Master Accretion / Dilution so you can ace your Investment Banking, Private Equity, and Investment Management interviews. We’ll break everything down with a simple 3-Step Framework as well as tips on how to avoid common pitfalls. Let’s jump in!

In this article, you will learn:

- Accretion / Dilution: what it is, why it matters, and how Analysts use it on the job.

- How to Calculate Accretion/ Dilution in Three Easy Steps.

- Common Accretion / Dilution Interview Questions.

- How Accretion / Dilution impacts Merger Models.

- The meaning of ‘Cash’ Accretion / Dilution.

- A real-life example of how Morgan Stanley highlighted Accretion / Dilution when it purchased E*TRADE for $13 billion.

Estimated reading time: 16 minutes

- TL; DR

- Want To Learn More About Finance?

- What is Accretion / Dilution?

- Why Does Accretion / Dilution Matter?

- Accretion / Dilution – Target vs. Acquirer

- Accretion / Dilution Benefits & Costs

- Calculate Accretion / Dilution in 3 Easy Steps

- What is Cash Accretion / Dilution?

- Accretion / Dilution Interview Question / Example

- Accretion / Dilution in Merger Models

- Real Life Example: Morgan Stanley Acquires E*TRADE

- Accretion / Dilution Wrap-Up

- Interview Question Video Review: Accretion / Dilution

- About the Author

- Frequently Asked Questions

- Related Links

TL; DR

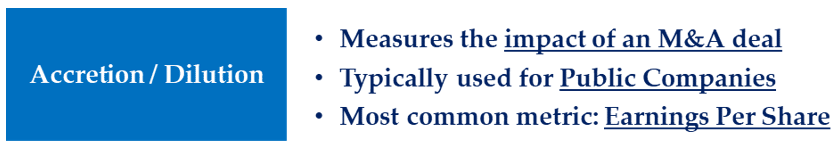

- Accretion / Dilution typically shows the direction of Earnings Per Share (EPS) for a Public Company when it buys another Company.

- An Accretion / Dilution analysis weighs the benefits and costs of an M&A deal.

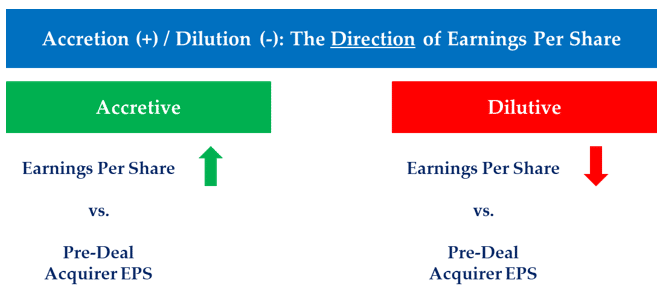

- In an Accretive Deal, the Company’s EPS increases after the M&A deal.

- In a Dilutive Deal, the Company’s EPS decreases after the M&A deal.

- CEOs and Boards communicate Accretion / Dilution to signal that an M&A deal is good for Shareholders.

Want To Learn More About Finance?

Ramp up faster with all of our (free) deep-dive articles in our Analyst Starter Kit:

What is Accretion / Dilution?

Accretion / Dilution typically measures the impact of an M&A deal on a Public Company’s Earnings Per Share.

In short, Accretive means the benefits of an M&A deal outweigh the costs for an overall positive impact to shareholders.

Dilutive means the costs of an M&A deal outweigh the benefits for an overall negative impact to shareholders.

Read on to learn how Investment Bankers and Company CEOs use Accretion / Dilution to measure the attractiveness of M&A deals.

Why Does Accretion / Dilution Matter?

As a company’s Earnings Per Share (EPS) grows, its share price typically follows.

As a result, Shareholders’ want EPS to trend upward over time.

Shareholders prefer an Accretive Acquisition, especially if the Accretion is significant and immediate (ideally within 1-2 years).

On the flip side, a deal that results in EPS Dilution may disappoint shareholders.

CEOs are ultimately responsible to Shareholders, so Accretion / Dilution is an established metric for communicating that an M&A deal is positive for shareholders.

CEOs that fail to communicate the benefits of an M&A deal well can even lose their jobs!

It is a classic chain reaction: Shareholders care about Accretion / Dilution, so CEOs care….CEOs care, so Investment Bankers care.

