Purchase Price Allocation (PPA) concepts often cause quite a headache. We can make it easy. After reading this article, you will be able to master this concept for use both in interviews and on the job in Investment Banking, Private Equity, Corporate M&A, and Investment Management.

In this blog post, we’ll discuss:

Why Purchase Price Allocation (PPA) matters.

What Goodwill is and how it relates to PPA?

How Asset vs Stock Deals impact PPA.

A real-life example of Purchase Price Allocation with the AMD/Xilinx M&A deal.

Where PPA shows up in interviews and on the job in Investment Banking and Private Equity.

Estimated reading time: 10 minutes

- TL;DR

- What Is Purchase Price Allocation?

- Why Does Purchase Price Allocation Matter in M&A?

- How Do You Calculate Fair Market Value?

- Intangibles: Goodwill & Other Intangible Assets in PPA

- Purchase Price Allocation Example

- The 4 Steps of Purchase Price Allocation

- Asset Acquisition vs Stock Acquisition Implications

- Real-Life PPA Example: AMD – Xilinx Transaction

- Purchase Price Allocation in IB/PE Interviews?

- Wrap-Up: Purchase Price Allocation

- About the Author

- Frequently Asked Questions

- Related Links

TL;DR

Purchase Price Allocation is an important part of the M&A process. PPA involves allocating the purchase price of an Acquisition Target among Assets and Liabilities on the Balance Sheet. We do this to account for disconnects between the Book Value and Market Value of the Acquired business.

What Is Purchase Price Allocation?

Purchase Price Allocation (PPA) is a big part of any M&A transaction or business combination. PPA involves allocating the purchase price among Assets and Liabilities in order to accurately account for them.

Buy-Side and Sell-Side jobs are centered around M&A transactions. Thus, PPA is a critical concept to master if you are aiming for or working in either field.

Why Does Purchase Price Allocation Matter in M&A?

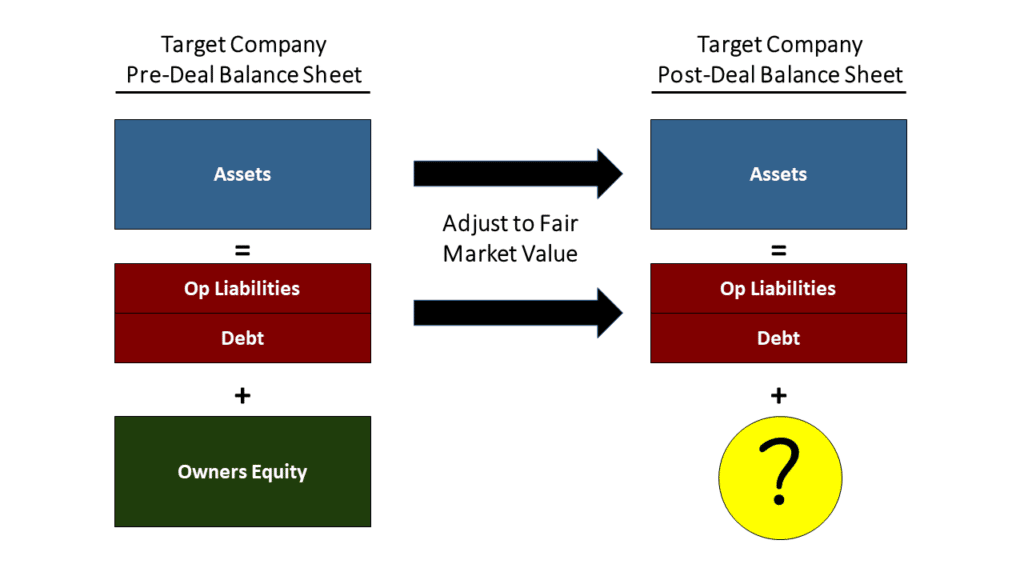

During an M&A transaction, Acquisition Accounting rules require the Acquired Company to mark its Assets and Liabilities to Fair Value.

In the US, the Financial Accounting Standards Board (FASB) creates Acquisition Accounting rules under US GAAP. The IRS creates Acquisition Accounting rules for Tax Purposes.

As we’ll see shortly, the amount by which you mark acquired Assets and Liabilities up or down can have a significant impact across the three financial statements.

How Do You Calculate Fair Market Value?

In real life, we estimate the Fair Market Value (FMV) of the Assets acquired and Liabilities assumed in an Acquisition prior to the close of the transaction.

Once the deal closes, the company will hire M&A Appraisers (e.g. an independent business valuation specialist). Appraisers mark all Assets acquired and assumed Liabilities to fair value.

