Learn to calculate LTM Revenue and EBITDA (or TTM Revenue and TTM EBITDA) like a pro so you can use it on the job in Investment Banking, Private Equity, and Investment Management.

In this article, you’ll see:

- Why Finance professionals use LTM Revenue and EBITDA Calculations.

- The 3-Step Process for calculating LTM Revenue and EBITDA.

- Examples of calculations for Uber (LTM Revenue) and Coinbase (LTM EBITDA).

- On-the-job use cases for Investment Banking and Private Equity Professionals.

TL;DR

- Last Twelve Month (‘LTM’) calculations help us see the most recent year of Financial performance and can be completed with a 3-Step Process detailed below.

- LTM Revenue and EBITDA are widely used across the Finance world.

- LTM and Trailing Twelve Months (‘TTM’) are interchangeable terms.

- Last Twelve Months calculations are far more useful in helping us understand past performance, whereas Next Twelve Months (‘NTM’) provides insight into future performance.

Estimated reading time: 13 minutes

- TL;DR

- What Does LTM Mean?

- Want To Learn More About Finance?

- What does TTM Mean? Is it the same as LTM?

- Why Use LTM Revenue and EBITDA?

- LTM Revenue and EBITDA Calculations in 3 Steps

- LTM Revenue and EBITDA Examples: Uber and Coinbase

- Examples of LTM Calculations in Real Life

- Investment Banking Use Case: EV / LTM EBITDA

- Private Equity Use Case: Debt / LTM EBITDA

- LTM Reflects the Past and NTM Reflects The Future

- Wrap-Up: LTM Revenue (and EBITDA)

- LTM Revenue (and EBITDA) – Deep Dive Video

- Related Links

- About the Author

- Frequently Asked Questions

- Aiming for Investment Banking, Private Equity, or Investment Management? Check This Out!

What Does LTM Mean?

The term LTM stands for ‘Last Twelve Months.’

Finance professionals use LTM Calculations to analyze the previous full year of performance for a Business.

Analysts create LTM calculations because the regularly reported Financial data only reflects the prior twelve months of data once per year (right after the Annual Report).

The LTM calculation is distinct from the most recent full-year (‘Fiscal’ or ‘Calendar’ Year) or prior three months (‘Quarterly’) data.

Two of the most common LTM calculations are LTM Revenue and LTM EBITDA. We’ll show examples of how to calculate both in this article.

Before we dive into why LTM usage is so widespread, let’s quickly clarify LTM vs TTM.

Want To Learn More About Finance?

Check out all of our (free) deep-dive articles in our Analyst Starter Kit:

What does TTM Mean? Is it the same as LTM?

Frustratingly, in the Finance world, we seem to need multiple terms for everything.

The numerous interchangeable terms often cause massive confusion for newcomers. LTM calculations are no exception.

As we mentioned before, LTM stands for ‘Last Twelve Months.’

However, there’s another term for this same concept which is TTM or ‘Trailing Twelve Months.’

While LTM is more common in our experience, TTM is pretty widespread and means the exact same thing as LTM.

So, if someone asks you to calculate TTM Revenue, it’s the same calculation as LTM Revenue.

Why Use LTM Revenue and EBITDA?

When analyzing a company, you’ll want to see the Company’s most up-to-date performance.

While Quarterly data can be helpful, some companies have significant fluctuations in their Business in particular quarters within each year.

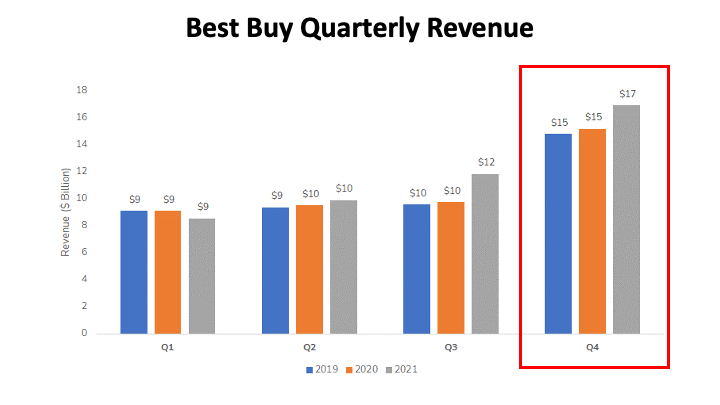

As an example, let’s look at a Retail Business like Best Buy.

As you can see above, the fourth quarter (i.e. the Christmas Holidays) generates a significant portion of annual Revenue.