And that is why Accretion / Dilution shows up in IB interviews.

Now that we have learned why this concept matters, learn a few key terms we will need to perform an Accretion / Dilution Analysis.

Accretion / Dilution – Target vs. Acquirer

Before diving in here, we must first clarify terms ‘Acquirer’ and ‘Target.’

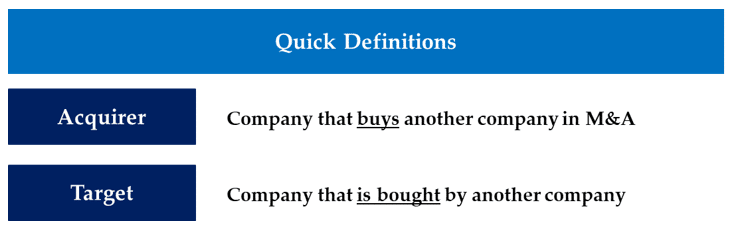

The Company buying or acquiring another company is called the Acquirer.

The Company being bought or acquired is called the Target.

Next, we need to learn about typical Accretion / Dilution Benefits and Costs.

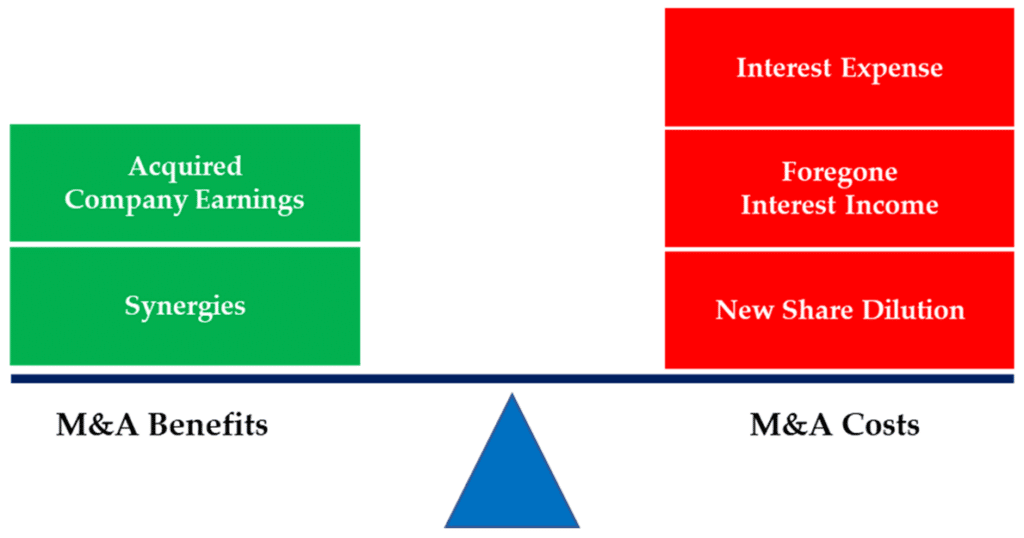

Accretion / Dilution Benefits & Costs

Next, we must understand the typical Benefits and Costs of a Public Company M&A Deal.

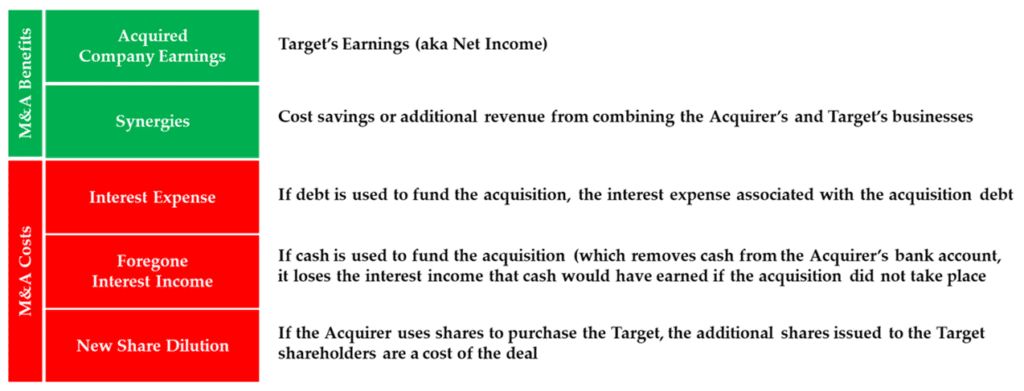

In a typical M&A deal, the Acquirer gains Earnings & Synergies, which are offset by Financing costs related to the Debt, Equity or Cash used to fund the deal.

