Introduction: Enterprise Value and Equity Value — Two Confusing Concepts

Let’s talk about two of the most commonly misunderstood terms in finance: Enterprise Value and Equity Value. There are numerous trick interview questions (see below) asked around these concepts because the mechanics behind them can be very confusing. Here’s a sample question:

Relevant Interview Question: A business has an EV of $1 million, $675K of debt, and $130K of Cash. The next day, the business generates an extra $26K in cash. Remember that EV = Equity + Net Debt. What’s the Enterprise Value on Day 2?

Traditional Explanations Cause Even More Confusion!

In my years teaching finance, I’ve observed that the traditional explanations cause tremendous confusion to students.

If you’ve ever heard an explanation that began with:

1) The formula for Enterprise Value is Market Cap plus……

OR

2) Enterprise Value = Equity + Net Debt

You’ve likely struggled with the same issues as my past students when asked anything beyond basic questions about Enterprise Value.

If your response to the above is “?!??!?!!?”, that’s even better because you can learn these concepts with a clean conceptual foundation here and avoid confusion in the future.

The explanation you’ll see here is (intentionally) different and is the result of having to re-explain this concept to thousands of students who have struggled with this over time. This article will attempt to provide you with a simpler and clearer explanation by using a real-life analogy that’s closer to ‘home’.

To begin, we’re going to use the house that you live in to guide the example.

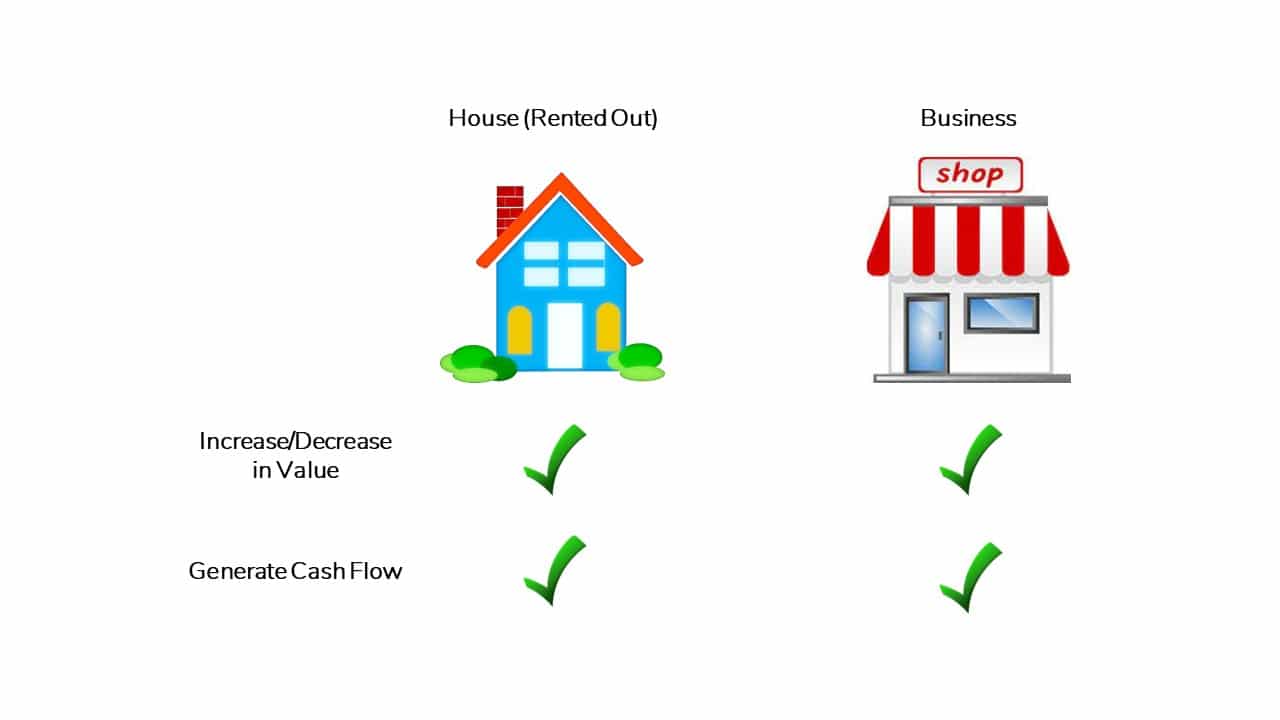

For the sake of this illustration, we’re going to assume that instead of living in your house you rent it out to someone else, at which point you begin receiving ‘cash flow’ from rent payments and it truly becomes a Business. Both rental properties and businesses can generate cash flow and increase (Appreciate) or decrease (Depreciate) in value.