If we only looked at the fourth quarter for Best Buy, we’d see a VERY distorted picture.

Because of fluctuations like this within each year, we typically want to see a full year of Financial data. This is where LTM Revenue would be very helpful.

If Companies reported a full year of Financial data with each Quarterly Report, the concept of LTM would not exist.

However, most companies report 12 months of data once per Year and Quarterly data three times per year.

As a result, we can only see the prior twelve months of performance for the 3 months after the Annual Report (or 10K Filing in the US).

As we’ll see in the next section, an LTM calculation allows us to see the previous 12 months of performance at any point in the year.

LTM Revenue and EBITDA Calculations in 3 Steps

To calculate any LTM metric, we follow the simple, 3-Step Process below:

How to Calculate LTM Revenue (or LTM EBITDA) in 3 Steps

- Find the Latest Annual Financial data.

Pull the most recent Annual data from the latest Annual Filing (typically the 10-K Filing in the US).

- Add the latest Year-To-Date Financial data.

Pull the most recent YTD data from the latest Quarterly Filing (typically the 10-Q Filing in the US).

- Subtract the Year-To-Date Financial data for the same period in the prior year.

Pull the prior year YTD data from the latest Quarterly Filing (typically the 10-Q Filing in the US).

With this calculation, we can quickly compute the latest Twelve Months of data at any point in the year.

Below we’ve included a simple, visual example of an LTM calculation on a timeline so you can more easily see how each of the pieces from the steps above come together.

Now let’s look at a few real-life LTM calculations!

LTM Revenue and EBITDA Examples: Uber and Coinbase

We’ve explained LTM at a high level. Now, let’s walk through a couple of LTM calculations in action for Uber and Coinbase.

These examples will help you understand how to source the data needed to calculate LTM Revenue and LTM EBITDA.

