Want to learn about the Investment Banking Career Path with simple, visual, and Plain-English explanations? If you’re exploring Investment Banking as a career option, you won’t find a more thorough overview. After reading this article, you’ll understand:

- What Investment Banks (and Investment Bankers) do.

- The levels within the Investment Banking hierarchy.

- The two main entry points in the Investment Banking Career Path.

- The Pre-MBA and Post-MBA recruiting cycles.

- Roles and Responsibilities as well as Compensation at each level in Investment Banking.

TL;DR

- Investment Banks offer Advisory (M&A and Restructuring) and Capital Raising (Debt & Equity) services.

- Investment Banking professionals work hard. But Investment Banking jobs open the door to significant career opportunities (and attractive pay along the way).

- Investment Banking Analysts and Associates are primarily focused on creating presentations and financial analyses.

- Beyond the Associate level, bankers are focused on deal execution and bringing in new clients to generate fees for the Bank.

- Each level in Investment Banking requires a slightly different skillset.

For more on the Career Path, Recruiting Cycles, Roles and Responsibilities and typical Investment Banking salaries, check out the rest of the article.

Estimated reading time: 20 minutes

- TL;DR

- The Investment Banking Career Path…A Common Source of Confusion

- What Do Investment Banks Do?

- Want To Learn More About Finance?

- A 'Typical' Investment Banking Career Path

- How to Land a Full-Time Investment Banking Role

- The Pre-MBA Recruiting Cycle

- How to Get Into Investment Banking

- Investment Banking Career Path: Analysts

- Investment Banking Career Path: Vice Presidents

- Investment Banking Career Path: Senior Vice Presidents

- Investment Banking Career Path: Managing Director

- How Can I Succeed in Investment Banking?

- Should I Pursue a Career in Investment Banking?

- Wrap-Up: Investment Banking Career Path

- Investment Banking Career Path: Animated Explainer Video

- Related Links

- About the Author

- Aiming for Investment Banking, Private Equity, or Investment Management?

- Frequently Asked Questions

The Investment Banking Career Path…A Common Source of Confusion

For many people, the world of Investment Banking (or ‘IB‘) is incredibly opaque. As a result, figuring out how to pursue a career in Investment Banking is very difficult.

For people with zero personal connections (i.e. most people), gaining clarity is challenging.

This deep-dive article will provide a simple, illustrated, and Plain English overview of the Investment Banking Career Path, Roles and Responsibilities, and typical Investment Banking Salaries.

Let’s dive in!

What Do Investment Banks Do?

Let’s begin our discussion with a walkthrough of what an Investment Bank does.