Below we have laid out detailed descriptions of the core typical Benefits and Costs you must weigh in an M&A Transaction.

Accretion / Dilution Calculation: Typical M&A Benefits

- Acquired Earnings: Target’s Net Income.

- Synergies: Cost Savings or additional Revenue from combining the Acquirer’s and Target’s Businesses.

Accretion / Dilution Calculation: Typical M&A Costs

- Interest Expense: if the Acquirer uses Debt to fund the Acquisition, the Interest Expense associated with the Acquisition Debt is a funding cost of the M&A deal.

- Foregone Interest Income: if the Acquirer uses Cash to fund the Acquisition (which removes cash from the Acquirer’s bank account), it loses the Interest Income that Cash would have earned if the Acquisition did not occur.

- Equity Dilution: if the Acquirer uses shares to purchase the Target, the additional shares issued to the Target shareholders will lower the earnings available to each shareholder.

All Benefits and Costs Must Be After-Tax

Note that Accretion / Dilution reflects the impact of an M&A deal on the Acquirer’s Earnings Per Share, taking into account the after-tax Benefits and Costs of the M&A deal.

So, we must calculate each of the above items on an after-tax basis.

Weighing M&A Benefits & Costs

Ultimately, we weigh all the items above against each other to determine whether a deal is Accretive or Dilutive.

Now that we understand the high-level Benefits and Costs, let’s dig into the Accretion / Dilution calculation.

Calculate Accretion / Dilution in 3 Easy Steps

Still nervous about working through an Accretion / Dilution analysis? We have good news!

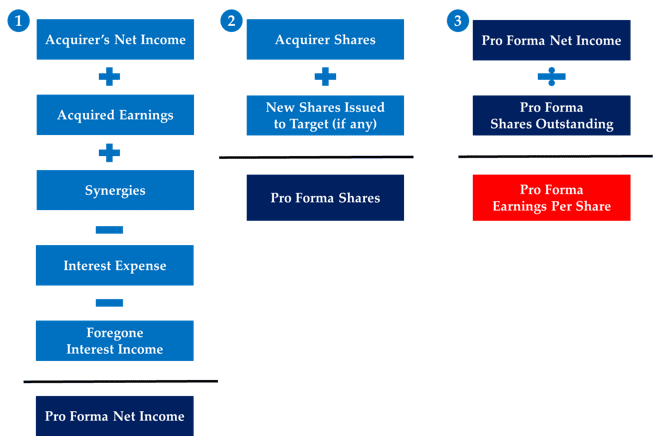

We can calculate Accretion / Dilution for any deal in just three easy steps:

Calculate Pro Forma Net Income in 3 Steps

- Calculate PF Net Income

Begin with the Acquirer’s Net Income, add the Acquired Target Earnings and Synergies, and subtract Interest Expense and Foregone Interest Income. As mentioned above, be sure to calculate all items on an After-Tax Basis.

- Calculate PF Shares

Start with the Acquirer’s Share Count and add any New Shares Issued to the Target.

- Calculate PF EPS

Divide Pro Forma Net Income by the Pro Forma Shares.

Note: Pro Forma (PF) roughly translates in Latin to ‘in the form of’ or ‘for the sake of form.’ In an M&A transaction, we look at the ‘form’ of two Companies as if they were combined.

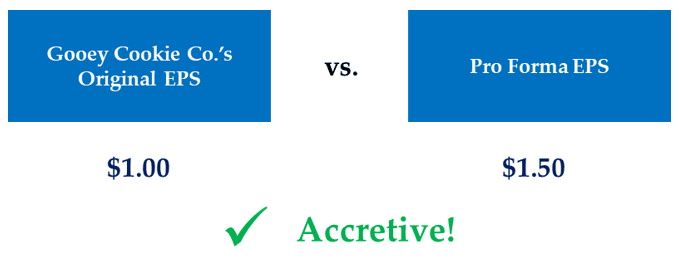

If Pro Forma EPS is greater than the Acquirer’s Pre-Deal EPS, the deal is Accretive!