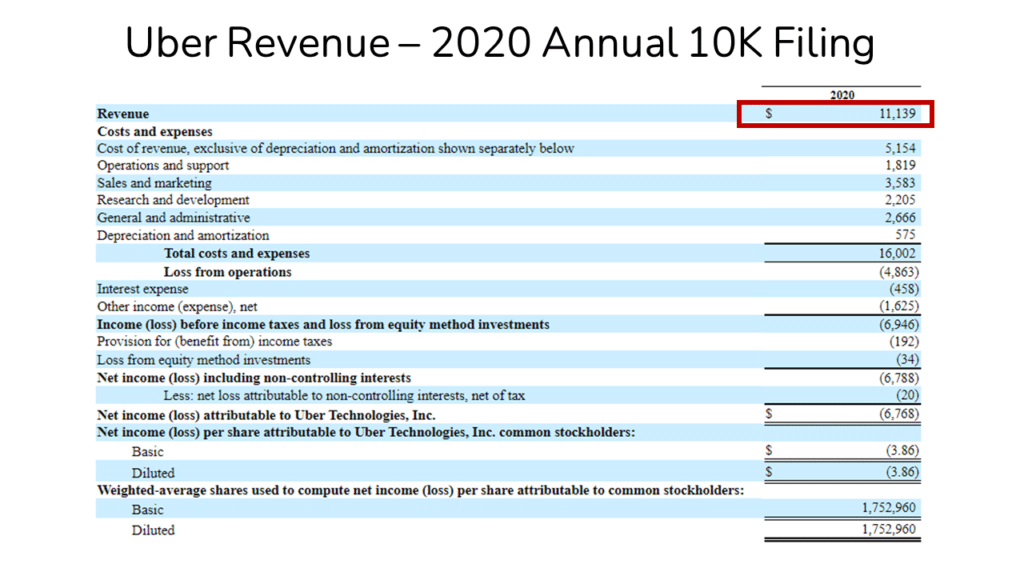

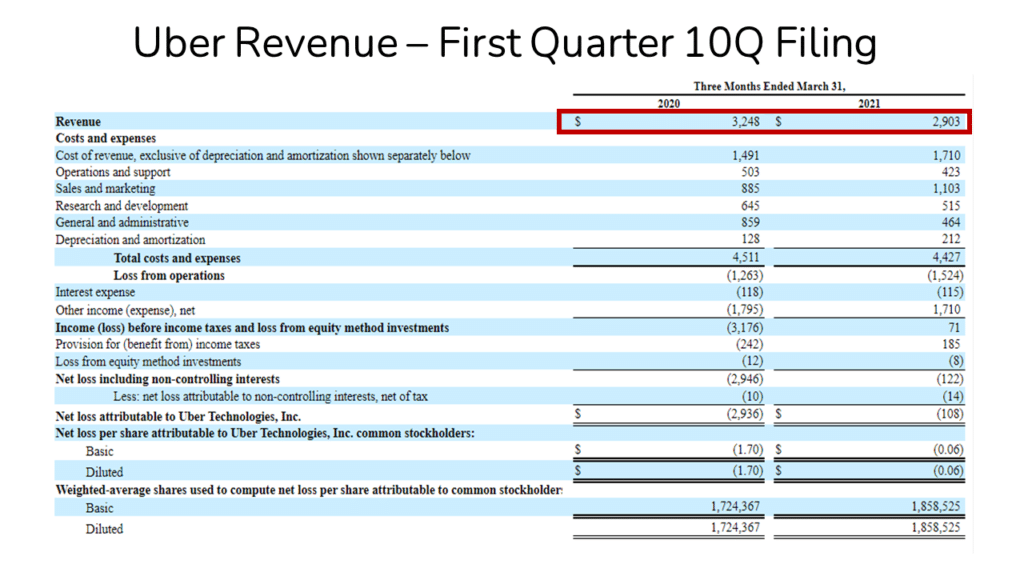

Example: How To Calculate LTM Revenue for Uber

Let’s imagine that we want to calculate the LTM Revenue for the ridesharing business Uber.

To calculate LTM Revenue, we’d begin by finding the Company’s latest Annual Revenue in Uber’s most recent 10-K filing.

We’d then look for the latest Year-To-Date Revenue data in Uber’s most recent 10-Q filing.

Now that we’ve found both of these items, we can complete the LTM Revenue Calculation for Uber.

In this example, Uber’s LTM Revenue declined slightly to 3% below the latest Annual Revenue.