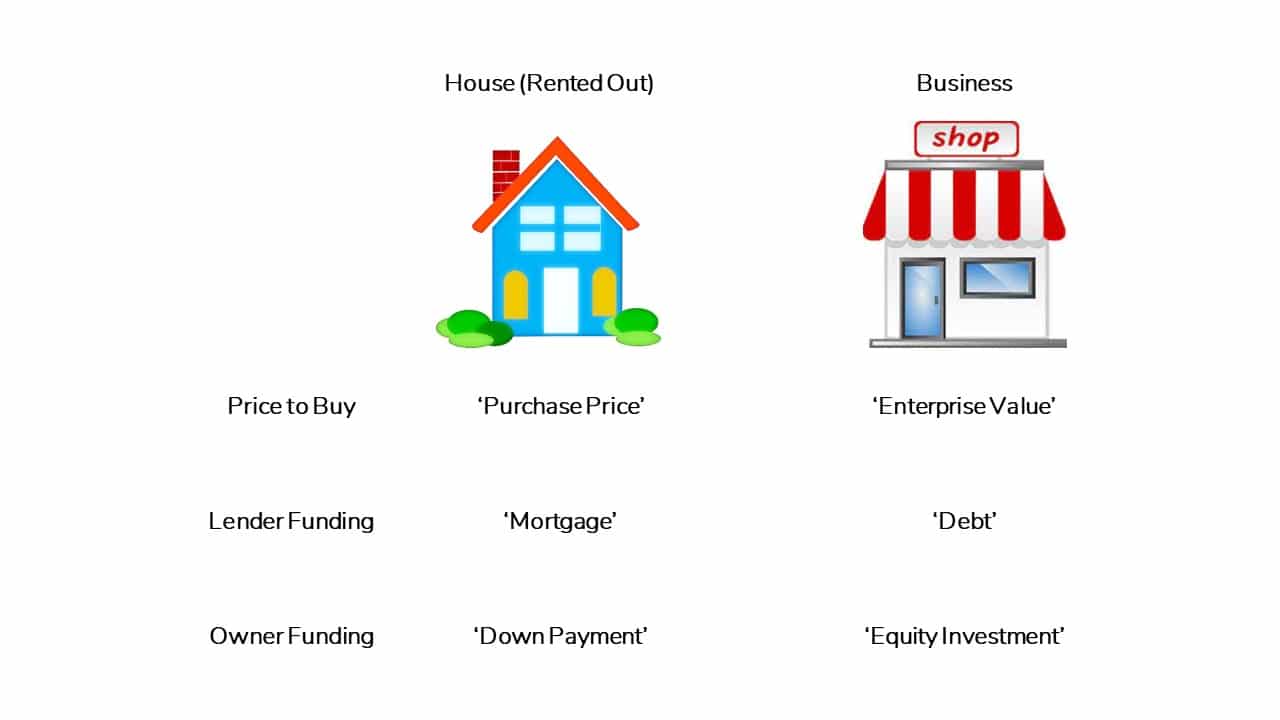

Buying a House vs Buying a Business

When you buy a house, you pay the Purchase Price of the house which is also referred to as the List Price. If you were to buy a business, we would replace the term Purchase Price with Enterprise Value.

Most people don’t have enough cash to buy their house outright, so they go to a lender and take out Mortgage. With a business, we replace the term Mortgage with the term Debt (I know…super creative!). For businesses, Debt typically consists of Loans or Bonds.

The remaining portion of the purchase price not funded by a Mortgage (or Debt) would be funded by the buyer. With a house, we call this additional funding the Down Payment but for a business, we would typically call it the initial Equity Investment or Equity Contribution.

Given that both houses and businesses are so similar, we can just think of them as interchangeable ‘boxes’ of value.