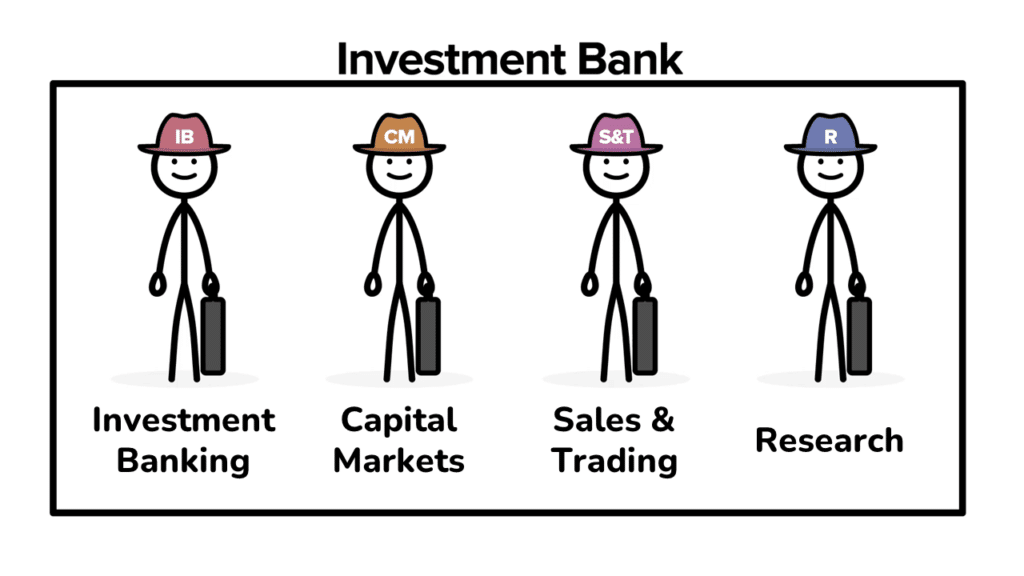

The Four Key Divisions of an Investment Bank

Within a typical Investment Bank, there are four key divisions:

- Investment Banking – work with clients on Mergers & Acquisitions (‘M&A’) and Restructuring advisory as well as Debt and Equity capital raises.

- Capital Markets – work with core ‘Investment Banking’ to connect clients with Investors (‘Equity’) and Lenders (‘Debt’).

- Sales and Trading – help large (‘Institutional’) Investor clients execute the purchase and sale of securities (e.g. Stocks and Bonds, Derivatives, etc.).

- Research – conduct analysis and provide opinions on the attractiveness of individual Stocks (‘Equity Research’) or Debt (‘Credit Research’) securities.

Quick Note: The Capital Markets division is technically within Investment Banking. But, they perform a distinct function (as you see above). Further, the Capital Markets career path is slightly different. As a result, we break Capital Markets out as a distinct division.

How the ‘Core Investment Banking’ Division Operates

The focus of this article is the career path for the ‘core Investment Banking’ division. You can think of the Investment Banking division as being similar to Real Estate Agents.

However, Investment Bankers assist with the Buying and Selling of Businesses (vs Houses).

And Buying and Selling a multi-billion dollar Business entails significantly more complexity than a home purchase.

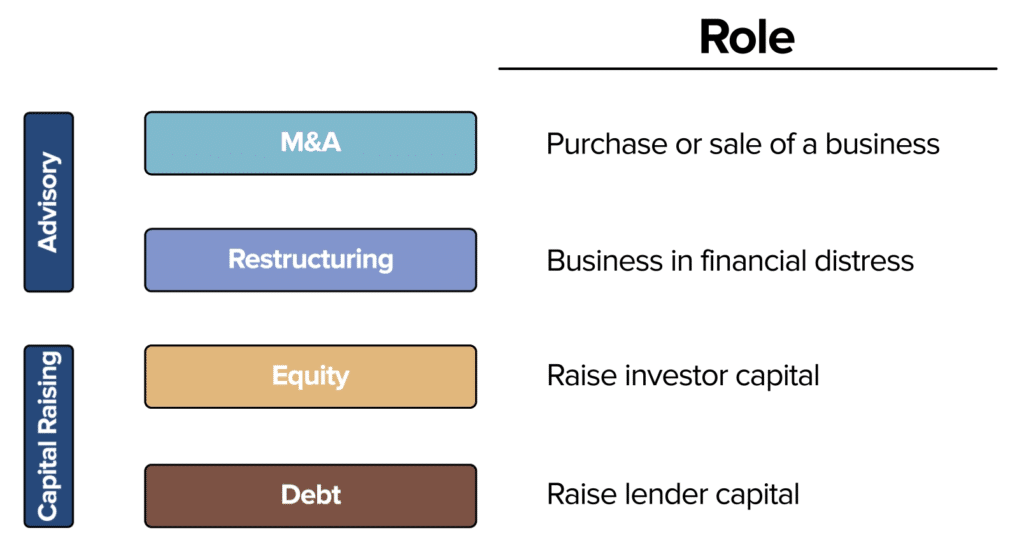

The Core Services of an Investment Bank

At a high level, the Investment Banking Division offers four core services:

- M&A – advise clients on the sale (‘Sell-Side M&A’) and purchase (‘Buy-Side M&A’) of companies.

- Restructuring – help clients work through periods of financial distress.

- Equity – work with the Capital Markets division to raise Investor capital for clients.