If Pro Forma EPS is less than the Acquirer’s Pre-Deal EPS, the deal is Dilutive!

As a quick recap, here is a visual summary of the calculation:

In the coming sections, we will walk through an example of a complete Accretion / Dilution Calculation.

Before we jump ahead, though, let’s explore a special case called Cash Accretion Dilution.

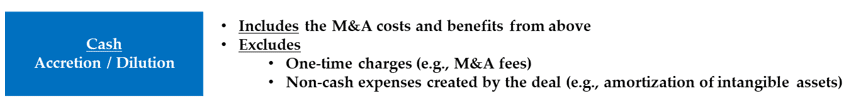

What is Cash Accretion / Dilution?

Analysts often calculate the EPS impact of an M&A deal, excluding One-Time Charges and Non-Cash Expenses created by an Acquisition.

Why Exclude One-Time Charges?

We exclude One-Time Costs because they do not reflect the underlying earnings of the combined Businesses in the future.

Examples of One-Time Charges include M&A fees paid to Investment Bankers, and Lawyers and breakage costs (which arise from the early retirement of the Target’s Debt).

Why Exclude Non-Cash Expenses?

We exclude Non-Cash Charges because they are difficult to estimate until accountants do their work after a deal closes.

Examples of Non-Cash Expenses created in an M&A transaction include the new Depreciation of Tangible Assets and the Amortization of Intangible Assets.

This process of creating new non-cash charges by marking Assets and Liabilities to fair value is called Purchase Price Allocation.

Now that we understand Cash Accretion Dilution, let’s look at a Common IB Interview Question.

Accretion / Dilution Interview Question / Example

Let’s dig into the most common Accretion / Dilution Investment Banking Interview Question:

A company with a High P/E Ratio acquires a company with a Low P/E Ratio in an All-Stock Deal. Is this deal Accretive or Dilutive?

Answer: The Deal is Accretive. But why?

Let’s walk through a simple example to explain.

Accretion / Dilution – Simple Example

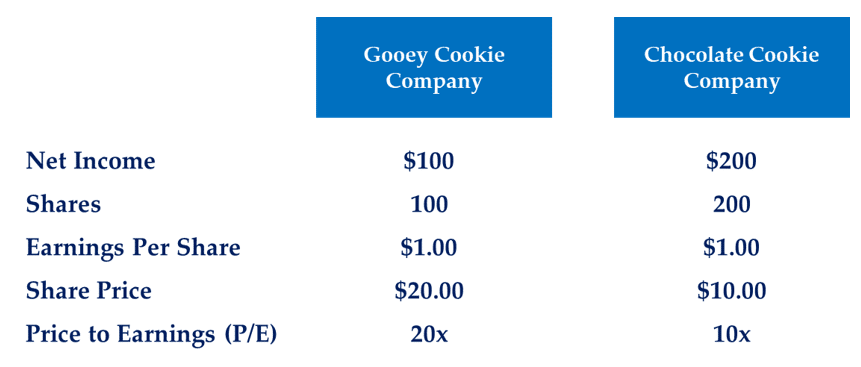

We will imagine that Gooey Cookie Company (Acquirer) wants to buy Chocolate Cookie Company (Target) in an All-Stock Deal.

Gooey Cookie Company’s P/E (20x) is higher than Chocolate Cookie Company’s P/E (10x).

Said differently, Gooey Cookie’s Share Value per dollar of Earnings is higher than that of Chocolate Cookie Company.

Let’s apply our Three Easy Steps for Calculating Accretion / Dilution to see why this deal is always Accretive.