As mentioned previously, we will likely need to borrow to fund our purchase. Borrowed money would typically cover 80% of the purchase price of a house but usually no more than 50% of the total purchase price of a business. As you can see below, we still have a portion of the purchase price that needs to be funded with some other source of funding.

As previously noted, to fund the gap, the buyer would need to make a contribution in the form of a Down Payment (or Equity Investment). These payments by the owner create Equity in the Property or Equity in the Business, both of which represent the owner’s economic stake in either the house or the business.

Note that the term Equity in the Property (or Business) is distinct from Equity Value and is not a standard term that you’ll find in a textbook. I will elaborate on this shortly.

Once you decide to earn income from your house by renting it out, the house starts to generate what is called Cash Flow from rent payments. With a business Cash Flow would come from customer purchases. The Cash Flow you earn from rent or customer purchases would go into your bank account.

Note that you can leave the cash in your bank account or make withdrawals whenever you need the cash. In business, withdrawals are referred to as Dividends, which is the amount of money paid to owners.

One important thing to note is that, although your rental income is connected to your bank account, the cash in your bank account is separate from your house.

To explain why that’s the case, let’s imagine that you decide to sell your house that you’ve rented out.

When the buyer purchases your house, would you give them your past rental earnings as part of the sale? Clearly not!

The buyer will only get the house and you keep any accumulated cash from rent payments. Essentially, the cash that you have in your bank account will remain with you after the sale.

So, as the owner of the house or business, you own both the Equity in the Property (or Business) and the excess Cash in the Bank (or in finance-ey terms, on the Balance Sheet). These two items combined are your Equity Value.

Or said differently, Equity Value reflects your economic stake in the asset (after Debt is repaid) as well as the cash that you are entitled to as the owner.

A quick final note for the finance pros: Cash is often illustrated as being co-mingled with Equity in the Business (or subtracted from Debt to get to Net Debt). This isn’t mechanically incorrect but it causes immense confusion.

Over time, I’ve found that separating cash from underlying Equity in the Business (and not utilizing Net Debt as a construct) makes the formulas for Enterprise Value and Equity Value easier to conceptualize. More to come on the formulas shortly.

Selling a House vs Selling a Business

We’ve walked through a purchase, now let’s see what happens when we sell our house or business. Let’s assume that you are now selling your house and business at $150. Does that mean that you get to keep all $150?

Sorry to say this, but the answer is no.

Remember, you bought that house partly with a Mortgage and funded part of the purchase of the business with Debt. So, you’ll need to repay both before you receive any proceeds in a sale:

- House: $80 Mortgage

- Business: $50 Debt

After repaying the Mortgage (and Debt), you now have:

- Equity Value in the Property: $70

- Equity Value in the Business: $100

Remember though, that before deciding to sell, you had generated cash flow from rental income and customer purchases. Let’s say the excess cash that you’ve generated is $10 and this amount is sitting in your bank account. As the owner of either a house or business, you get to keep your $10 when you sell. So, you can add the Cash in the Bank to your Equity in the Property (or Business) to arrive at Equity Value.

As a result, your total Equity Value is:

- House: $80 ($70 Equity in the Property + $10 Cash in the Bank)

- Business: $110 ($100 Equity in the Business + $10 Cash in the bank).

In short, Equity Value is the amount of cash that the owner of the house (or business) keeps after collecting cash from the sale and paying off debt, plus any excess cash in the owner’s bank account.

Or said differently, Equity Value reflects the underlying Equity in the Property (or Business) plus any excess Cash in the Bank.

Hopefully, these examples help you see just how similar your house is to a business. Now that we’ve linked houses and businesses across nearly every dimension, we will just focus on businesses going forward.

What if There is More Than One Owner?

Unlike the previous examples, most businesses have multiple owners in real-life. As a result, we divide the ownership of Equity Value into equal units (or Shares) of Stock.

Let’s say we divide Equity Value into 10 equal Shares, so there can be up to 10 investors in a company. Each Share would reflect ownership of 10% of Equity Value. It’s important to note here that each share reflects 10% of both the Equity in the Business as well as 10% of the Cash in the Bank.