- Debt – work with the Capital Markets division to raise Lender capital for clients.

For each of the services above, Investment Banks earn a fee.

Banks charge fees based on a percentage of the sale value of a Business or the money raised.

Want To Learn More About Finance?

Check out all of our (free) deep-dive articles in our Analyst Starter Kit:

Further Investment Banking Breakdowns

From this point on, we will dig into the Investment Banking career path.

It’s worth noting, however, within each Investment Bank, the services listed above break into Industry Coverage (focus on an Industry Sector) and Product Groups (focus on a particular service like M&A).

In addition, the Finance world often divides Investment Banks into Bulge Bracket vs. Elite Boutique vs. Middle Market banks.

For a deeper dive into those details, check out our How Investment Banks Operate article.

Now that we’ve clarified what Investment Banks do, let’s look at the day-to-day role.

What does an Investment Banker Do?

So, we now have a high-level view of what Investment Banks do.

But what do what does an Investment Banker do each day?

What does the day-to-day routine look like for a typical Banker?

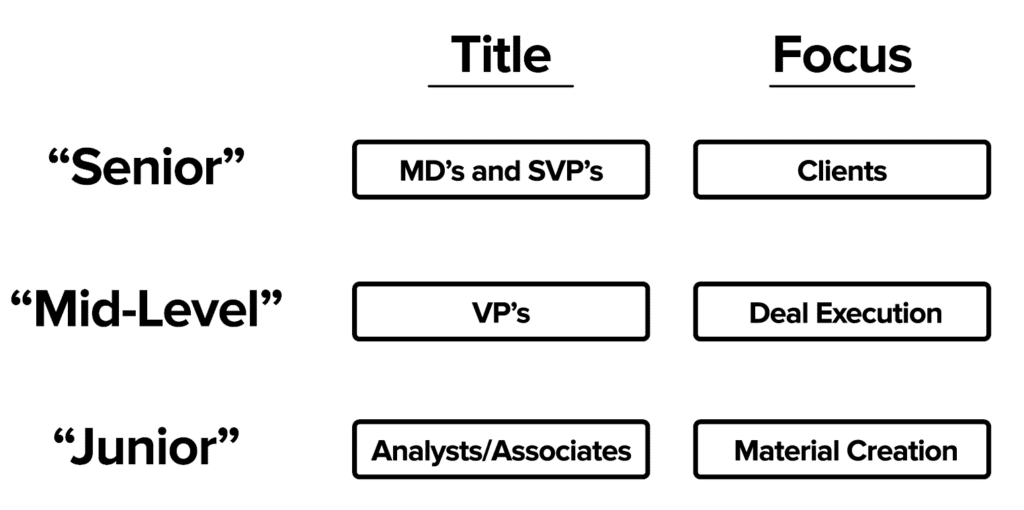

The short story is that your seniority in the hierarchy largely determines your daily routine.

There are three major buckets within the Investment Banking hierarchy:

- Senior Bankers – Managing Directors (‘MDs’) and Senior Vice Presidents (‘SVPs’) build and foster client relationships.

- Mid-Level Bankers – Vice Presidents (‘VPs’) lead deal execution.

- Junior Bankers – create supporting materials and analyses used to ‘Pitch’ clients for new business and for ‘Live Deal’ execution.

As you can see above, what Investment Bankers do in each role is slightly different.

In the coming sections, we’ll dig deeper into the roles and responsibilities at each level.

A ‘Typical’ Investment Banking Career Path

One of the most common questions at this point is, “What is the ‘typical’ Investment Banking career path?”

While there isn’t a typical path, there are two primary entry points for a job in investment banking: Pre-MBA and Post-MBA.

How to Land a Full-Time Investment Banking Role

As we’ll discuss shortly, pay is very high (i.e. six-figures or more right out of school) relative to most other jobs.

And seven-figures to eight-figures for Senior Investment Bankers (with 10-15 years of experience).

Working in IB early in your career also opens doors to a wide variety of hard-to-get (and even higher-paying) job options down the road.