Accretion / Dilution – Step #1: Pro Forma Net Income

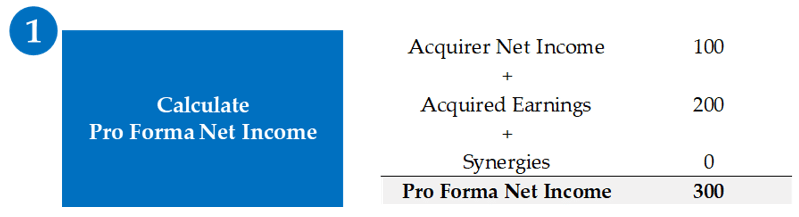

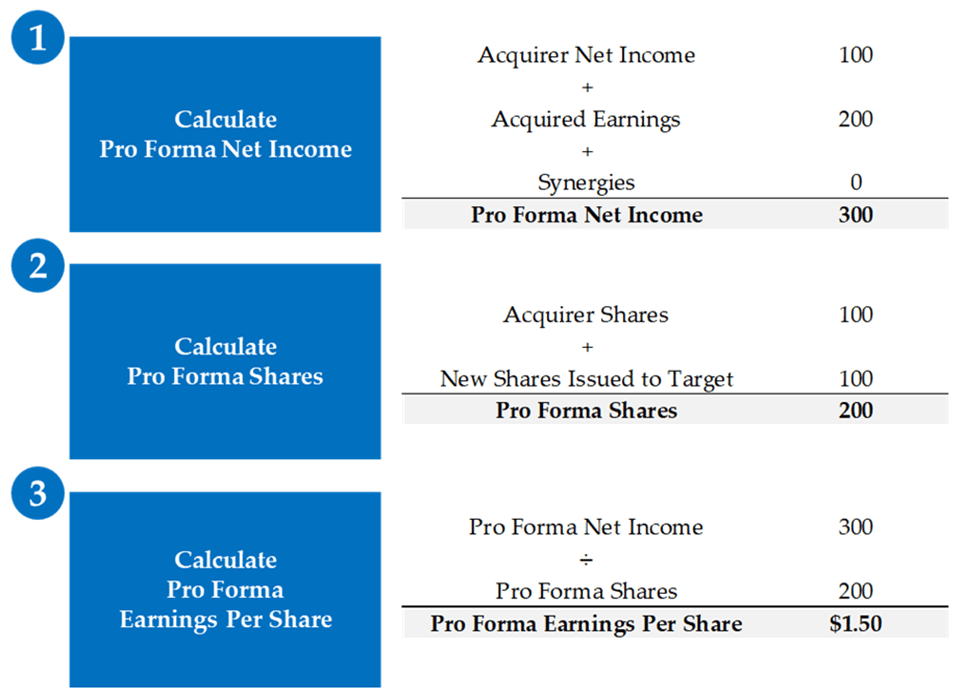

First, we calculate Pro Forma Net Income by adding Acquirer Net Income, Acquired Earnings, and Synergies (which we assume to be zero since the value of Synergies is not specified in the question).

Pro Forma Net Income is $300 in this example.

Accretion / Dilution – Step #2: Pro Forma Shares

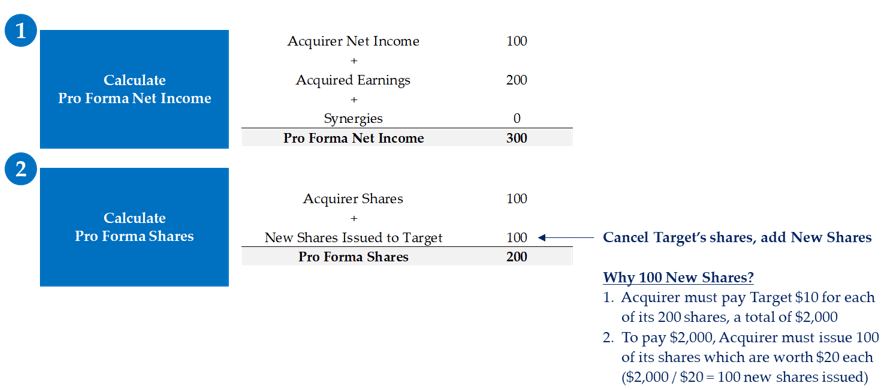

Second, we will calculate Pro Forma Shares by adding Acquirer Shares and the New Shares Issued to the Target.

To calculate the number of New Shares Issued to the Target, first calculate the dollar amount Target shareholders will receive.

In this example, the Target has 200 shares at $10 per share, for a total Equity Value of $2,000.

The Acquirer must purchase $2,000 of the Target’s Equity Value with $20 shares.

As a result, the Acquirer must issue 100 of its own Shares ($2,000 Target Equity Value / $20 Acquirer Share Price) to purchase the Target Company’s total Equity Value.

As a result, the Pro Forma Share Count will be the Acquirer’s 100 shares plus 100 new shares to be issued to the Target Company’s shareholders.

The combined Companies will have 200 shares following the close of the deal.

Take note of what happened here!

The Acquirer issues 100 of its own shares to retire 200 of the Target’s shares!