For publicly traded companies (meaning those whose shares trade freely on a stock exchange), like Microsoft or Google, the shares mentioned above are what we see trading up and down in value every day on the Stock Market. Said differently, every day investor views on the ‘right’ valuation change for every publicly traded business and that change in view in the market is what causes stock prices to fluctuate.

By dividing Equity Value into smaller pieces, even smaller investors with just $50 or $100 to invest can participate in the ownership (and future upside!) of the company.

To bring this to full circle, the value of the total number of shares is referred to as the Market Capitalization (or Market Cap). Market Cap is just a fancy name for Equity Value (Equity in the Business + Cash in the Bank) for publicly traded companies. To calculate Market Capitalization, we multiply the Price Per Share by the Fully Diluted Share Count (using the Treasury Stock Method).

I’d like to stop here for a second to emphasize that Market Capitalization (aka Equity Value) includes both the underlying Equity in the Business and Cash. This is one of the most misunderstood aspects of Equity Value for nearly every student (including finance majors) that I’ve taught in the past.

Summary

To summarize, Enterprise Value is the price you would pay for a business (same thing as the Purchase Price of a house), while Equity Value is what you own in the business (the value to the owner(s) after paying the company’s Debt and collecting extra Cash).

Now let’s transition to the formulas underlying these concepts that allow us to work from Enterprise Value to Equity Value (and vice versa).

From Enterprise Value to Equity Value (aka the ‘Equity Value Formula’)

To determine the Equity Value, in the diagram below, we work from Enterprise Value to Equity Value in a few steps:

- We begin with Enterprise Value

- We then subtract Debt (remember Debt is always repaid first), which leaves us with the Equity in the Business

- But remember, we need to add Cash in the Bank since, as the owner, that’s our cash

- Now we are left with Equity Value (which reflects our Equity in the Business + Cash in the Bank)

In short, this formula allows us to work from the value of the business to all value (including cash) attributable to the owner (or owners) of the company.

From Equity Value to Enterprise Value (aka the ‘Enterprise Value Formula’)

Now, conversely, we can work from Equity Value to Enterprise Value:

- We begin with Equity Value (aka Market Cap for a publicly-traded company), which reflects: Equity in the Business + Cash in the Bank

- We then subtract Cash in the Bank because that’s not part of the business (and wouldn’t carry over to a new owner if the entire business were sold)

- Then we add Debt (because Equity in the Business can only exist if the Enterprise Value is greater than the value of the company’s Debt)

- We are then left with the Enterprise Value of the company

If the starting point for the above graphic looks funny to you, you’re not alone.

The Enterprise Value formula above is where the traditional explanation of Enterprise Value typically begins when, in fact, it should be the end of the explanation after you have established a clear foundational understanding that Enterprise Value represents the Purchase Price of a Business and Equity Value includes underlying Equity in the Business + Cash.

The only reason we use the formula as a starting point is because the traditional explanation starts with a publicly traded company, and so we have no choice but to work from Market Cap, which includes Cash (which is the owner’s property but isn’t part of the core business) so it has to be removed by subtraction.

We then add Debt because there would be no Equity in the Business in the first place if the value of the business weren’t greater than the debt.

Once we have completed this process, we arrive at Enterprise Value (in an admittedly backdoor manner) and, at that point, Enterprise Value is just the value you’d pay to buy the business outright (exactly the same as the Purchase Price of a house).

And that’s all there is to it! Hopefully after reading through this article, all of this is a little more clear now!

Wrap-Up (Back to the Interview Question from the Beginning)

Going back to the original interview question posed at the beginning of the article, the answer is the EV (Enterprise Value) should still be $1 million. All of the other information is a red herring. The levels of debt and cash affect the owner’s Equity Value, but should have zero bearing on the value someone is willing to pay from one day to the next.

Also, people ask questions like this because they know that interviewees will immediately start working through the EV = Equity + Net Debt formula only to go in circles.

In short, if you understand that EV is just the Purchase Price of the business and that the Cash in the bank is separate from the underlying business, you’ll be able to fly through questions like these and ace your interview.

I hope this article has been helpful in providing you with a better understanding of the terms, Enterprise Value and Equity Value, as these two are important when applying valuation techniques.

If you have any questions, let me know in the comments section below!