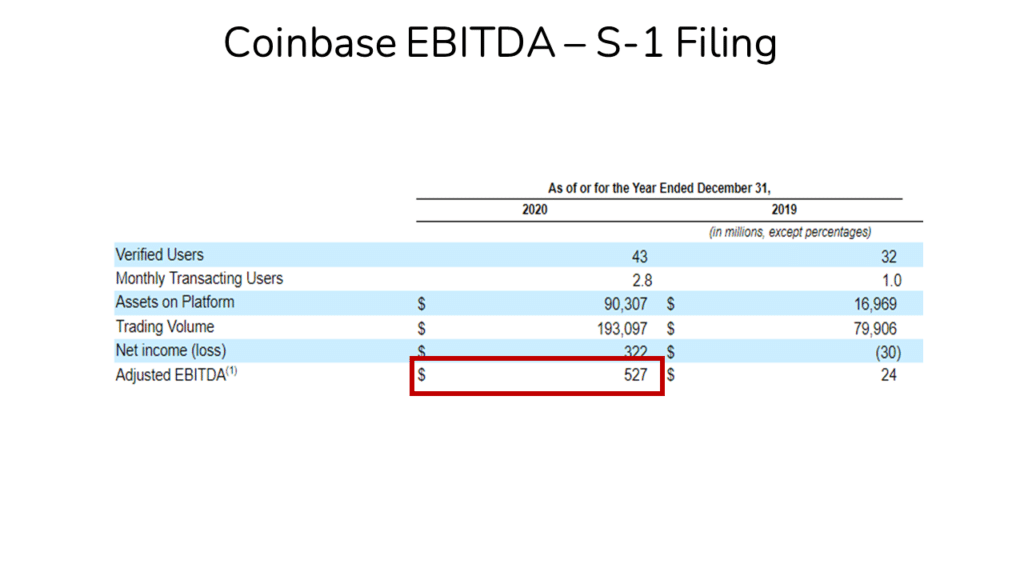

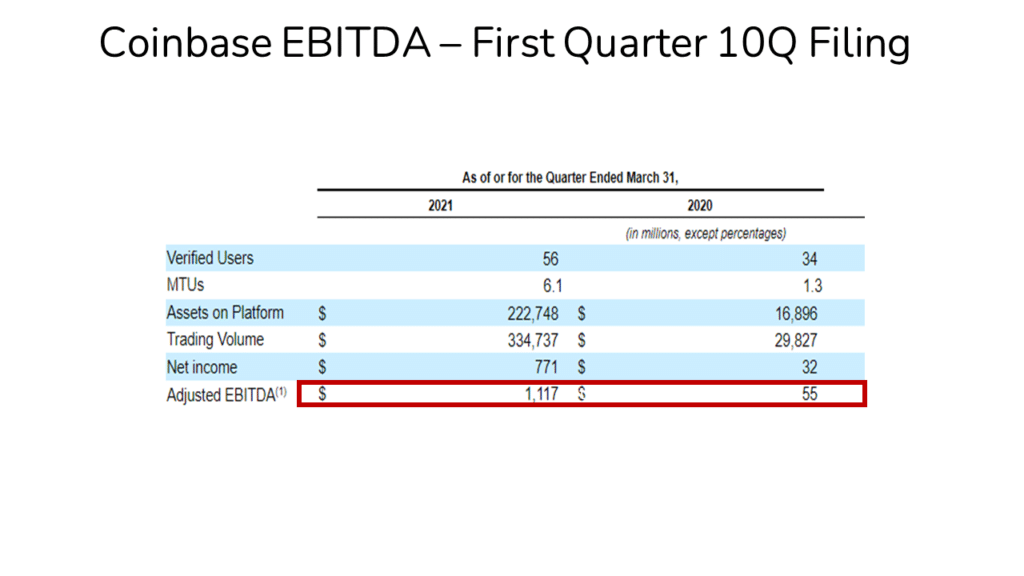

Example: How To Calculate LTM EBITDA for Coinbase

Let’s now imagine that we want to calculate the LTM EBITDA for the Cryptocurrency Exchange Platform Coinbase.

We’d begin by finding the Company’s latest Annual EBITDA in Coinbase’s S-1 Filing.

Note: We are only pulling from the S-1 filing in this case because Coinbase just went public in April 2021. As a result, the company hasn’t yet published a 10K filing.

We’d then look for the latest Year-To-Date Financial data in Coinbase’s most recent 10Q filing.

Now that we’ve found both of these items, we can complete the LTM EBITDA Calculation for Coinbase.

In this example, Coinbase’s LTM EBITDA increased significantly to 202% higher than the latest Annual EBITDA.

Examples of LTM Calculations in Real Life

Finance Professionals across Investment Banking, Private Equity, and Lending (or ’Credit’) use LTM Revenue and LTM EBITDA metrics every day.

In the sections below, we will cover a few real-life use cases for LTM Revenue and LTM EBITDA.

Investment Banking Use Case: EV / LTM EBITDA

Nearly every Investment Bank has a Mergers and Acquisitions (or ‘M&A’) advisory offering. In M&A, Bankers advise their Clients on the Valuation of their Clients’ Businesses.

One of the most commonly used metrics for Valuation in Investment Banking is the Enterprise Value / LTM EBITDA (or EV / LTM EBITDA) Multiple.

This particular multiple is one of the most typical multiples for Acquisition Analysis.

By looking at the Last Twelve Months of EBITDA, the Bankers can create a Valuation Multiple that incorporates the Company’s latest Financial performance.

What is Enterprise Value?

Very briefly, Enterprise Value represents the Purchase Price of the entire Business. And it’s common to look at Enterprise Value relative to the Last Twelve Months of EBITDA.

How an Investment Banker would use EV / LTM EBITDA

An Investment Banker would typically calculate the EV / LTM EBITDA Multiple for several peer companies.

The banker would then apply the Peer EV / LTM EBITDA Multiple to the Client company’s EBITDA to determine the appropriate sale Valuation.

Private Equity Use Case: Debt / LTM EBITDA

Traditional Private Equity (i.e. ‘Leveraged Buyout’ or ‘LBO’) firms make acquisitions using Debt.

The level of Debt that they can raise is typically expressed as a multiple of Debt to LTM EBITDA (or Debt / LTM EBITDA).

Let’s say Lenders are willing to offer 5 Times (or ‘5x’) Debt / LTM EBITDA.

We could then calculate LTM EBITDA to determine the level of Debt that could be raised to fund the LBO transaction.

Let’s say our Acquisition Target generates $100 million of LTM EBITDA.

In that case, the Private Equity firm could raise $500 million ($100 million LTM EBITDA * 5x Debt / EBITDA) of Total Debt to fund the Acquisition.

Why do Lenders use Debt / LTM EBITDA?

Debt / LTM EBITDA is the go-to metric for Lenders in Private Equity transactions.

LTM data helps them see the latest Year of EBITDA performance for the Company to lend their money.

Lenders can weigh the latest year of EBITDA against the Debt (i.e. Interest) burden the Company will bear after money is lent.

LTM Reflects the Past and NTM Reflects The Future

LTM Revenue and EBITDA tell us what happened in the past.

Lenders to Private Equity deals focus primarily on past performance (or ‘Creditworthiness’) to ensure they will be repaid. As a result, LTM metrics dominate the Debt world.