So, the Combined Share Count shrinks as a result of the deal.

Accretion / Dilution – Step #3: Calculate Pro Forma EPS

Now, we can calculate the Pro Forma Earnings Per Share by dividing the Pro Forma Net Income (from Step 1) by the Pro Forma Shares (from Step 2).

In other words, Pro Forma Net Income is the same as it was before the deal…but the combined Share Count is lower.

So, Earnings Per Share will mechanically increase (vs. before the deal). Hence the deal will be Accretive!

Through this example, we have proven a rule of thumb for All Stock Deals:

- If the Acquirer’s P/E is higher than the Target’s P/E, the deal is Accretive.

- If the Acquirer’s P/E is lower than the Target’s P/E, the deal is Dilutive.

The rule above will help you solve many basic Accretion / Dilution Interview Questions in Investment Banking Interviews.

This question, along with ‘Walk Me Through a DCF’ and ‘Walk Me Through an LBO’ are some of the most common Investment Banking Interview Questions.

Advanced Accretion / Dilution Interview Questions

For an A+ interview performance, you can flip the P/E ratio upside down (E/P ratio) and think of it as an Earnings Yield (i.e., funding cost for a given Earnings).

If the Acquisition Financing Cost is lower than the Target’s Yield, the deal is Accretive. Otherwise, Dilutive.

There are also more complicated variations of Accretion / Dilution questions that require understanding the impacts of Cash and Debt (instead of just Equity).

You can learn how to tackle these advanced concepts in our M&A Fundamentals Course.

Now, let’s discuss how Accretion / Dilution works in a full Merger Model.

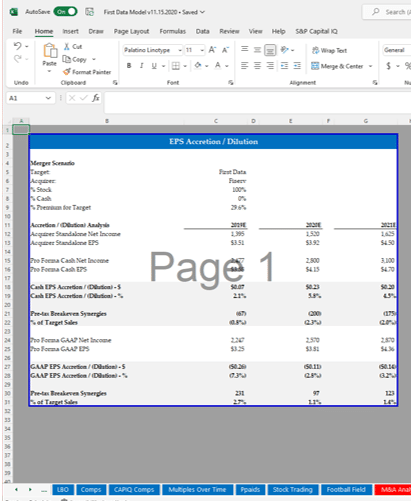

Accretion / Dilution in Merger Models

Investment Bankers build Merger Models to analyze the impact of a proposed Public Company M&A transaction.

A Merger Model (also called an Accretion Dilution Model or M&A Model) combines the two Companies’ financials and builds Pro Forma financials (typically a complete Income Statement, Cash Flow Statement, and Balance Sheet) to compare with the Acquirer’s original financials.

A Merger Model shows Accretion / Dilution as an output, among other metrics used to evaluate a deal (e.g., Leverage Multiples and Valuation Multiples).

Merger Models typically ‘sensitize’ Accretion / Dilution for various funding and deal structure assumptions.

Now that we understand the ins and outs of Accretion / Dilution, let’s see how it impacts real-life M&A Deals.