As a result, competition for Investment Banking job roles is incredibly high across the board.

Whether pre-MBA or post-MBA, incoming Investment Bankers are typically high achievers with high GPAs, high test scores, and a track record of repeated success (in and out of school).

The Pre-MBA Recruiting Cycle

Investment Banks fill most of their Analyst classes with former Summer Interns.

While it is possible to land a full-time job at an Investment Bank without a Summer Internship at that Bank, there are far fewer spots.

So, the best bet for most candidates is to land an internship.

The ‘big’ internship to get in IB is the Junior Summer Internship.

The Pre-MBA Junior Internship Recruiting Cycle

While it might sound a bit crazy, the recruiting for Junior Summer internships occurs 12-18 months before the internship begins.

As a result, aspiring Analysts should begin preparing to recruit in their sophomore (and sometimes Freshman) year of College.

‘Target’ vs ‘Non-Target’ Schools

Investment Banks recruit on-campus for a select group of schools (or ‘Target Schools‘).

Target schools are composed of top private and public Universities (Harvard, Yale, Stanford, Michigan, UVA, etc.).

Schools outside of this group are referred to as ‘Non-Target‘ schools.

Historically, a typical Analyst class would only have a few ‘Non-Target’ Analysts.

In recent years, however, Banks have realized they are missing out on a LARGE pool of highly talented students and are much more open to ‘Non-Target’ Students.

There are also organizations dedicated to helping ‘Non-Target’ students land roles in IB like Access Distributed.

So, the good news is that you can get in if you are at a ‘Non-Target’ School, but it just requires a bit more legwork, largely in the form of extensive networking.

Post-MBA Recruiting Paths

There are three ways to get into the upper ranks of the business:

- Direct Promote – top-performing Analysts promoted to Associate.

- Top-Tier MBA Graduate – students at high-caliber MBA programs.

- Lateral Hire – individuals who work at other Investment Banks or sometimes Corporate Finance or Corporate Development roles.

While people get into IB through all three of the routes discussed above, MBA graduates make up the lion’s share of post-MBA Investment Bankers.

MBA Recruiting for Investment Banking is a Bit More Structured

Similar to Pre-MBA recruiting, Post-MBA recruiting is very competitive. But, recruiting at the MBA level is a little more straightforward.

Investment Banks come to the campuses of top-tier MBA programs to recruit. This typically occurs 3-5 months before their Summer Associate internship (between the first and second year) begins.

How to Get Into Investment Banking

Whether Pre-MBA or Post-MBA, target or non-target, there are a few common things you’ll need to do to get into Investment Banking:

How to get into Investment Banking

- Network Extensively

When applications are submitted to an Investment Bank, they are often reviewed internally by small teams of Bankers that lead the charge for individual schools. Most candidates have high GPAs and test scores, so that’s not usually enough to stand out. Instead, you want the decision-making Bankers to know your name and to advocate for you.

You can do this by networking extensively with Alumni (or any connections you can find) at your targeted firms. We recommend you start reaching out to Analysts and Associates at least a few months before core recruiting starts.

Extensive networking is ESPECIALLY important for students at non-target schools. And, if you’re at a non-target school, you aren’t limited to Alumni of your school. Non-target folks tend to look out for each other. So look for any non-target Alumni at your target firms. - Create a Pattern of ‘Demonstrated Interest’ in Finance

When someone reviews your resume, they are going to look at your background to see if you have a history of pursuing Finance and/or Banking-related activities.

You should aim to join Finance clubs at your school, analyze and personally invest in stocks (even with a free stock simulator like StockTrak), and read as many books about Finance and Investing as possible.

If possible, you should also look for school-year and summer internships at small Investment Banks, Private Equity Funds (or Search Funds), or Hedge Funds. - Prepare Answers for Behavioral Questions

The first major category of Interview Questions you should prepare to tackle is Behavioral questions.

Some common questions are:

-Tell Me About Yourself

-Why do you want to work in Investment Banking?

-What are your greatest strengths and weaknesses?

