Learn to answer ‘Walk Me Through an LBO’ like a pro and land your dream job in Investment Banking, Private Equity, or Investment Management. After reading our Ultimate Guide, you’ll understand:

- The 6 Step Process to answer ‘Walk Me Through an LBO’ or ‘Walk Me Through an LBO Model.‘

- The underlying idea behind an LBO Transaction.

- LBO Purchase Mechanics.

- LBO Debt and Equity funding structures.

- How to calculate Cash Flow for an LBO analysis.

- How to create an Exit Valuation for an LBO analysis.

- A shortcut to quickly calculate Internal Rate of Return (IRR).

Estimated reading time: 24 minutes

- TL;DR

- A Little Context on 'Walk Me Through an LBO'

- What is an LBO?

- Variations of 'Walk Me Through an LBO'

- Big Picture and Common Pitfalls: 'Walk Me Through an LBO'

- 'Walk Me Through an LBO' in 6 Steps

- Preface: Finding an LBO Candidate

- Walk Me Through an LBO Step #1: Purchase Price

- Walk Me Through an LBO Step #2: Debt and Equity Funding

- Walk Me Through an LBO Step #3: Calculate Cash Flows

- Walk Me Through an LBO Step #4: Exit Enterprise Value

- Walk Me Through an LBO Step #5: Exit Equity Value

- Walk Me Through an LBO Step #6: Investor Returns

- Wrap-Up

- Interview Question Video: 'Walk Me Through an LBO'

- About the Author

- Frequently Asked Questions (FAQ)

- Aiming for Investment Banking, Private Equity, or Investment Management? Check This Out!

- Related Links

TL;DR

- Initially, keep your answer high-level…and let the Interviewer pull you into the details.

- ‘Walk Me Through an LBO‘ and ‘Walk Me Through an LBO Model‘ are effectively the same question.

- Private Equity firms pursue LBO transactions, in which they use Debt to amplify the returns they can generate for their investors.

- The core drivers of value creation in an LBO are Purchase Price, Cash Flow, and EBITDA Expansion.

- You can answer this question in just six simple steps, which we’ve listed below.

A Little Context on ‘Walk Me Through an LBO’

‘Walk Me Through an LBO’ is one of the most common Investment Banking Interview Questions. It is also a very common question for Private Equity Interviews.

Many students aiming for top-tier Finance simply memorize the information needed to answer this question, but quickly find themselves in a jam when they can’t explain the underlying concepts.

In this article, we walk through a 6-Step framework you can use to answer this question, but we also provide detailed explanations for the underlying concepts behind each step.

We provide a full LBO walkthrough with a thorough, Plain English explanation of the Leveraged Buyout Process.

If you read this article and fully absorb the content, you’ll be able to nail this Interview question and land your dream job.

Quick Note: this question is different from the more advanced Paper LBO exercise. If you want to learn how to complete a Paper LBO, then check out our deep-dive walkthrough of Paper LBOs.

What is an LBO?

A Leveraged Buyout (or ‘LBO’ for short) is a transaction where a Private Equity firm (‘PE Firm’ or ‘Financial Sponsor’) purchases a Business using Debt to fund a significant portion of the Purchase Price.

The portion of the Purchase Price not funded by Debt will come from the PE Firm’s Investors, which is called ‘Sponsor Equity.’

An LBO Purchase is very similar to how you would buy a house with a mortgage and fund the remainder of the Purchase Price with a Down Payment.

The primary reason for using Debt (as opposed to investing more Equity) is to increase the potential for higher returns for the Private Equity firm’s Investors.

As we will discuss, though, this only works if you have a very stable and predictable business.

While there are quite a few moving pieces to the LBO structure, as you’ll see in this article, we can break an LBO Transaction into just six simple steps.

