Want to understand the difference between Stocks and Bonds with simple, visual, and Plain-English explanations? After reading this article, you will understand:

- The key differences between Stocks and Bonds.

- How Bonds vs Stocks (and Debt vs Equity) relate to the House you live in.

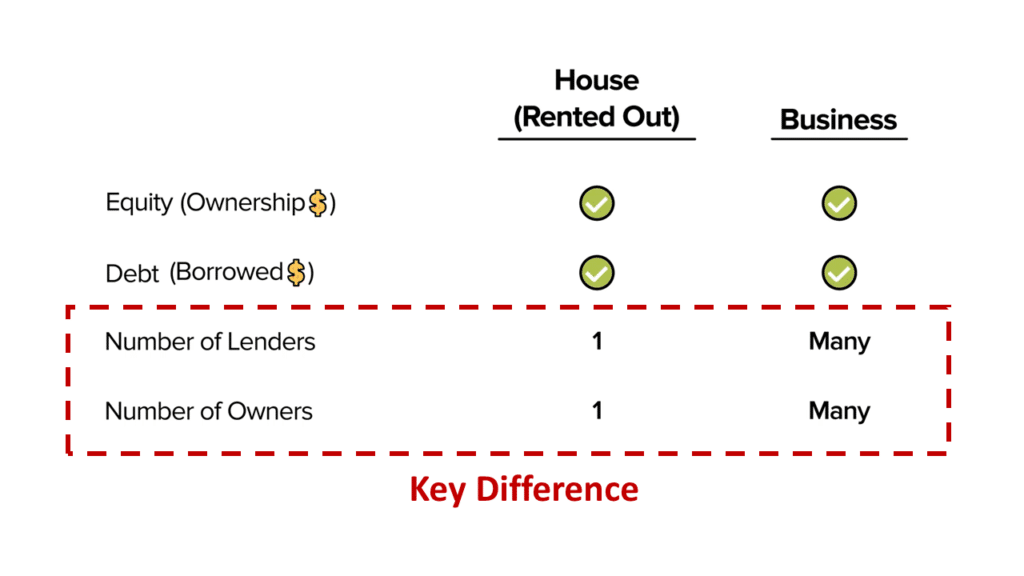

- Why Houses typically have one owner and lender but Businesses typically have many Owners and Lenders.

- How Stocks and Bonds are issued (and then traded).

TL;DR

- Stocks represent ownership in a Business (aka Equity).

- Bonds represent money lent to a Business (aka Debt).

- Unlike with a House, a Business has many owners called Shareholders.

- Unlike with a House, a Business borrows from many lenders, called Bondholders.

- Stocks and Bonds can be publicly traded, which allows investors to buy and sell daily.

Estimated reading time: 14 minutes

- TL;DR

- Intro to the Difference Between Stocks and Bonds

- Want To Learn More About Finance?

- The Difference Between Stocks and Bonds: Big Picture

- Equity vs Debt for a House and a Business

- Difference Between Stocks and Bonds: Bonds

- Difference Between Stocks and Bonds: Stocks

- Typical Stock and Bond Investors

- Wrap-Up: The Difference Between Stocks and Bonds

- Stocks vs Bonds: Full Animated Explainer Video

- Related Links

- About the Author

- More Content Related to Stocks vs Bonds

- Frequently Asked Questions

Intro to the Difference Between Stocks and Bonds

When people first learn about Finance, they typically hear about Stocks and Bonds soon after.

Unfortunately, many go years into their studies (or work) before gaining a full grasp of what Stocks or Bonds represent.

In this article, we will provide a simple, Plain English review of the difference between Stocks and Bonds.

Want To Learn More About Finance?

Ramp up faster with all of our (free) deep-dive articles in our Analyst Starter Kit:

The Difference Between Stocks and Bonds: Big Picture

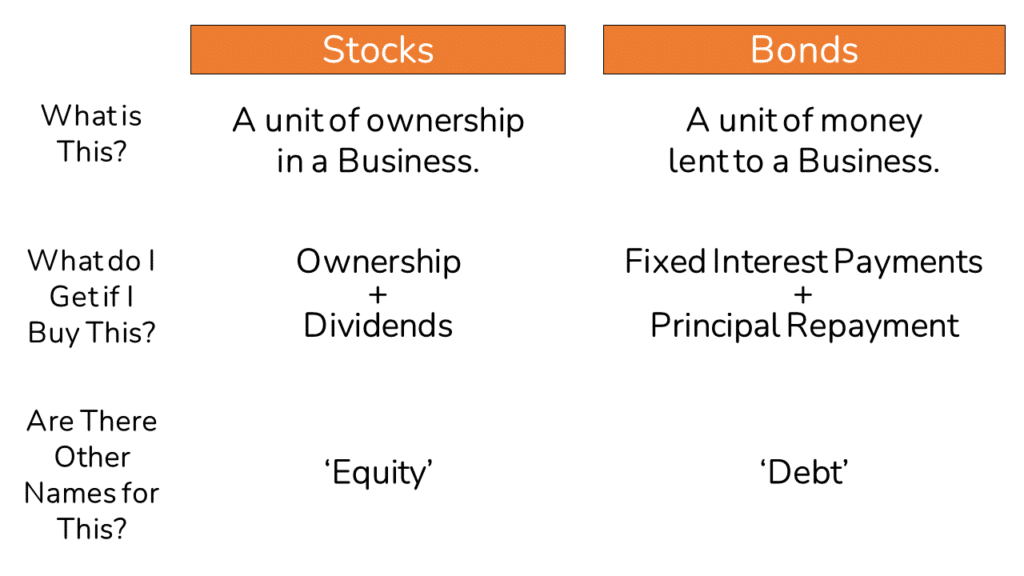

Before we dive into the deep end, let’s begin here with a big picture view of Stocks versus Bonds.

Below we identify the features of Stocks and Bonds:

The Difference Between Stocks and Bonds

First, Stocks represent a unit of Ownership in a Business, whereas Bonds are a unit of a larger amount of money lent to a Business.

When you buy a Stock, you become an owner of the underlying Business and are entitled to receive your share of any distributions (or ‘Dividends‘) paid to owners.

Bonds are different from Stocks because when you buy a Bond, you do not gain any ownership in the Business.

As a Lender, you receive Fixed Interest Payments over the Bond’s life. In addition, at the end of the life of the Bond, you are entitled to full repayment of the Face Value (or ‘Principal‘) of the Bond.

Finally, Stocks are a form of ‘Equity‘ whereas Bonds are a form of ‘Debt‘.

In the rest of this article, we’ll dive deep into how Stocks vs Bonds work.

We begin below by relating both Stocks and Bonds to the House you live in.

Quick Note: We are comparing Corporate Bonds vs Stocks. There are other types of Bonds issued by municipalities, governments, etc. Here we are focused solely on Corporate Bonds. These are great articles on Municipal Bonds and Government Bonds if that’s what you are after.

Equity vs Debt for a House and a Business

Let’s start with a review of the core concepts of Equity and Debt.

To do that, we’ll use the examples of a House (Rented Out) and a Business since they are so similar.

First, ‘Equity‘ is the same as the word ‘Ownership.’

In other words, Equity reflects the Owner’s value in a House or Business.

This usually consists of Equity Value in the House or Business (Total Sale Value less Borrowings) plus any excess Cash from rental income or sales to customers.

On the other hand, Debt reflects borrowings made by the owner of a House or Business.

How Stocks and Bonds Relate to Your House

Let’s begin by looking at Equity and Debt in the context of a House that we’ve rented out.

When we purchase a House, we typically borrow some of the Purchase Price by taking out a Mortgage on the property.

As the Buyer, we must fund the rest of the purchase by making a Down Payment.

Contributing the Down Payment makes us the owner of the House. The amount we’ve invested here is our Equity.

As the House increases in value over time, our Equity Value in the House increases. Equity Value increases because we could sell the House at a higher price, pay off our debt, and collect the rest.

As the Owner, we are also entitled to any cash generated by renting out the House. This Cash Flow from rent also increases the value to us as the owner.

In short, Equity Value reflects the underlying Equity in the House plus any excess cash from Rent.