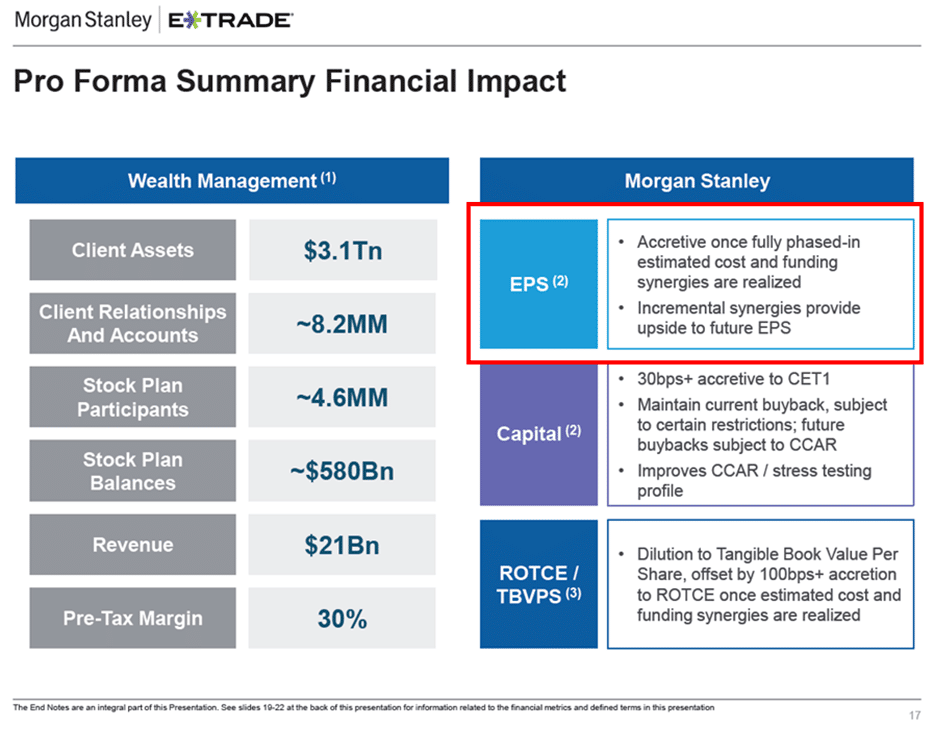

Real Life Example: Morgan Stanley Acquires E*TRADE

When Morgan Stanley acquired E*TRADE in an All-Stock Deal, the Acquirer communicated to shareholders that the deal would be EPS accretive.

In the press release, Morgan Stanley stated:

Combining the companies allowed Morgan Stanley to achieve Cost Synergies of $400 million a year from ‘consolidating duplicative platforms and systems, infrastructure and data center savings, shared services consolidation, real estate optimization, and operational efficiencies from the increased scale.’

As we said before, Public Company CEOs typically emphasize Accretion Dilution in M&A transactions to convey to their Shareholders that they are creating value over time.

Now that we’ve seen a real-life example of Accretion Dilution, let’s wrap up!

Accretion / Dilution Wrap-Up

Accretion / Dilution is a critical concept to understand for anyone recruiting for an Investment Banking, Private Equity, or Investment Management job.

In summary, Accretion / Dilution expresses the impact of an M&A deal on an Acquirer’s Earnings Per Share.

All else equal, Accretive deals (i.e., where EPS goes up) create value for Shareholders, whereas Dilutive deals (i.e., where EPS goes down) may destroy Shareholder Value.

We hope this article helped answer your questions.

Please email [email protected] with any feedback or requests for any topics you would like to see in future articles.

Interview Question Video Review: Accretion / Dilution

Want a video overview of Accretion / Dilution?

Check out this YouTube Video Walkthrough of Accretion/Dilution from our Founder, Mike Kimpel, with a full walkthrough.

Also, check out our YouTube Channel here for more Interview Question reviews and Finance Explainer Videos.

About the Author

Mike Kimpel is the Founder and CEO of Finance|able, a next-generation Finance Career Training platform. Mike has worked in Investment Banking, Private Equity, Hedge Fund, and Mutual Fund roles during his career.

He is an Adjunct Professor in Columbia Business School’s Value Investing Program and leads the Finance track at Access Distributed, a non-profit that creates access to top-tier Finance jobs for students at non-target schools from underrepresented backgrounds.

Frequently Asked Questions

In the context of M&A Deals, Accretive typically describes a deal in which the combined earnings of the Acquirer and Target (post-deal) exceed the earnings of the standalone Acquirer before the deal.

You can calculate Accretion / Dilution by (1) Calculating the Pro Forma Net Income of the combined Acquirer and Target, (2) Calculating the Pro Forma Share Count, and then (3) Calculating the Pro Forma Earnings Per Share.

Accretion / Dilution helps CEOs, Boards, and Shareholders of Publicly Traded companies determine the direction of Earnings Per Share following a Merger or Acquisition close.

The opposite of Accretive is Dilutive. In short, in the M&A world, an Accretive deal means Earnings Per Share increase following the close of a deal. Conversely, a Dilutive deal means that Earnings Per Share will decrease following the close of a deal.

Note that Accretion / Dilution generally refers to the impact to Earnings Per Share but can also apply to other metrics such as EBIT, EBITDA, or Free Cash Flow.

You would typically use the word ‘Accretive’ to describe the impact of an M&A transaction on a Company’s Earnings Per Share.

If you were to say, ‘The deal will be Accretive to earnings,’ you are saying that Earnings Per Share will increase following the close of a deal.