Variations of ‘Walk Me Through an LBO’

The question ‘Walk Me Through an LBO’ can come in many forms. Below are the most common variations of this question:

1. Walk Me Through an LBO Model.

2. Walk Me Through an LBO Analysis.

These are both variants of the ‘Walk Me Through an LBO’, but the Interviewer is usually looking for a slightly more in-depth, model-mechanics-focused response.

In this article, we will walk you through the high-level explanation of ‘Walk Me Through an LBO.” This will provide a solid foundation for answering any version of this question.

If you’d like a deeper dive into LBO models (or Analysis), check out our LBO Modeling Course.

The LBO Course is currently only available to our members while we are in our pre-launch phase.

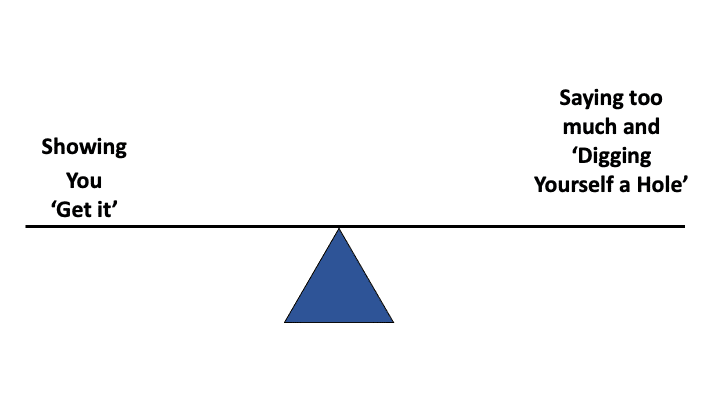

Big Picture and Common Pitfalls: ‘Walk Me Through an LBO’

Before we get into the 6-Step Framework, let’s first address the approach to take when answering this question.

As is the case when answering most Finance interview questions, you want to keep your answer very high-level at first by leading with our 6 Step approach (explained below).

Beyond that, there are three common mistakes to avoid:

Three Common Interview Mistakes

Mistake #1: Getting Lost in the Weeds – I’m often asked something to the effect of, ‘With so many steps and pieces, How do you answer walk me through an LBO?”. The short story is that you need to create a few high-level anchors (i.e. the 6 Steps). These anchors give you something to hang onto, so you don’t get lost in the weeds.

Mistake #2: Seeming Long-Winded – If you give a long answer, it can seem like you don’t understand the concept and/or can’t give a succinct answer. Neither of those things reflects well on a prospective candidate.

Mistake #3: Trying to Show off Your Knowledge – Let’s face it, the person sitting on the other side of the table in an interview has a huge leg up on you in most cases. They have likely been on the job for years and can run circles around you. If you try to show off how much you know, they will just take it to the next level. It’s nearly impossible to win this game. You definitely do not want to dive into the deep end of the pool with advanced concepts like Purchase Price Allocation.

You’ll want to avoid these common mistakes at all costs.

Now, let’s dive into ‘Walk Me Through an LBO’!

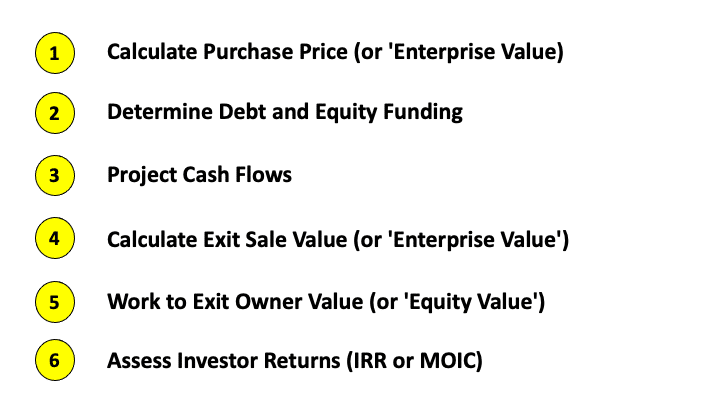

‘Walk Me Through an LBO’ in 6 Steps

At first glance, answering ‘Walk Me Through an LBO’ can seem daunting…it doesn’t need to be.