-Tell me about a time you failed.

Aim to come up with 4-6 personal stories that can be re-purposed into answers for all of the above questions.

Here’s a link to some common Behavioral Interview Questions. - Start Early with your Technical Prep

We can’t overstate how important it is to start preparing early for Technical Interview Questions. Many candidates wait until the last minute and have trouble with anything beyond regurgitating memorized answers to common questions…and they often fall short.

To give yourself the best chance of succeeding, you need to be able to give the answer but then explain the underlying substance and concepts behind each question.

A few common technical questions are:

–Walk Me Through a DCF.

–Walk Me Through an LBO.

–How does $10 of Depreciation flow through the 3 Statements.

–Does an All-Stock transaction result in Accretion/Dilution?

As you progress, you can then tackle more complicated questions like the Paper LBO.

Here’s a link to some additional common Technical Interview Questions.

We’ve outlined how people typically get into IB. Now, let’s take a deeper look at each role in the Investment Banking hierarchy.

At each step, we’ll also walk through the Investment Banking career path salary progression.

Quick Note: The compensation levels quoted here are for top-tier banks. Compensation is typically lower for smaller and/or regional banks.

Investment Banking Career Path: Analysts

What do Investment Banking Analysts Do?

Once a full-time Analyst is on the job, they are typically ‘staffed’ right away with one (or multiple) assignments.

These ‘staffings’ broadly break into two categories:

- Pitches – create a ‘Pitch Book,’ which is typically an long slide deck with a deal recommendation to present to a client.

- Live Deals – once a client agrees to work with a bank, they ‘engage.’ At that point, the deal is then ‘Live.’

Analyst Day-To-Day Tasks on the Job

While the Senior and Mid-Level Investment Bankers outline the broad strokes, the Analysts (with oversight from Associates) are ‘in the weeds’ and are typically tasked with:

- Creating presentations.

- Formulating and maintaining detailed analyses (including Financial Models for things like Discounted Cash Flow and Leveraged Buyout analyses).

- Helping coordinate logistics to execute Live Deals.

This role is very intense, with Analysts often logging 80-100+ hour weeks.

Why such long hours, you might ask?

When your client is the CEO of a large company, often making the biggest decision of their career around a merger or capital raise, time is of the essence.

And you’re competing against other HIGHLY talented bankers across Wall Street for the CEO’s business.

Why Work in Such a Crazy Role?

If you’re asking yourself, ‘Why in the world would I want one of these jobs?’…it’s a fair question.

The answer comes down to three primary factors:

- Pay – analysts at top-tier banks have historically made $120,000 – $170,000 or more per year in their first year. Many Investment Banks recently increased their pay by a further $10,000-15,000 per year.

- Exit Opportunities – analysts typically transition to Private Equity or Hedge Funds after two years. Those roles often pay twice what they make in IB (or more).

- Network – gain access to a network of 50-150+ other high-achieving individuals in their Analyst Class.