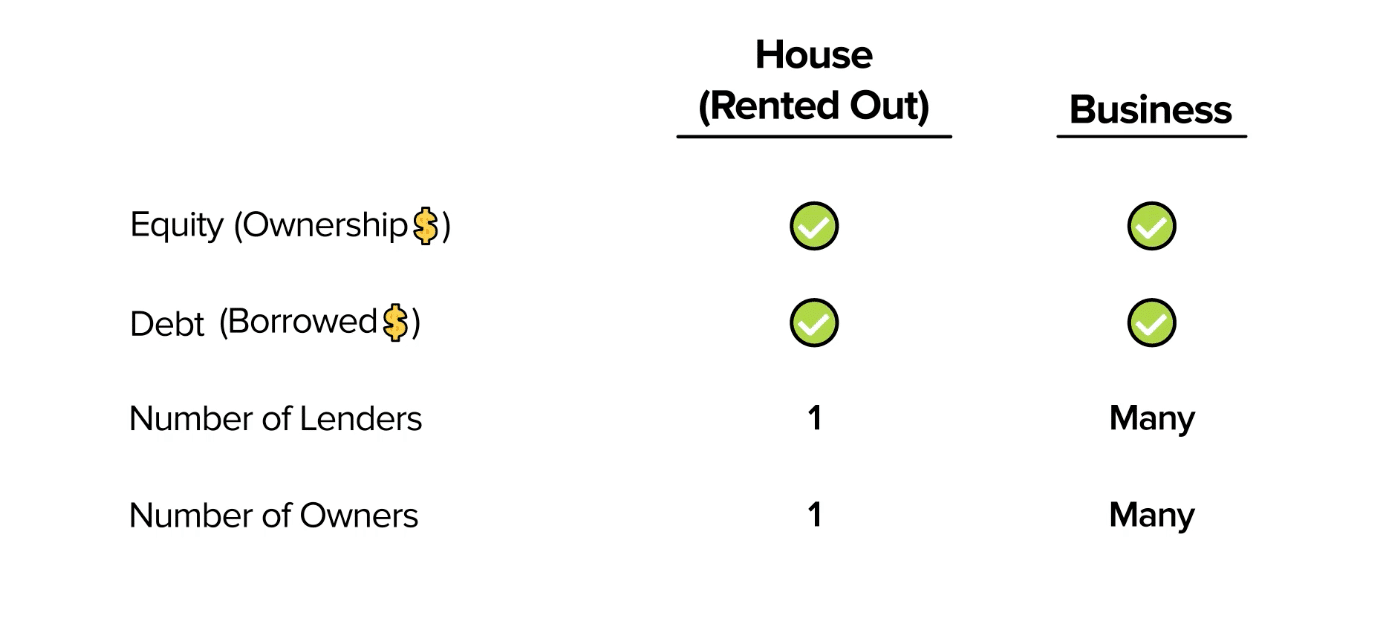

Thus far we’ve said that the Debt and Equity of a House and a Business are nearly the same.

However, there’s one MAJOR difference between Debt and Equity for a House vs a Business.

Debt and Equity (Houses vs Businesses)

The critical difference between a House and a Business is the number of Lenders and Investors involved.

With most houses, there is only one Lender and one Investor.

By contrast, Businesses are typically much more expensive (vs a House).