Let’s begin by laying out the 6 Steps to answer this question at a very high level:

The 6 Step Answer

How to Answer ‘Walk Me Through an LBO’ in 6 Steps

- Calculate Purchase Price (or ‘Enterprise Value)

Determine the price to pay by multiplying the EV/EBITDA Multiple by the Target Company’s EBITDA. Then add any Financing or Advisory fees to arrive at the Total Uses of Funds.

- Determine Debt and Equity Funding

Determine the Debt available based on a multiple of EBITDA (typically 4-7x). Subtract Debt from the Total Uses Sources of Funds to determine the Sponsor Equity required to fund the Purchase.

- Project Cash Flows

Calculate Free Cash Flow (see below for details) over a five-year horizon, including Interest Expense.

- Calculate Exit Sale Value (or ‘Enterprise Value’)

Determine the sale price by multiplying an EV/EBITDA multiple by the Target Company’s EBITDA at Exit (typically Year 5). Note that the Exit EV/EBITDA multiple is typically assumed to be the same as the initial Purchase EV/EBITDA multiple.

- Work to Exit Owner Value (or ‘Equity Value’)

Subtract the cumulative Cash Flows (Step 3 above) from the Debt used to fund the deal (Step 2 above). This will give you the Debt that needs to be repaid when the Company is sold. Exit Equity Value is then calculated by subtracting the Debt repaid at Exit from the Exit Sale Value (‘Enterprise Value’). This is the money returned to the Investors in the deal.

- Assess Investor Returns (IRR or MOIC)

Use the Exit Equity Value and the initial Sponsor Equity to calculate the Internal Rate of Return and the Multiple of Invested Capital. See below for detailed calculations (and a helpful shortcut).

In the sections below, we’ll walk through each of these steps in extensive detail.

We’ll also explain the underlying idea behind each step.

Preface: Finding an LBO Candidate

Before we can execute an LBO Purchase, we need to find an attractive LBO candidate.

Because the Company acquired in an LBO will typically have a meaningful Debt (and thus Interest) load, we need a steady and cash generative Business.

Fortunately, there are a few common criteria we look for in an LBO Target, which we’ve listed below:

Criteria for the Ideal LBO Candidate

While this isn’t technically part of our 6-Step Framework, this can often be a precursor to the question.

So, it is helpful to have this in the back of your mind if the Interviewer asks you how to find an LBO candidate.

Walk Me Through an LBO Step #1: Purchase Price

Once we have an LBO target in mind, we need to calculate the target Company’s Purchase Price (or Enterprise Value).

How to Calculate the LBO Purchase Price

In the LBO world, the most commonly used approach to calculate the Purchase Price is to use peer multiples.

The most common multiple is an Enterprise Value / EBITDA (or EV/EBITDA) multiple.

Alternatively, if a Business has a higher level of Capital Intensity, you might instead use EV/EBITDA – Capital Expenditures.

This approach helps to normalize across Businesses with high reinvestment needs.

With either approach, we would take the Peer Multiple and multiply it by the Acquisition Target’s EBITDA (or EBITDA – Capital Expenditures) to arrive at the Purchase Price (or Enterprise Value).

How to Calculate Purchase Price for a Public LBO Target

If the Acquisition Target Company is Publicly Traded, we will take a slightly different route to arrive at Enterprise Value.

Instead of applying an EV/EBITDA multiple to arrive at Enterprise Value, we start at Share Price and work to Enterprise Value.

Below are the key steps in this process:

1. Calculate Market Capitalization: Price Per Share * Fully Diluted Share Count (using the Treasury Stock Method).

2. Subtract any Excess Cash.

3. Add all Outstanding Debt.

For a deeper dive into the concepts behind these calculations, check out our Enterprise Value vs. Equity Value article.

