Master the Depreciation Tax Shield concept so you can use it on the job in Investment Banking, Private Equity, and Investment Management.

In this article, you will learn:

- Why the Depreciation Tax Shield matters.

- How to Calculate the Depreciation Tax Shield.

- The Cash Flow and Valuation Impacts of the Depreciation Tax Shield.

Estimated reading time: 10 minutes

- TL;DR

- Want To Learn More About Finance?

- Why Does the Depreciation Tax Shield Matter?

- The Depreciation Tax Shield in 2 Steps

- The Tax Impact of Depreciation

- Example: Depreciation Method Tax Impacts

- Are There Other Tax Shields?

- Wrap-Up: Depreciation Tax Shield

- Depreciation Tax Shield – Deep Dive Video

- About the Author

- Frequently Asked Questions

- Related Links

TL;DR

- Any expense that lowers (i.e. ‘Shields’) taxes paid, is a Tax Shield.

- The Depreciation Tax Shield reflects the Tax Savings from the Depreciation Expense deduction.

- The Depreciation Tax shield directly affects Income Taxes paid (i.e. Cash Flow) and thus directly impacts Valuation.

- The Interest Tax Shield is similar to the Depreciation Tax Shield, but the tax savings come from Interest Expense (vs Depreciation Expense).

Want To Learn More About Finance?

Ramp up faster with all of our (free) deep-dive articles in our Analyst Starter Kit:

Why Does the Depreciation Tax Shield Matter?

The Depreciation Tax Shield is a core concept to master if you are aiming for (or working in) Finance.

But how do we define ‘Tax Shield?’

In short, a Tax Shield is any item that lowers taxable income and thus lowers the taxes you must pay.

There are a variety of deductions that can shield a company (or Individual) from paying Taxes.

This article will focus on the Tax Shield created by Depreciation, particularly the Cash Flow and Valuation impacts.

Now let’s look at how the Depreciation Tax Shield concept shows up in Interviews.

Depreciation Tax Shield in Interviews

If you’re aiming to work in Finance, it is essential to pin down this concept.

Interview questions around the Depreciation Tax Shield are quite common because it ties directly into the Discounted Cash Flow (DCF) analysis process.

A few common interview questions are:

- What is the Depreciation Tax Shield?

- How do you calculate the Depreciation Tax Shield?

- How does the Depreciation Tax Shield impact Cash Flow and Valuation?

To answer these questions, you will need to understand:

- The underlying meaning of ‘Tax Shield’ (covered above).

- The Depreciation Tax Shield Calculation (next section).

- The impact of Tax Shields on Cash Flow and Valuation (go to section).

After reading this article, you will be able to nail all of the Interview Questions above.

Let’s dive in!

The Depreciation Tax Shield in 2 Steps

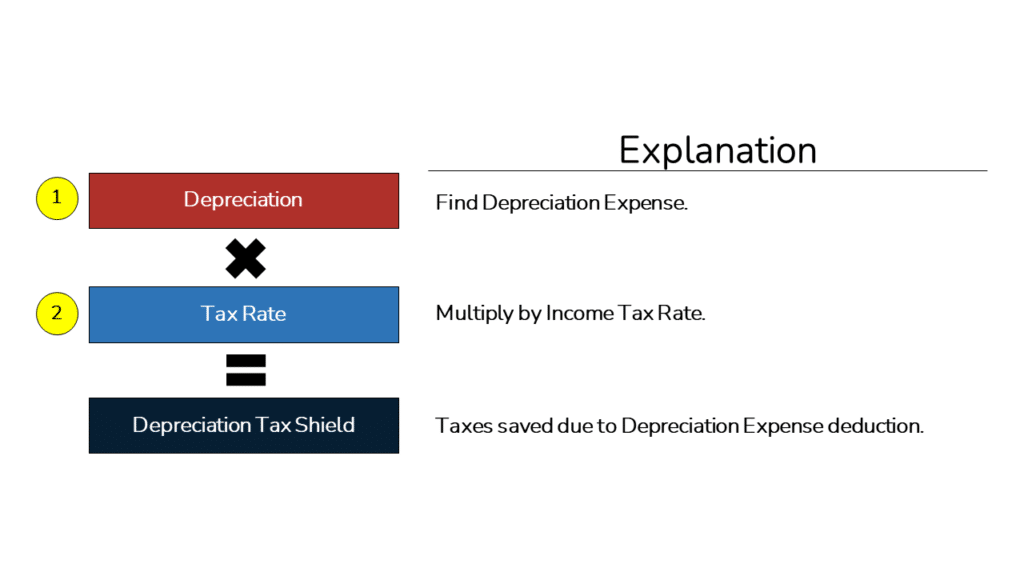

We’ll begin our discussion with Depreciation Tax Shield Formula, which breaks just two steps:

How to Calculate the Depreciation Tax Shield

- Find Depreciation Expense

Find Depreciation Expense in the Company’s financial filings (SEC Edgar Search).