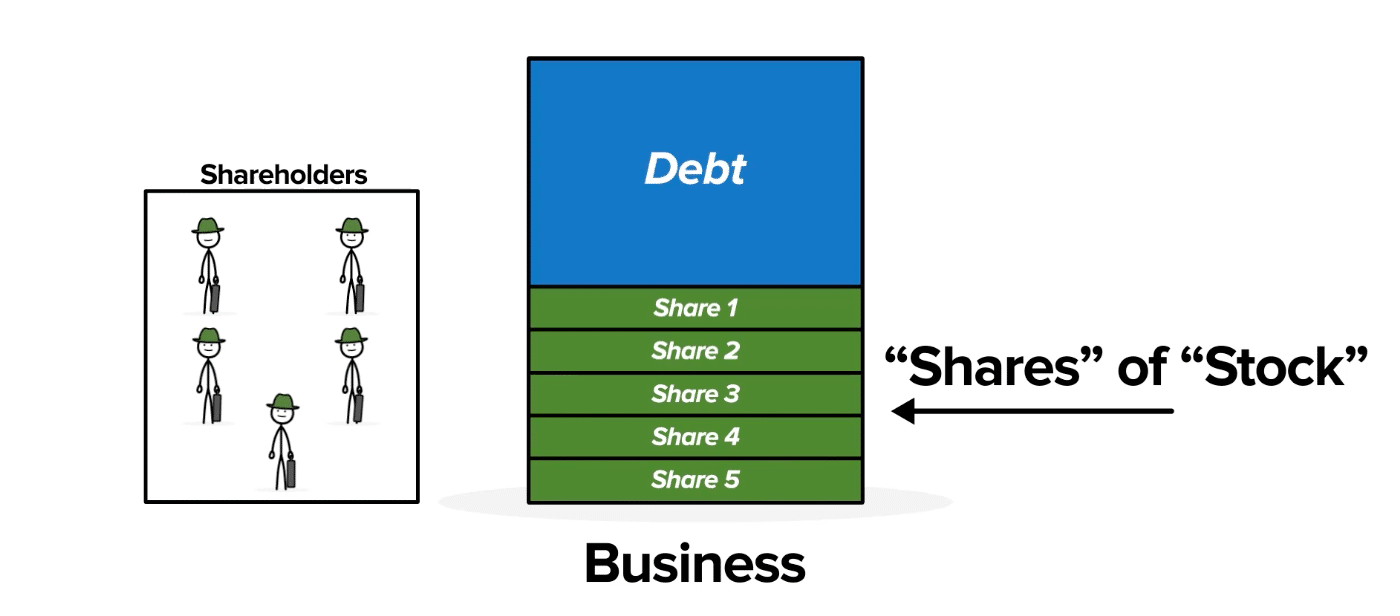

As such, Businesses break Equity and Debt into smaller pieces to make each more affordable.

Because of this, you can be a partial lender or owner without buying all of the Company’s Debt or Equity.

Because of this, Businesses often have many Lenders and many Investors.

Let’s now look at how Equity and Debt work with a Business!

From a House…to a Business

With a Business, the same flow of Equity and Debt funding above also applies, but with a few differences.

First, the typical Business‘s Cash Flows are less stable than those of a House.

As such, we typically wouldn’t borrow as much of the Purchase Price.

Also, while the substance of Equity is the same, we’d typically call the Down Payment an ‘Equity Contribution‘.

Similar to the house example, the Equity Contribution entitles owners to the underlying value in the Business.

Owners are also entitled to any excess cash generated by sales to customers.

But again, the big difference with a Business (vs a House) is that the Purchase Price is much higher in most cases.

To make ownership and lending more approachable, Businesses break Debt and Equity into smaller pieces which are called ‘Stocks‘ and ‘Bonds.’