Transaction and Advisory Fees

In addition to paying the Purchase Price (Enterprise Value) of the LBO Target Company, we must also pay Fees to close the deal.

The two primary types of fees we need to pay are:

- Advisory Fees – payments to Investment Bankers, Accountants, Consultants, and Lawyers.

- Financing Fees – payments to Lenders in return for providing Debt to fund the deal.

To wrap up Step #1, let’s lay out the ‘Uses of Funds’ for the LBO purchase of the Company.

In short, to calculate the total payment (or ‘Uses of Funds’) needed to close the deal, we have to include the Purchase Price plus our Fees paid to Lenders and Advisors.

LBO Value Creation Driver #1: Purchase Price

Before we continue, let’s quickly discuss LBO Value Drivers. If you would like to take a deeper dive into these drivers, check out our LBO Value Creation Drivers video.

In any LBO transaction, there are a variety of factors that will impact the transaction.

However, in the end, the value created in an LBO boils down to just three factors: Purchase Price, Cash Flow, and EBITDA Growth (which drives the Exit Sale Price).

The first LBO Value Creation Driver, Purchase Price, creates value by increasing the potential for growth in the value of the Business over the course of the LBO.

A lower Purchase Price may also result in a lower required Equity Investment at Purchase.

Now that we’ve calculated the Purchase Price (including Fees), let’s jump to Step #2 and determine how to fund the LBO transaction.

Walk Me Through an LBO Step #2: Debt and Equity Funding

Private Equity firms fund LBO transactions with a combination of Debt and Equity.

Let’s look at how each of these ‘Sources of Funding’ functions in a little more detail.

LBO Structure: Debt Funding

As previously mentioned, a PE Firm typically funds an LBO purchase with a significant amount of Debt, similar to the structure used to fund the purchase of a Home.

The level of Debt in an LBO transaction is typically a function of the Business’ EBITDA generation. It’s worth noting that Debt levels are generally expressed as multiples (or ‘Turns’) of EBITDA in the LBO world.

The level of Debt for an LBO can vary from as low as 1-2x EBITDA to over 10x EBITDA.

For more on historical Debt levels in LBOs, check out the Bain Annual Private Equity Report.

Unlike the structure for a Home purchase, however, the LBO Debt structure is typically composed of Loan and Bond Debt (as opposed to a Mortgage).

LBO Debt Funding Source #1: Loan Debt

The primary Source of Funding for the vast majority of LBO transactions is Loan Debt.

Loan Debt typically comes in a few forms:

- Revolving Credit Facility (or ‘Revolver’) – a short-term borrowing facility that the Company can utilize for borrowings on an as-needed basis.

- First-Lien Term Loan – a first-priority Loan that typically requires some principal repayment (‘Amortization’) over the course of the Loan.

- Second-Lien Term Loan – a second-priority (and thus higher cost) Loan.

Side Note: It’s worth mentioning that ‘Loan Debt’ is often referred to as ‘Bank Debt’ because back in the day, this type of Debt was primarily offered by Banks. Today, there are many specialty, non-bank lenders that offer Loan Debt, but the name has stuck.

LBO Debt Funding Source #2: Bond Debt

For larger deals, Private Equity firms may seek funding from the Bond market.

The Bonds raised for LBO transactions are quite different from run-of-the-mill Bonds issued by large, high-quality Companies like Microsoft, Ford, or Kellogg’s.

LBO Bonds are referred to as ‘High Yield’ (or ‘Junk’) Bonds because they are much riskier given the level of Debt typically used in an LBO transaction.

Because of their riskiness, they carry a much higher cost than a traditional Bond.

LBO Debt Funding Source #3: Mezzanine Debt

The last source of Debt funding is a catch-all for any other type of Debt that doesn’t neatly fit into the categories above.

Like a Mezzanine floor in a building, Mezzanine Debt sits between the Debt and Equity in an LBO structure. It typically has characteristics of both Debt (i.e. Interest Payments) and Equity (i.e. Upside in the Investment).