If you are doing this for your Company or Privately held Client, you will need to ask the Accounting department or the Client, respectively, for the Depreciation numbers. - Multiply Depreciation by the Income Tax Rate

Find the Company’s Income Tax Rate either in the SEC Filings or use Management Guidance from the latest Quarterly Earnings call (if provided).

If you are doing this for your Company or a Privately held Client, you will have to ask the Accounting or Tax department or the Client, respectively, for the current Income Tax Rate.

By multiplying Depreciation Expense by the Income Tax Rate, you calculate the taxes saved (i.e. ‘Shielded’).

As you can see from the above calculation, the Depreciation Tax Savings as the expense increases.

Also, at higher tax rates, Depreciation is going to provide additional savings.

Let’s now look at the Depreciation Tax Shield impact on Cash Flow and Valuation.

The Tax Impact of Depreciation

Let’s begin with the Cash Flow impact of the Depreciation Tax Shield.

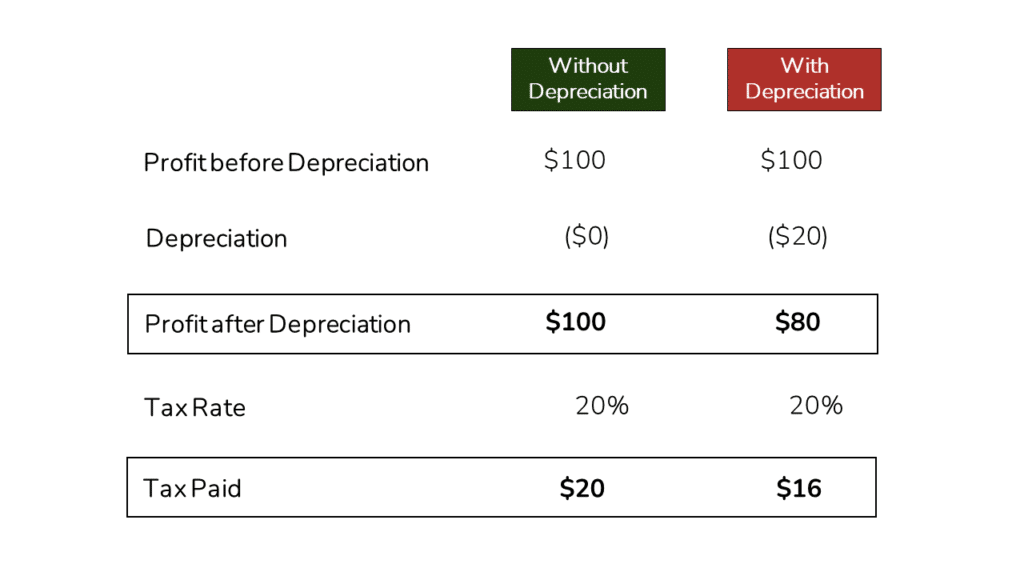

Below, we show a simple example of a Company with and without Depreciation Expense.

As you can see above, taxes are $20 without Depreciation vs. $16 with a Depreciation deduction, for a total cash savings of $4.

The dollars saved represent the ‘Tax Shield’ created by Depreciation.

Below, we take a look at an example of how a change in the Depreciation method can have an impact on Cash Flow (and thus Valuation).

Example: Depreciation Method Tax Impacts

Companies can often choose different Depreciation methods.

In the section below, we cover two of the most common methods and their Cash Flow and Valuation impacts.

Straight-Line vs. Accelerated Depreciation Approaches

Let’s take a look at how we would calculate Depreciation with each approach.

Straight-Line Approach:

- Calculate the ‘Depreciable Base:’ Acquisition Cost – Salvage Value.

- Each year, we would divide the Depreciable Base by the Asset’s Useful Life to arrive at Depreciation Expense.