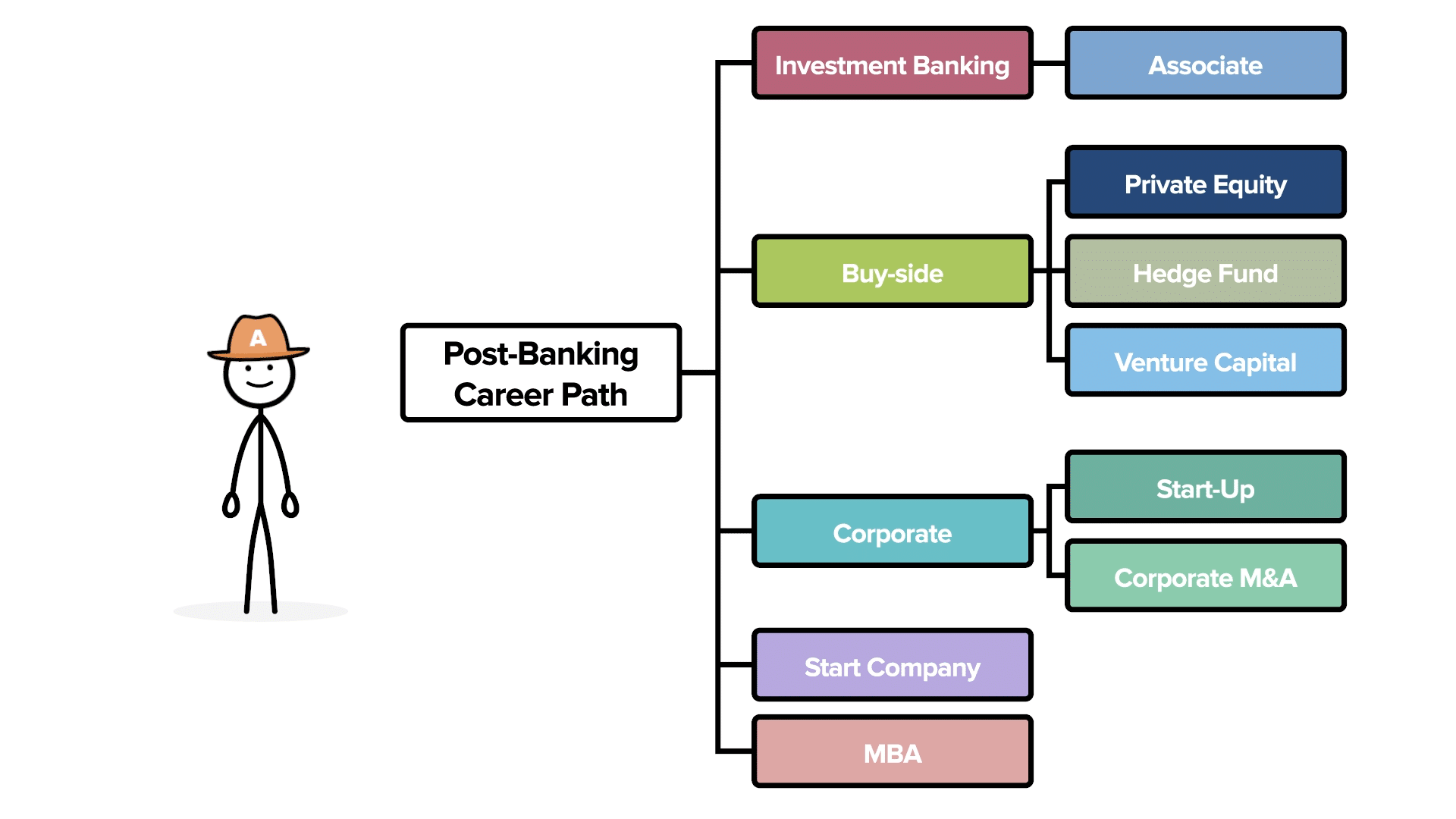

Investment Banking Analyst: Exit Opportunities

While all three factors above are important, given that most Analysts only stay for two years, the biggest driver for many Analysts is the opportunity for careers after Investment Banking (or ‘Exit Opps’).

While there are many post Investment Banking careers to pursue, below are the most common:

Typical Analyst Exit Options

In short, nearly all the attractive career doors remain open for Analysts.

Investment Banking Career Path: Associates

Associates are the next level above Analysts.

As previously mentioned, most Associates come from top-tier MBA programs, are lateral hires, or are directly promoted from the Analyst role.

Investment Banking Associate: Day-To-Day Role

Associates oversee (and mentor) Analysts and work for VPs or sometimes even SVPs or MDs.

While the Analyst creates the underlying materials, the Associate is responsible for the quality and accuracy of the work.

Associates at top banks earn $250-$500K per year in return for their hard work.

Associate: Exit Options

Associates don’t have the same breadth of post-investment Banking options as Analysts.

While some Associates find roles in Hedge Funds and Private Equity, it is far more common for Associates to transition to Corporate Development or Corporate Finance roles.

In addition, many Associates stay in IB.

After three to four years, an Associate progresses to the role of Vice President.