If you’d like to take a Deeper Dive into LBO Debt structures, check out the following primers from the leading provider of LBO Debt information, S&P Global LCD:

LBO Structure: Equity Funding

Whatever can’t be funded with Debt must be funded with an Investment (or ‘Sponsor Equity’) by the Private Equity Firm (or ‘Financial Sponsor’).

In short, the Private Equity firm is the funding backstop.

If we were to rewind to the early days of LBOs in the 1970s to the 1990s, we would see LBOs funded with as little as 10% Equity.

Over time Lenders have pushed Equity funding requirements higher to ensure the Private Equity firms have meaningful ‘skin in the game.’

Today, the Sponsor ‘Equity Contribution’ typically composes at least 40% or more of the Purchase Price in an LBO transaction.

For more on this topic, check out this article from the Wall Street Journal.

To wrap up this step, let’s now lay out our total ‘Sources of Funds’ for the LBO.

Once we’ve pinned down our Equity and Debt funding for an LBO transaction, we move on to calculating Cash flow in Step #3.

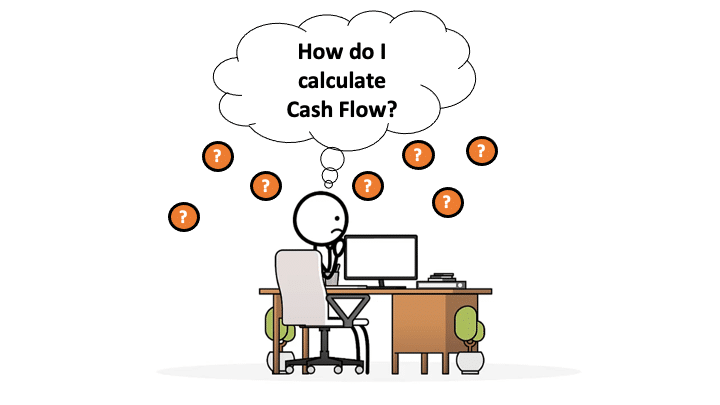

Walk Me Through an LBO Step #3: Calculate Cash Flows

The typical time horizon for most LBOs is five years, so that’s the time horizon over which we’ll need to project out Cash Flows.

But we need to be a bit more specific. If you’ve read our ‘Walk Me Through a DCF’ guide, you’ve learned how to calculate Unlevered Free Cash Flow.

With an LBO, we’re taking a similar approach, but given that we’ll be taking on Debt, we need to incorporate the impact of Interest Payments.

Below are the components needed to calculate Free Cash Flow for an LBO Analysis:

How to Calculate Free Cash Flow for an LBO

As previously mentioned, we need to project this Cash Flow over a five-year horizon.

LBO Value Creation Driver #2: Cash Flow

Cash Flow is the second primary value driver in an LBO transaction.

Cash Flow creates value in an LBO in two ways:

1. Debt Paydown

2. Invest in High Return on Capital opportunities

Both of these uses of cash increase returns to Investors in the LBO transaction.

How Debt Paydown Creates Value

Debt paydown reduces the level of Debt the Private Equity firm needs to repay when it sells the Business.

The lower level of debt at Exit increases the Equity available to the Private Equity Investors.

The process above is similar to how you would receive a higher payout if you pay down more of your mortgage before selling a house.

We will dig into this in more detail in Step #5.

How Reinvestment Creates Value

Alternatively, a Private Equity firm could reinvest the excess cash in high return on capital reinvestment opportunities.

The goal would be to grow the Business and thus EBITDA.

As we will see in Step #4, growing EBITDA drives a higher Exit Enterprise Value at Sale and thus a higher return for the Private Equity firm.

Once we’ve made our Cash Flow projections, we can proceed to calculating Exit Enterprise Value in Step #4 of ‘Walk Me Through an LBO.’

Walk Me Through an LBO Step #4: Exit Enterprise Value

As mentioned in Step #3, the typical time horizon for an LBO is five years.