As an alternative to the Straight-Line approach, we can use an ‘Accelerated Depreciation’ method like the Sum of Year’s Digits (‘SYD’).

Sum-of-Years-Digits Approach:

- Calculate the Depreciable Base: Acquisition Cost – Salvage Value.

- Next, we Sum up the total value of the digits of the Useful Life of the Assets (e.g. 5-year Life would be (1 + 2 + 3 + 4 +5) = 15.

- We then work in reverse order down the years to calculate the percentage of the asset to Depreciate in each year (.e.g. Year 1: 5 / 15 = 33%, Year 2: 4 / 15 = 27%, etc.)

- In each year, we would multiply the Depreciable Base by the Depreciation percentage in Step #3 above to calculate the expense in each year.

As you can see, the SYD method offers far more Depreciation Expense in the early years than the Straight-Line method.

With the two methods clarified, let’s look at the Cash Flow impact of each approach.

Straight-Line vs. Accelerated Depreciation – Cash Flow Impact

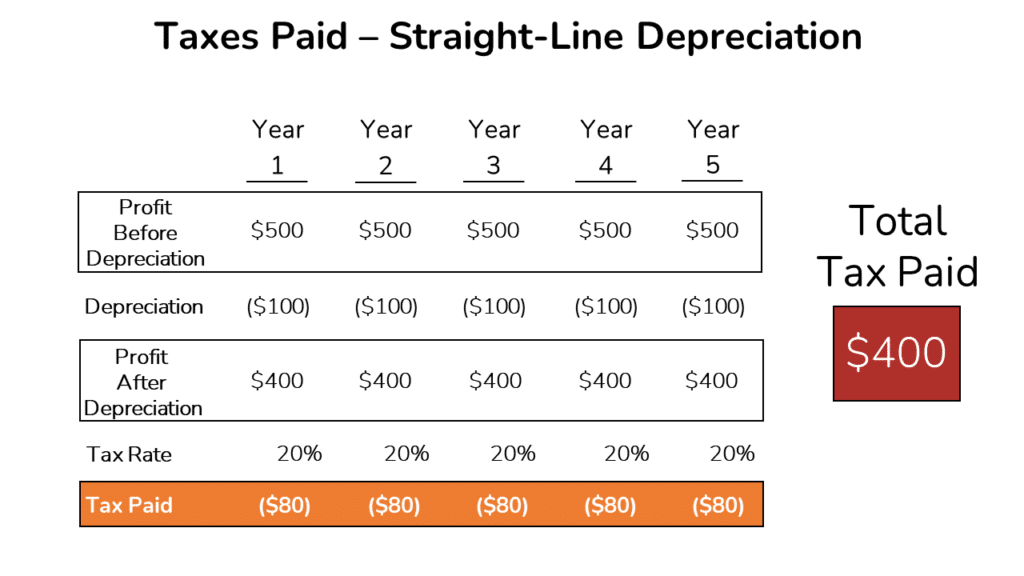

In the examples below, we assume the following:

- Useful Life: 5 Years

- Purchase Price: $500

- Salvage Value: $0

Below are the Depreciation Tax Shield calculations using the Straight-Line approach.

Now, let’s look at the alternative approach.

Below we have also laid out the Depreciation Tax Shield calculations using the Sum of Years Digits approach.

As you can see, the Taxes paid in the early years are far lower with the Accelerated Depreciation approach (vs. Straight-Line).