Difference Between Stocks and Bonds: Bonds

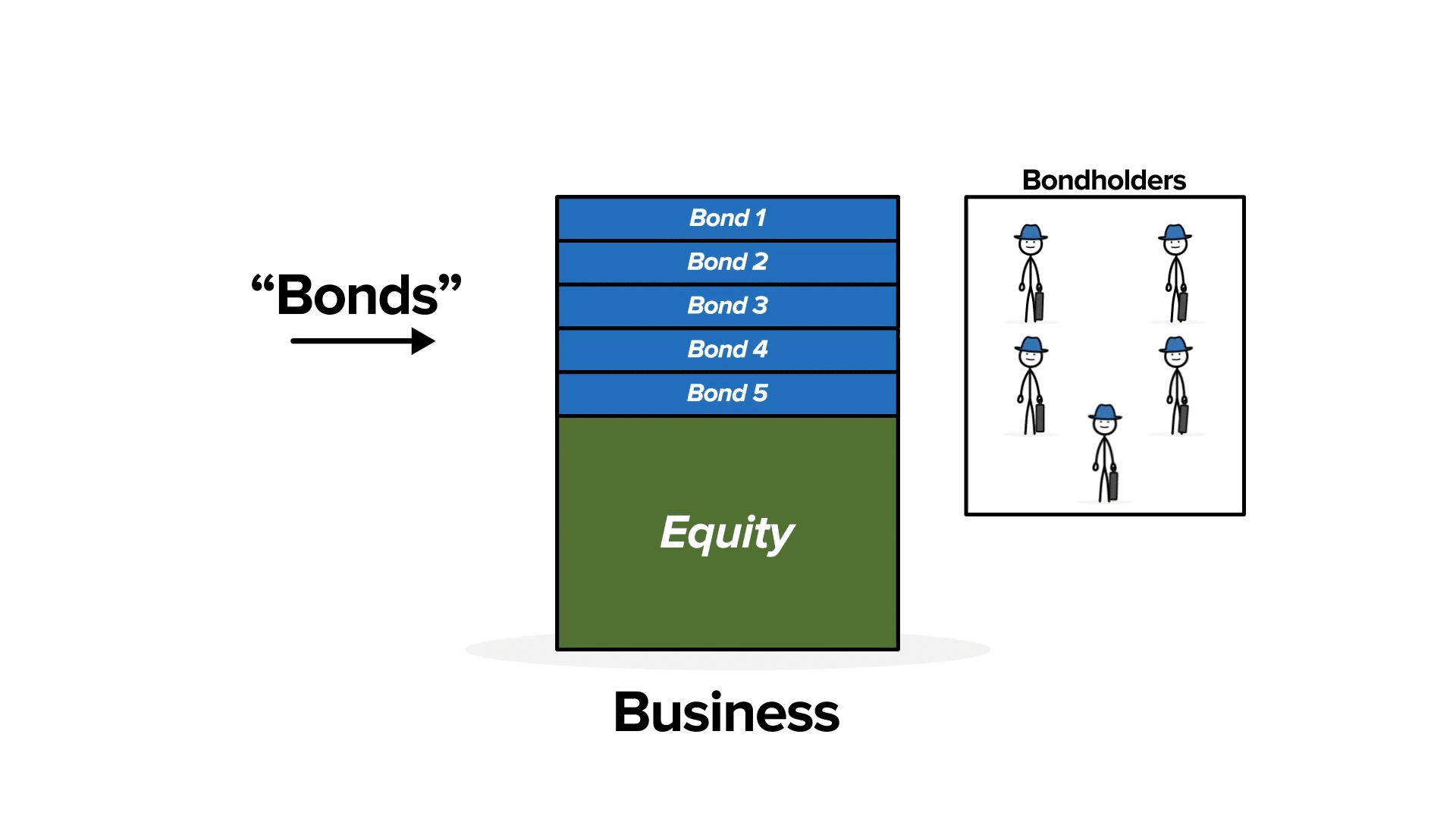

A Business’ Debt usually consists of Loans or Bonds. Since most people are familiar with Bonds that they can buy and sell, we’ll focus on Bonds here.

Loans vs Bonds

But first, a few quick notes on Loans.

Loans function the same way as Bonds function. As with Bonds, there are often many individual lenders behind a single loan.

The mechanics are slightly different from Bonds though, and we will explore the differences in a later article.

How a Bond Issuance Works

Now back to Bonds. If a Business wants to issue Bonds, they would typically hire an Investment Bank to market the Bonds.

Investment Banks will market the Company to large (or ‘Institutional‘) Lenders who would buy up the Bonds.

Even though there are many Bondholders, all of their Bonds combine into one unit of Debt from the Company’s perspective.

In return, the Business must ensure that the Bondholders receive their Interest Payments over the life of the Bonds.

The Business must also repay the full ‘Face Value‘ (i.e. the amount owed by the Business) when the Bond Matures.

How Bonds Trade on the ‘Credit’ Market

Once a Company raises Bonds, the Bonds trade between buyers and sellers on the ‘Bond Market‘ (or ‘Credit Market‘).

It’s worth noting that the money raised from the Bonds only flows to the Business one time.

In other words, the Business receives money right when it issues the Bonds.

After that point, the Bonds simply trade between buyers and sellers on the Bond market.

When Bond investors trade back and forth and no money flows back to the Company.

Now, let’s look at how Stocks differ from Bonds.

Difference Between Stocks and Bonds: Stocks

To initially fund a private Business, the investors (or ‘Shareholders‘) invest through an Equity Contribution and gain ownership (or ‘Equity‘) proportional to their investment.

Similar to Bonds, the Companies divide the ownership of a Business into smaller (equally sized) units (or ‘Shares‘ of ‘Stock‘).

Owners (or ‘Shareholders’) receive a share of the profit distributions (or ‘Dividends‘) of the Business and any value if the Company is ever sold.

How a Stock Listing (or I.P.O.) Works

When a Business is privately held, a Shareholder must wait until the Business is sold to sell their shares. In Finance-speak, these shares aren’t easily sellable (or ‘Liquid‘).

Private ownership like this is standard for Private Equity and Venture Capital Funds.

If a Company’s shareholders want to make their shares ‘Liquid‘, they can list the Company’s Shares on Stock Market in an Initial Public Offering (or ‘IPO‘).

To carry out an IPO, a Company would hire an Investment Bank.

The bank would then market the Company to Investors. Once they receive enough Investor interest, the bank would list the Company’s shares on the Stock Market.

As part of the process, the Company typically raises new shares (usually to fund growth), which lowers the ownership of (‘Dilutes‘) existing shareholders.

Despite the dilution, the listing makes the shares freely tradeable and injects capital for the Business to grow.

How Stocks Trade on the Stock Market

Similar to what we saw with Bonds, the money raised from selling Shares only flows to the Business one time.