So, after we’ve made five years of Cash Flow projections, we’ll set up an Exit Analysis.

In an Exit analysis, we assume that the Private Equity firm puts the Business up for sale to another Buyer.

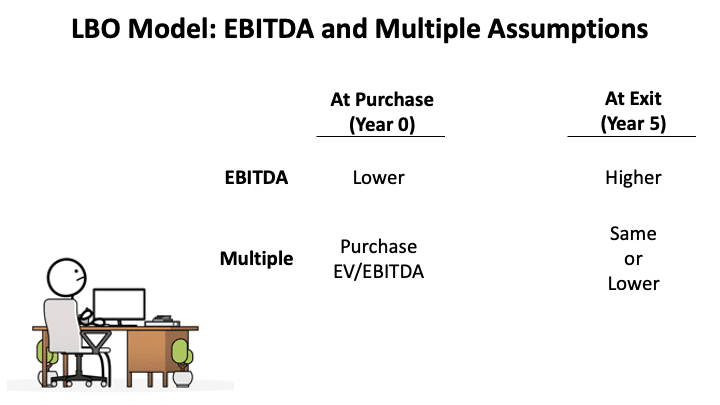

As with our Purchase Price analysis in Step #1, Buyers will typically base their purchase on the EBITDA of the Business and relevant Peer Valuation Multiples (again EV/EBITDA or EV/EBITDA – Capital Expenditures).

Based on the above, we can see that higher EBITDA and higher EV/EBITDA multiples will increase the Business’s Sale Value.

What is the Right Exit Multiple Assumption?

It is worth noting, however, that when analyzing an LBO investment, most Private Equity investors assume that the Exit Multiple at Sale will be the same or less than the Purchase Valuation multiple.

PE Firms make this assumption due to conservatism and because PE Firms have been burned in past cycles (e.g. the 2008 crisis) by assuming Exit Multiples would continue to expand.

Value Creation Driver #3: EBITDA Expansion

EBITDA expansion is the third and final LBO Value Driver.

Because the Exit Multiple is typically held constant (vs the Purchase Multiple), the Exit Valuation is primarily dependent on EBITDA Expansion (or Contraction).

This is because as EBITDA expands (holding the Exit Multiple constant), the Sale Value at Exit also increases.

Once we’ve calculated the Exit Valuation, based on our Exit Year EBITDA and the appropriate Valuation Multiple, we can move to Step #5.

In Step #5 we’ll determine how much of the Exit Price returns to the Private Equity firm’s Investors.

Walk Me Through an LBO Step #5: Exit Equity Value

When a Private Equity Firm sells a Business, they don’t keep all of the proceeds because Lenders must be repaid first.

On a more positive note, they do get to keep any excess Cash on the Balance Sheet.

To calculate the Exit Equity Value that would return to the Private Equity firm, we would:

1. Calculate Exit Enterprise Value (from Step #4).

2. Subtract the total Principal value of all outstanding Debt.

3. Add any excess Cash on the Balance Sheet.

The dollars that remain after completing this calculation are what the Private Equity firm will keep (and thus return to investors.

Quick Note: ‘Gross’ vs. ‘Net’ Return

When answering this question, the Interviewer may ask about ‘Gross’ vs. ‘Net’ Returns.

Interviewers ask this because Private Equity firms don’t return the entire Exit Equity Value to their Investors.

Instead, they will typically return the Exit Equity Value minus a 20% cut of any Profit (called ‘Carried Interest’) made over the original Investment.

So, the Exit Equity Value reflects a Gross Return, whereas the Exit Equity Value minus Carried Interest reflects the ‘Net’ dollars returned to the Investors in an LBO.

You typically won’t need to go into this level of detail for a basic ‘Walk Me Through an LBO’ exercise. But we wanted to address the topic, so you aren’t caught off guard.

Now, we can move to the final step!