Straight-Line vs Accelerated Depreciation – Valuation Impact

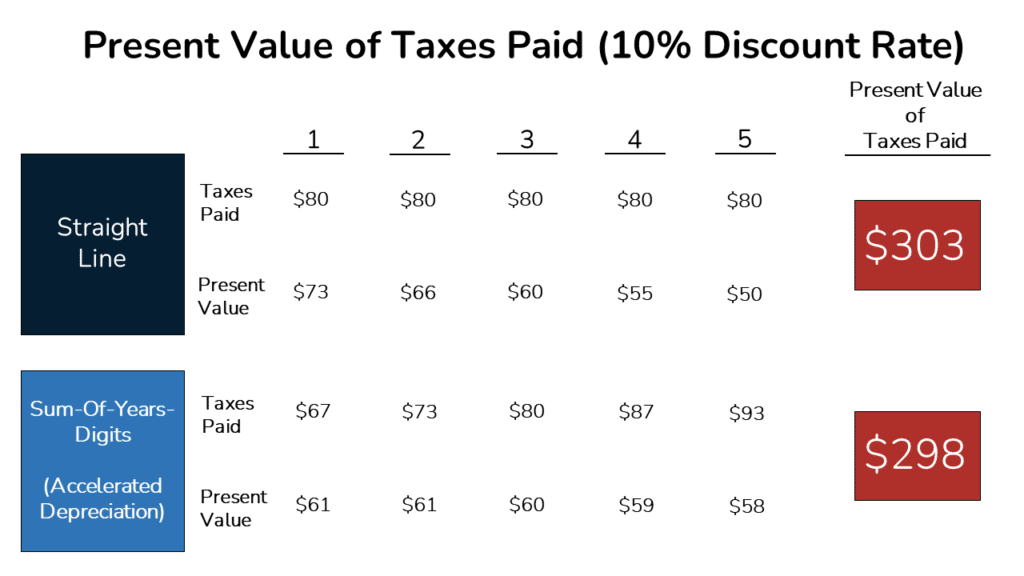

The Cash Flow differences illustrated above directly affect the Discounted Cash Flow value of the Business.

Below we use a 10% Discount Rate to value the Tax Cash Flows that we calculated in the prior section.

In short, the Net Present Value of the Depreciation Tax Shield is $5 lower with the Sum-of-Years-Digits approach.

Let’s imagine that the entire Business is worth $1,000 (Enterprise Value) before the Tax Shield.

So, the Business could be worth $5 more (or less), depending on the approach it chooses.

While $5 is not an enormous number here, the key takeaway is Depreciation can change the underlying Cash Flow of a Business and thus change its Valuation.

Are There Other Tax Shields?

Beyond Depreciation Expense, any tax-deductible expense creates a tax shield.

One of the other commonly discussed Tax Shields is the Interest Tax Shield.

The Interest Tax Shield

The Interest Tax Shield is the same as the Depreciation Tax Shield in concept.

In contrast though, with the Interest Tax Shield, it is Interest Expense that shields a Company from taxes paid.

The Interest Tax Shield concept is highly relevant for Leveraged Buyout (‘LBO’) acquisitions executed by Private Equity firms.

Private Equity Funds typically use large amounts of Debt to fund acquisitions. The Debt used in the purchase creates Interest Expense that reduces the acquired Company’s Tax bill.

Let’s take a quick look at how this works.

Quick Note: What is Debt?

We’ll begin by quickly clarifying how a company creates Interest Expense.

First, when a Company borrows money (or ‘Principal’) from a Lender, they typically agree to repay the borrowed dollars in the future.

As a cost of borrowing, the borrower must make Interest payments for the benefit of borrowing.

The Interest Payments are typically tax-deductible, which lowers the Company’s tax bill.

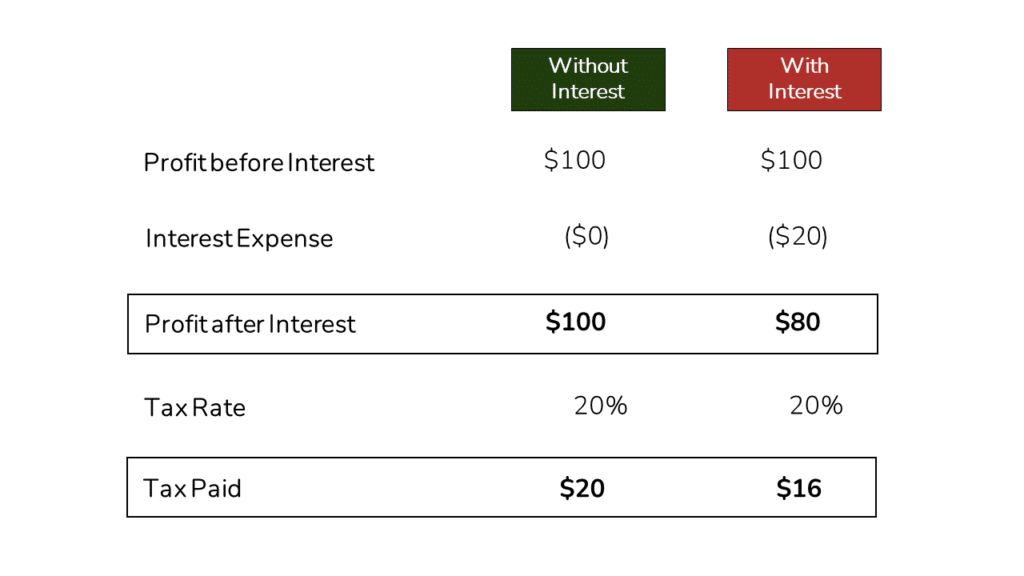

Below is a simple example of the impact of Interest on taxes paid.

