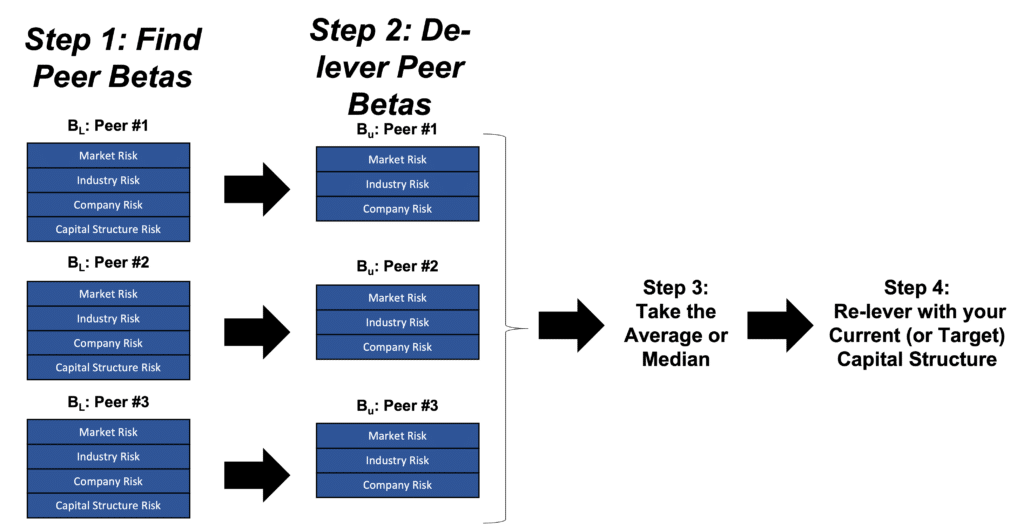

Here are the 4 steps to find a Private Company’s Beta:

- Find Peer Betas

Find the Levered Betas of a group of peer companies in the same industry and ideally in the same sector.

- De-Lever Peer Betas

De-lever the industry peer Betas of the Publicly Listed Companies using the Unlevered Beta formula.

- Take The Average or Median

Calculate the Average or Median of the Unlevered Betas for the comparable companies.

- Re-Lever With Current / Target Capital Structure

Finally, for the subject company re-lever the Beta to go from the Company’s Unlevered Beta to its Levered Beta.

By re-levering Beta, you can now assess the Target Company’s risk profile using its publicly listed peers as a proxy.

Quick Note: If you don’t have sufficient information on the company’s Capital Structure, you can use average Peer Debt-To-Equity ratios as a proxy for the subject company’s market performance.

By following the steps outlined above, you can obtain the Target Company’s Beta.

Now, let’s see where we can find Beta in real life.

How to Source Beta?

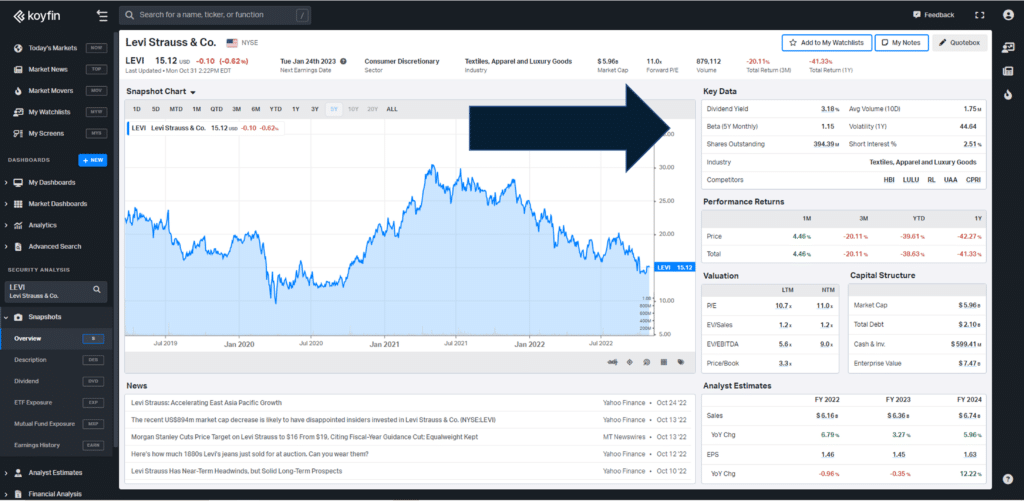

If you’re on the job, Bloomberg, CapitalIQ, or Factset are your friends here. However, those platforms are incredibly expensive for individuals.

But if you’re a student reading this, chances are you don’t have access to fancy Bloomberg terminals – but don’t panic.

You can still access this information using Yahoo Finance or Koyfin (see example below).

With that covered, let us now take a look at how Beta shows up in Investment Banking and Private Equity Interviews.

Common Unlevered Beta Interview Questions

Questions about Beta are quite common in Finance interviews. In particular, if you are aiming for a career in Investment Banking, this is a concept you would want to understand in detail.

A few common interview questions are:

How would you go about calculating the Unlevered Beta for a private company?

How does the total debt of a company affect its Beta?

Which is more useful for investors, the Unlevered or Levered Beta?

To answer these questions, you will need to understand:

Beta for a private company

How debt impacts the risk of a company and how more debt impacts expected returns

How investors use beta to assess a company’s risk profile

With all of this covered, let’s now wrap up our discussion on Beta.

Wrap-Up: Unlevered vs Levered Beta Formulas

Hopefully, you now have a much better understanding of Unlevered Beta and Levered Beta.

As we discussed throughout this article, Beta is a critical measure of risk used throughout the Finance world.

Beta is important because it tells you the sensitivity of the Security/Asset to the overall (i.e. ‘systematic’) risk of the Stock Market.

We hope you found this article helpful!

Let us know if you have any questions in the comments below. We’d love to hear from you!

Video Review: Unlevered Beta Formula

Want a video overview of Unlevered Beta Formula?

Check out this YouTube Video Walkthrough of Unlevered Beta Formula from our Founder, Mike Kimpel, with a full walkthrough.

Also, check out our YouTube Channel for more Interview Question reviews and Finance Explainer Videos, and follow us on Instagram for daily finance tips and tricks.

About the Author

Mike Kimpel is the Founder and CEO of Finance|able, a next-generation Finance Career Training platform. Mike has worked in Investment Banking, Private Equity, Hedge Fund, and Mutual Fund roles during his career.

He is an Adjunct Professor in Columbia Business School’s Value Investing Program and leads the Finance track at Access Distributed, a non-profit that creates access to top-tier Finance jobs for students at non-target schools from underrepresented backgrounds.

Frequently Asked Questions

What is Unlevered Beta?

Unlevered Beta is a measure of a Company’s Business/Operational risk. It doesn’t take into account the Financial Leverage and Capital Structure of a Company.

How to calculate the Unlevered/Asset Beta?

Asset Beta, also known as Unlevered Beta, can be found by taking the Levered Beta and dividing it by [1 + (1 – tax rate) x (debt/equity)]. The Levered Beta can be found using on-the-job resources like Bloomberg or from other resources like Koyfin.

What are Levered and Unlevered Beta?

Levered and Unlevered Beta are both measures of the Risk Profile of a Company. Levered Beta takes into account the Financial Leverage / Capital Structure of a firm. Unlevered Beta purely measures the Business / Market Risk.

What is Asset Beta?

Asset Beta, also known as Unlevered Beta, is an assessment of the Business Risk of a Company without taking into account its Capital Structure.