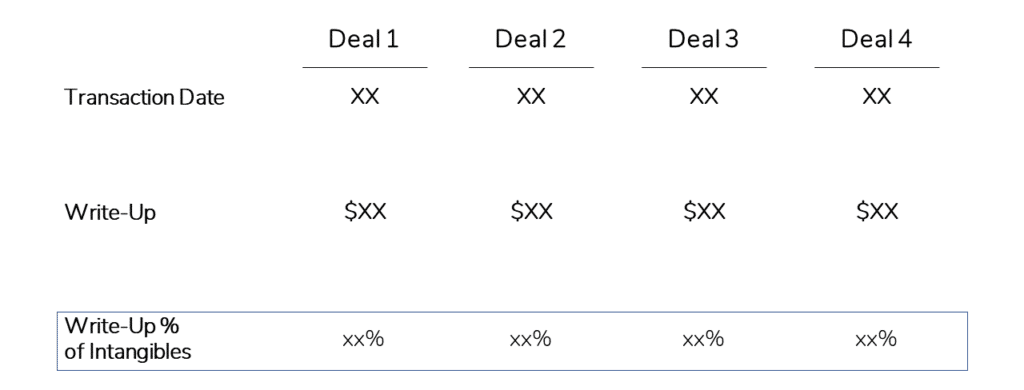

Since PPA is so important to the M&A process, we can also estimate the Fair Market Value (FMV) using other past deals.

Hack: Estimate Fair Market Value With Past Deals

You can find the FMV estimates in the filings of public peers that have gone through an M&A event or business combination.

Specifically, you can find this information in the Merger Proxy filing, specifically on the Pro Forma Balance Sheet, where we can see the amount the acquirer allocates as a fair value.

It is important to note that every company is different, so the actual fair value might vary. But, this is still a helpful method for estimations.

Now that we have covered Fair Market Value, let’s talk about the other core concept in PPA, Goodwill.

Intangibles: Goodwill & Other Intangible Assets in PPA

Goodwill represents the Equity Purchase Price paid above Book Equity Value for a Target Company in a Merger or Acquisition.

We record Goodwill to plug the gap to make the Balance Sheet balance. In doing so, we capture the extra value in the actual purchase price paid (Market Value – Book Value).

It’s worth noting that Intangible Assets are often the biggest driver of write-ups during acquisitions.

The Intangible write-up reflects the fact that the new owner can use assets from the acquired company, like Brand Names and Customer Relationships, to make money.

How Do I Calculate Goodwill?

Now that we understand Goodwill, we can move on to how to calculate it.

The Goodwill Calculation is simple: Purchase Price of Equity – Book Value of Equity Acquired (aka Net Assets).

Purchase Price Allocation Example

For example, imagine you are buying a Business with Intangible Assets of $100 prior to the deal. Let us also imagine that the Intangible Assets have a Market Value of $25 more than their current Balance Sheet book value.

In an M&A scenario, the Acquired Entity would write up its assets to Fair Market Value.

So, we write up to Fair Value by taking assets from $25 to $125.

Assuming a Liability value of $50 leaves us with a Book Value of Equity of $75, higher than without the write-up.

Then, assuming the Purchase Equity Value (aka Market Capitalization) of the Target Company is $100, the Goodwill is $100 of the Equity Purchase Price less the $75 of adjusted Book Value.

As a result, recorded Goodwill is $25, or smaller than it would have been without the mark-up to fair market value.

The 4 Steps of Purchase Price Allocation

To keep this simple, there are just a few Steps to PPA:

With that in mind, let’s now look at our 4-Step Framework.

- Calculate Fair Market Assets and Liabilities

Before the deal closes, Analysts typically use an estimate for write-up/down values. After the deal closes, Appraisers perform a detailed analysis based on Fair Market Value for all Assets and Liabilities on the Balance Sheet.

- Calculate Goodwill

We simply use the formula: Market Value of Equity – Book Value of Equity

- Adjust the Balance Sheet to Fair Market Value

Mark all relevant Assets and Liabilities (typically Intangibles and PP&E) to Fair Value.

- Wipe out Existing Book Equity and Plug the Balance Sheet with Goodwill

Remove the existing Book Equity in the Equity section of the Balance Sheet. On the Asset side of the Balance Sheet, add Goodwill to reflect the difference between the Purchase Price of Equity and the Book Value of Equity.

Asset Acquisition vs Stock Acquisition Implications

PPA is also important when it comes to distinguishing between Asset Acquisitions vs Stock Acquisitions (a.k.a Asset Deals vs Stock Deals). Now, let us take a look at each of these deal types.

What Is an Asset Deal vs Stock Deal?

In short, there are two major Acquisition structures: Asset Deals and Stock Deals, each of which has different tax implications.

In a Stock Deal, the Acquirer buys the shares of the Target Company.