Debt (Interest) Tax Shield Example

The taxes saved due to the Interest Expense deductions are the Interest Tax Shield.

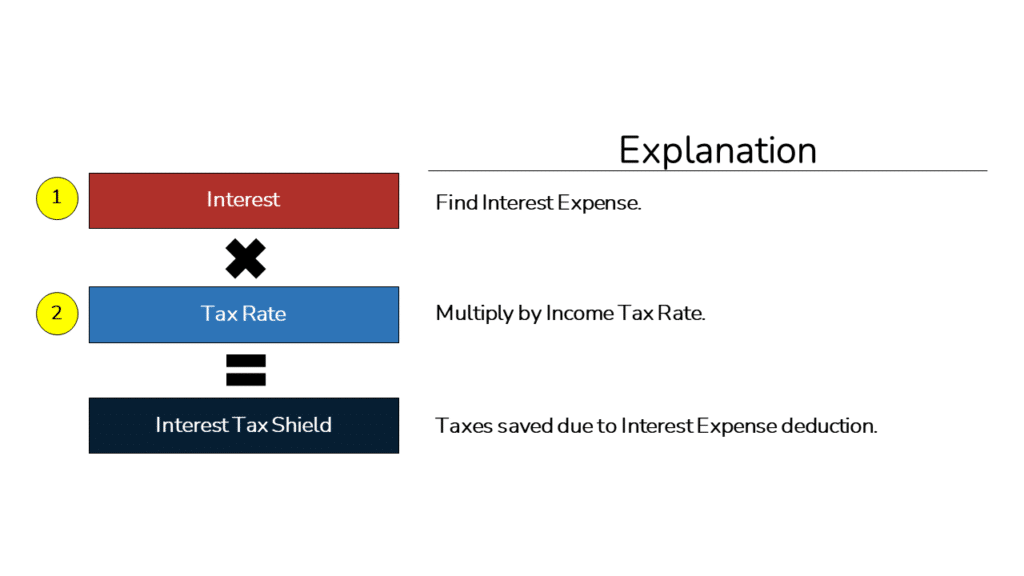

As you will see below, the Interest Tax Shield formula is nearly the same as with the Depreciation Tax Shield.

To calculate the Interest Tax Shield, you simply multiply the Interest Expense by the Tax Rate.

Wrap-Up: Depreciation Tax Shield

To wrap this up, we hope you now have a much better understanding of the Depreciation Tax Shield Calculation as well as the underlying concept.

In short, the Depreciation Tax Shield (and other Tax Shields) are important because they impact Cash Flow and thus Valuation.

Let us know if you have any questions in the comments below. We’d love to hear from you!

Depreciation Tax Shield – Deep Dive Video

If you enjoyed this article, definitely check out our video on the Depreciation Tax Shield.

Find more videos just like this on our YouTube Channel.

About the Author

Mike Kimpel is the Founder and CEO of Finance|able, a next-generation Finance Career Training platform. Mike has worked in Investment Banking, Private Equity, Hedge Fund, and Mutual Fund roles during his career.

He is an Adjunct Professor in Columbia Business School’s Value Investing Program and leads the Finance track at Access Distributed, a non-profit that creates access to top-tier Finance jobs for students at non-target schools from underrepresented backgrounds.

Frequently Asked Questions

A Tax Shield is any expense that lowers Taxable Income and thus shields a Business (or Person) from paying more Income Tax.

To calculate the Tax shield, you multiply the Deductible Expense by the Income Tax Rate.

The Depreciation Tax Shield reflects the Income Tax savings created by Depreciation Expense.

The Depreciation Tax Benefit reflects the money saved on Income Taxes due to Depreciation Expense.

Is there a depreciation tax shield in the event of a sale of an asset that has been already fully depreciated (equipment)?

Hey Sebastian, great question. Unfortunately, the Depreciation Tax Shield goes to zero once the asset is fully depreciation. The only exception is when a company writes/steps-up their assets to Fair Market in an M&A event.