This occurs right when the Shares are issued to new Investors in the Initial Public Offering.

From then on, the shares simply trade on the Stock Market.

As the shares trade between Investors, no money flows back to the Company.

Typical Stock and Bond Investors

Once a Business publicly lists its Stocks and Bonds, Investors can buy and sell every day.

This includes large investors in both Stocks and Bonds, such as Hedge Funds and Mutual Funds.

Individual (or ‘Retail‘) investors also account for a large proportion of Stock and Bond ownership.

In the end, investing in Stocks vs Bonds on the Stock Market (or ‘Equity Market‘) and Bond Market (or ‘Credit Market’) is a very similar process for any Investor.

Wrap-Up: The Difference Between Stocks and Bonds

In summary, Stocks and Bonds differ in that one reflects ownership (or ‘Equity‘) and the other reflects Borrowing (or ‘Debt‘).

The concepts of Debt and Equity are relevant for both Houses and Businesses alike.

However, Businesses typically have MANY investors who own Stock and MANY lenders who lend via Bonds or Loans.

If you continue to explore the world of Finance, we strongly encourage you to anchor to this House analogy. Especially when you get stuck in an interview!

House purchase mechanics are often easier to think through than the more abstract concept of a Business.

We hope this article has helped you to gain a better grasp of the difference between Stocks and Bonds (and the related concepts of Debt and Equity).

Please let us know if you have any comments or questions below!

Stocks vs Bonds: Full Animated Explainer Video

If you enjoyed this article, definitely check out our full Animated Explainer Video below on the differences between Hedge Funds and Mutual Funds.

You can find more videos just like this on our YouTube Channel.

Related Links

About the Author

Mike Kimpel is the Founder and CEO of Finance|able, a next-generation Finance Career Training platform. Mike has worked in Investment Banking, Private Equity, Hedge Fund, and Mutual Fund roles during his career.

He is an Adjunct Professor in Columbia Business School’s Value Investing Program and leads the Finance track at Access Distributed, a non-profit that creates access to top-tier Finance jobs for students at non-target schools from underrepresented backgrounds.

More Content Related to Stocks vs Bonds

We have created the ultimate free resource for aspiring Finance Analysts with our Finance Analyst Starter Kit.

- We have Free, Plain English articles and Animated Explainer Videos on:

- Who the core players (e.g. Investment Banks and Private Equity) are in the Finance world and how they operate.

- Core mental frameworks for learning Valuation and Returns Analysis.

- Reviews of common trouble topics like Enterprise Value vs Equity Value based on our experience training thousands of students.

- Detailed walkthroughs of common Interview Questions like Walk Me Through a DCF.

Frequently Asked Questions

Stocks represent ownership (or ‘Equity‘) in a Business. Buying a stock entitles the owner to receive proceeds if the Business is ever sold as well as a proportional share of cash distributions (or ‘Dividends‘).

On the other hand, (Corporate) Bonds represent a single unit of a larger piece of Debt that has been lent to a Company. As an owner of a Bond, you do not have ownership rights. Instead, you receive fixed Interest Payments and repayment of the Bond principal (or ‘Face Value‘) at the end of the Bond’s life.

A ‘Share‘ of ‘Stock‘ represents ownership (or ‘Equity‘) in a Company. Buying a single share entitles the owner to receive proceeds if the Company is ever sold and a proportional cut of cash distributions (or ‘Dividends‘).

On the other hand, Bonds are a single unit of a larger piece of Debt lent to a Company. As an owner of a Bond, you do not own the Business. Rather, you receive regular Interest Payments and repayment of the Bond principal at the end of the Bond’s life.

Stocks offer ownership of a Business and a share of any cash distributions (‘Dividends‘).

Bonds offer the ability to participate in Lending to a Business but no ownership. Instead, the buyer of a Bond receives Interest and Principal payments over time.

The single biggest difference is that Stocks represent ownership (or ‘Equity‘) in a Business whereas a Bond is simply Debt.

While Bonds and Stocks have many differences, they are quite similar in that they are both:

1) Investments that can generate returns for their Owners.

2) Often Publicly Traded so they can be easily bought and sold.

‘Stocks‘ and ‘Shares‘ are actually the same thing.

When you buy a unit of ownership in a Business (or a ‘Share‘), you are buying an individual unit of ‘Stock.’

Each unit entitles the Owner to a ‘proportional share‘ of value in the Business (hence the term ‘Share’) as well as any Cash Dividends.

2 Comments