On the other hand, LTM metrics do not offer insight into what will happen in the future.

As a result, LTM Revenue and LTM EBITDA are not nearly as commonly used in Investment Management.

To be specific, we are referring here to Equity-focused Investment Managers like Hedge Funds and Mutual Funds.

Equity funds are looking to generate returns based on future results.

As a result, they tend to focus on the future performance, which is captured by Next Twelve Months (or ‘NTM’) Revenue and EBITDA.

Where Can I Find NTM Financial Data?

Equity Research analysts create estimated NTM financials for the Companies they cover. The Analysts then submit their estimates to aggregators like FactSet and Bloomberg.

Individual Investors can find these metrics on Koyfin, an aggregator that offers the same information but for free.

These aggregators then publish the average (or ‘Consensus’) of all the estimates submitted, which are used to create EV / NTM Revenue and EV / NTM EBITDA multiples.

Wrap-Up: LTM Revenue (and EBITDA)

Hopefully, you have a much better understanding of both the LTM Calculation Process and the underlying idea behind LTM Calculations.

LTM metrics are widely used throughout the Finance world, and you can follow our 3-Step Process to calculate LTM Revenue, LTM EBITDA, or any LTM metric.

Let us know if you have any questions in the comments below. We’d love to hear from you!

LTM Revenue (and EBITDA) – Deep Dive Video

If you enjoyed this article, definitely check out our video on LTM Revenue and EBITDA.

Find more videos just like this on our YouTube Channel.

Related Links

About the Author

Mike Kimpel is the Founder and CEO of Finance|able, a next-generation Finance Career Training platform. Mike has worked in Investment Banking, Private Equity, Hedge Fund, and Mutual Fund roles during his career.

He is an Adjunct Professor in Columbia Business School’s Value Investing Program and leads the Finance track at Access Distributed, a non-profit that creates access to top-tier Finance jobs for students at non-target schools from underrepresented backgrounds.

Frequently Asked Questions

To calculate LTM Revenue, we:

1) find the Latest Annual Financial data

2) then add the latest Year-To-Date Financial data, and

3) Subtract the Year-To-Date Financial data for the same period in the prior year.

LTM (or ‘Last Twelve Months’) calculations reflect the most recent Twelve Months of Financial performance and have various applications in the Finance world across Investment Banking, Private Equity, and Investment Management.

LTM stands for ‘Last Twelve Months,’ and it refers to calculations that show the most recent Twelve Months of Financial performance (e.g. LTM Revenue and LTM EBITDA).

TTM stands for ‘Trailing Twelve Months’ and it refers to calculations that show the most recent twelve months of Financial performance (e.g. LTM Revenue and LTM EBITDA). The term is interchangeable with LTM or ‘Last Twelve Months’.

TTM stands for ‘Trailing Twelve Months’ and it refers to calculations that show the most recent Twelve Months of Financial Performance (e.g. TTM Revenue and TTM EBITDA).

LTM stands for ‘Last Twelve Months’ and reflects the most recent Twelve Months of Financial performance. NTM stands for ‘Next Twelve Months’ and reflects a Business’s estimated Financial performance for the upcoming Twelve Months.

LTM (or ‘Last Twelve Months’) and TTM (‘Trailing Twelve Months’) are interchangeable. Both reflect the most recent Twelve Months of Financial performance for a Business.

LTM Revenue and TTM Revenue are interchangeable terms. Both reflect the most recent Twelve Months of Revenue generated by a Business.

LTM Revenue and TTM EBITDA are interchangeable terms. Both reflect the most recent Twelve Months of EBITDA generated by a Business.

EV/LTM Revenue is a commonly used Valuation Multiple that looks at the Purchase Price (‘Enterprise Value’ or ‘EV’) of the entire Business relative to the last twelve months (‘LTM’) of Revenue generated by the Business.

EV/LTM EBITDA is a commonly used Valuation Multiple that looks at the Purchase Price (‘Enterprise Value’ or ‘EV’) of the entire Business relative to the last twelve months (‘LTM’) of EBITDA generated by the Business.

Aiming for Investment Banking, Private Equity, or Investment Management? Check This Out!

- We have created the ultimate free resource for aspiring Finance Analysts with our Finance Analyst Starter Kit.

- We have Free, Plain English articles and Animated Explainer Videos on:

- Who the core players are in the Finance world and how they operate.

- Core mental frameworks for learning Valuation and Returns Analysis.

- Reviews of common trouble topics based on our experience training thousands of students.

- Detailed walkthroughs of common Interview Questions.