In an Asset Deal, the Acquirer buys specific assets of the Target Company.

We discuss both deal types in more detail in both of these courses:

As we explain in the courses, PPA can have a significant impact on profit metrics such as EBITDA and Earnings Per Share (EPS).

Especially when building Merger Models, incremental Depreciation and Amortization can largely impact Accretion Dilution calculations.

Before we jump ahead, we need to make a quick note on Deferred Taxes.

Quick Note: Stock Acquisition DTLs?

Because of discrepancies in GAAP Accounting Principles vs the IRS Tax Code for Stock Deals, we need to create a Deferred Tax Liability.

It is important to understand that in a Stock Deal where we have to perform PPA, we adjust the balance sheet for this Deferred Tax Liability.

Now let’s take a look at a real-life example of PPA.

Real-Life PPA Example: AMD – Xilinx Transaction

AMD’s recent acquisition of Xilinx is a real-life example of PPA.

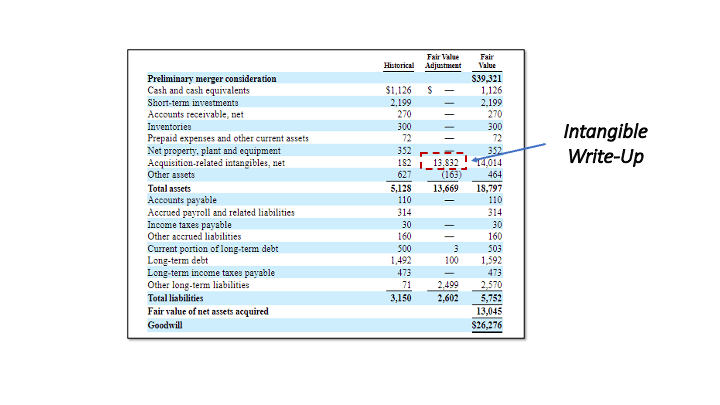

AMD paid $35 billion in cash and stock for Xilinx. The image below shows that the estimated fair value of Xilinx’s Intangibles was $14 billion higher than its Book Value on the pre-deal Balance Sheet.

From the Merger Proxy, we can see on the Pro Forma Balance Sheet that Intangible Assets have been marked up by $14 billion.

Without this write-up amount, equity would have been $14 billion lower, and Goodwill would have been $14 billion higher.

With our real-life example covered, let’s now take a look at how PPA shows up in Interviews.

Purchase Price Allocation in IB/PE Interviews?

PPA is a common topic in M&A interviews because it’s an important part of the overall process.

You can expect to be asked about PPA, Goodwill, Asset vs Stock Deals, and other related topics when interviewing for Investment Banking or Private Equity roles.

Be sure to do your research and practice PPA questions before interviews so you can ace them! Some examples of interview questions here:

How is Goodwill created in an Acquisition?

Under what circumstances would Goodwill increase?

The 2 basic ways you can buy a company are through a Stock purchase and an Asset purchase. What’s the difference, and what would a buyer prefer? What about the seller?

If you want to dig into more interview questions, check out our Investment Banking Interview Question Guide:

Wrap-Up: Purchase Price Allocation

In conclusion, PPA is an important process in M&A transactions as it involves allocating the purchase price among Assets and Liabilities assumed in order to accurately account for them.

It is important to master PPA principles when applying for Investment Banking or Private Equity jobs since it’s likely to come up during interviews.

We hope this post was helpful in understanding PPA and its importance!

About the Author

Mike Kimpel is the Founder and CEO of Finance|able, a next-generation Finance Career Training platform. Mike has worked in Investment Banking, Private Equity, Hedge Fund, and Mutual Fund roles during his career.

He is an Adjunct Professor in Columbia Business School’s Value Investing Program and leads the Finance track at Access Distributed, a non-profit that creates access to top-tier Finance jobs for students at non-target schools from underrepresented backgrounds.

Frequently Asked Questions

Purchase Price Allocation is the process through which we write up the value of Assets and Liabilities on a company’s Balance Sheet in an M&A transaction to ensure the Book Value and Market Value of the business connect.

A Purchase Price Allocation (‘PPA’) adjustment is when we write up items on an Acquired Company’s Balance Sheet to more accurately assess their Fair Value.

The 4 Step process to Allocating a Purchase Price are:

1. Calculate fair market, assets, and liabilities

2. Calculate Goodwill: Market Value of Equity – Book Value of Equity

3. Adjust the Balance Sheet to Fair Market Value

4. Back out Book Equity and plug the Balance Sheet with Goodwill

Yes, Purchase Price Allocation is required during an M&A transaction because of Acquisition Accounting rules created by FASB and the Internal Revenue Code. These rules require that an Acquired Entity write up its Assets and Liabilities to Fair Value.