After the promotion to Vice President, many Investment Bankers become ‘Career Bankers.’

Investment Banking Career Path: Vice Presidents

The Vice President (VP) role is about deal execution.

Quick Note: At some Investment Banks, the Vice President role is called ‘Director.’

VPs typically lead (or ‘Quarterback’) the execution of each deal. Thus, VPs are the ‘buffer’ between Senior Bankers and Junior Bankers.

They support the needs of the Senior Bankers while ensuring team cohesion and execution with the Junior Bankers.

The VP role is much more client-facing than the Associate role. VPs are often invited to client Pitch presentations.

Once a client engages, VPs often lead the charge and work with the client to ensure they are happy.

VPs in Investment Banking earn $400-$700K per year at top Investment Banks.

After three to four years in the role, a Vice President advances to Senior Vice President (or ‘SVP‘).

Investment Banking Career Path: Senior Vice Presidents

The next level up is Senior Vice President (called ‘Executive Director’ at some banks).

SVPs are Managing Directors in training.

They’ve earned their stripes as deal execution pros. But, at this point, they need to prove that they can bring in new business.

Most SVPs play a hybrid role. For example, SVPs support deal execution for MDs and also work to bring in new business (often in underserved sub-sectors).

Senior Vice Presidents can earn $700,000 to $1 million per year at top-tier banks.

Unfortunately, not all SVPs make it to the next level.

IF an SVP is promoted to Managing Director, the promotion typically occurs within 2-3 years.

Investment Banking Career Path: Managing Director

Managing Director (‘MD‘) is the top role in the world of IB.

MDs bring in the deals that generate fees for the Investment Bank.

MDs aspire to become ‘trusted advisors‘ to their clients to create a recurring stream of business.

While the job is still highly analytical, MDs need additional skills.

They have to be good with people AND numbers.

In return for making it to the top, Managing Directors typically earn over $1 million per year.

Superstar MD’s (or ‘Rainmakers’) can earn over $10 million per year or more.

If you’ve made it this far into the article, you’re probably wondering, ‘What do I need to succeed in this career field?’

How Can I Succeed in Investment Banking?

There is no single formula for success. But, there are common threads across most successful candidates for IB jobs.

Below is a brief list of the key success factors:

Success Factors for Junior Investment Bankers

If you are still reading at this point, then perhaps a career in Investment Banking is for you.

IB is a demanding career path to pursue. However, the rewards can be significant if you’re willing to work through the challenges.

Should I Pursue a Career in Investment Banking?

In the end, the core question should be whether or not Investment Banking is a good career path for you.

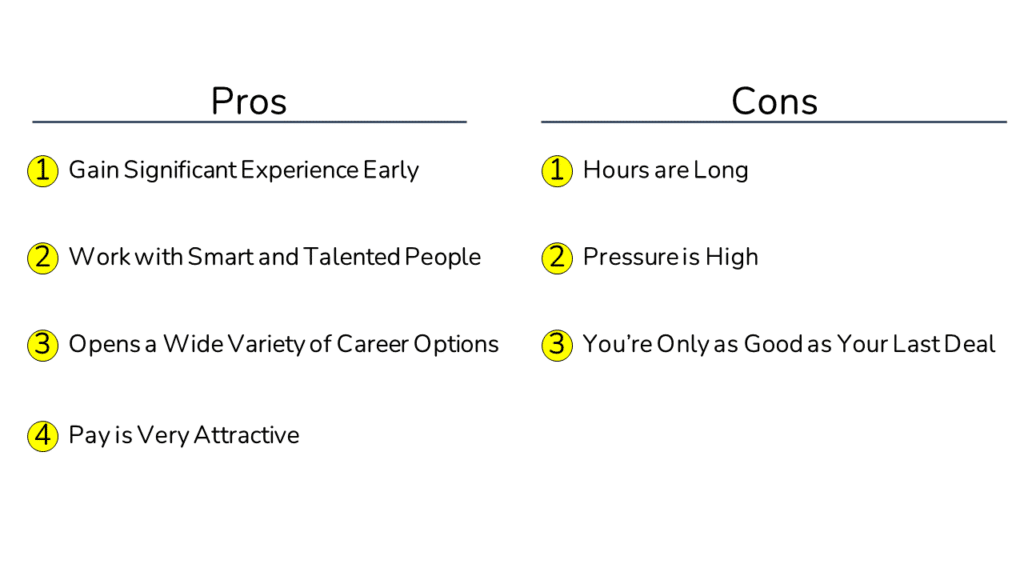

The answer largely comes down to weighing the Pros and Cons below:

The Pros and Cons of the Investment Banking Career Path

If the Pros above outweigh the Cons, keep digging to learn more about this field.

Wrap-Up: Investment Banking Career Path

Now, let’s quickly recap the key points here.

The Investment Banking Career Path is a tough (but rewarding) career field that requires different skills at each level.

To learn more about Investment Banking, check out our Animated Explainer videos below:

If you have any comments or questions, please let us know below!

Investment Banking Career Path: Animated Explainer Video

If you enjoyed this article, definitely check out our full animated explainer video on the Investment Banking Career Path.

Find more videos just like this on our YouTube Channel.

Related Links

About the Author

Mike Kimpel is the Founder and CEO of Finance|able, a next-generation Finance Career Training platform. Mike has worked in Investment Banking, Private Equity, Hedge Fund, and Mutual Fund roles during his career.

He is an Adjunct Professor in Columbia Business School’s Value Investing Program and leads the Finance track at Access Distributed, a non-profit that creates access to top-tier Finance jobs for students at non-target schools from underrepresented backgrounds.

Aiming for Investment Banking, Private Equity, or Investment Management?

We have created the ultimate free resource for aspiring Finance Analysts with our Finance Analyst Starter Kit.

- We have Free, Plain English articles and Animated Explainer Videos on:

- Who the core players (e.g. Investment Banks and Private Equity) are in the Finance world and how they operate.

- Core mental frameworks for learning Valuation and Returns Analysis.

- Reviews of common trouble topics like Enterprise Value vs Equity Value based on our experience training thousands of students.

- Detailed walkthroughs of common Interview Questions like Walk Me Through a DCF.

Frequently Asked Questions

Investment Banking is a challenging career, but offers the ability to open doors to a wide variety of attractive career options (post-banking) while making six figures or more directly out of school.

Investment Bankers at top banks typically earn over $100,000 per year (some as high as $200,000) directly after University. MBA graduates typically earn over $250,000 per year straight out of school. The top-level Bankers (i.e. Managing Directors) can earn over $1 million per year, and superstar bankers can make $10 million or more.

If you are an undergraduate at a core (i.e. ‘Target’) school or a top-tier MBA program, then Investment Banks will come to your campus to recruit.

If you are not at a ‘Target’ school, you can still ABSOLUTELY break-in, but you’ll need to do more leg work. This will mean a lot of networking with your school’s alumni or any contacts you have in the Investment Banking world.

The entry-level position in Investment Banking is the Analyst role. The next level up is Associate, which most people join from an MBA program. Beyond that, Investment Bankers are promoted to Vice President (or Director), Senior Vice President (or Executive Director), and finally the top role of Managing Director.

Investment Banking can be an incredibly rewarding career option to turbocharge your early career progression. But, it’s a tough job with 80-100+ hour work weeks in the early years and the requirement to be on call 24/7 for your clients when you get to the top.

While it’s certainly easier to start in Investment Banking with a Finance or Accounting major, the job doesn’t require math beyond basic algebra.

As a result, Investment Banking Analyst classes contain a wide variety of majors from Liberal Arts to Engineering.

Incoming Investment Bankers are typically high achievers with stellar grades, test scores, and past achievements.

If you are at a core (i.e. ‘Target’) school or an MBA program, then Investment Banks will recruit on-campus.

If you are not at a ‘Target’ school, you’ll need to network extensively with your school’s alumni or any contacts you can find who work in the field.