Walk Me Through an LBO Step #6: Investor Returns

To calculate the returns to Investors in an LBO deal, Private Equity firms primarily rely on two metrics:

1. Internal Rate of Return (‘IRR’) – reflects the time-weighted Return to Investors in the deal.

2. Multiple of Invested Capital (‘MOIC’) – reflects dollars returned vs. dollars invested.

How to Calculate Internal Rate of Return

There are two methods to calculate an Internal Rate of Return: the Simple CAGR and the IRR Formula or Function.

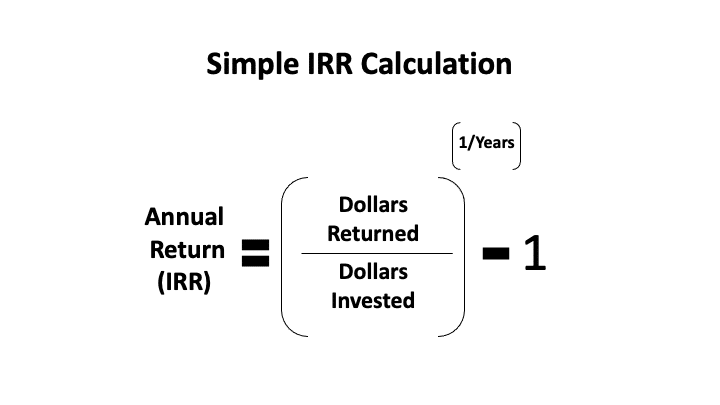

If there are only two cash flows (Dollars Invested + Dollars Returned), we can use the Compounded Annual Growth Rate (or ‘CAGR’) formula, which we’ve laid out below:

If there are more than two cash flows, we’ll need to use the IRR Function in Microsoft Excel because the math gets a bit more complicated.

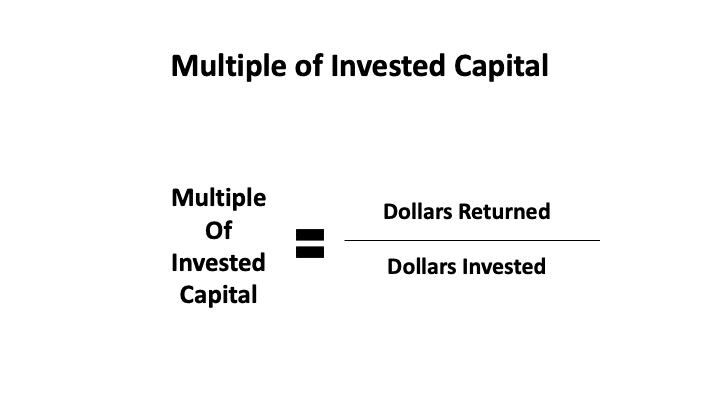

How to Calculate Multiple of Invested Capital

Calculating the Multiple of Invested Capital is much easier. We simply divide the Exit Equity Proceeds (‘Dollars Returns’) by the Initial Sponsor Equity Investment (‘Dollars Invested’).

It is worth noting that Multiple of Invested Capital has several alternative names: Multiple of Money (MOM), Multiple of Investment (MOI), and Cash on Cash Return (CoC). Each of these is the same as MOIC.

Which is better: IRR or MOIC?

A common question that arises at this point is, ‘Why do you use two return metrics?’.

Pros and Cons: Internal Rate of Return

The short story is that IRR is a time-weighted return, but things like an early exit (i.e. sooner than five years) can easily distort an IRR.

IRR also doesn’t capture the absolute dollars returned to Investors.

For example, a Private Equity firm could make very high IRR investments on tiny deals but not return significant absolute dollars.

Since Investors pay PE firms based on absolute dollars returned, this wouldn’t be a positive outcome for the PE Firm Partners.

Pros and Cons: Multiple of Invested Capital

By contrast, MOIC simply weighs dollars invested versus dollars returned.

MOIC is not ideal given that it is not time weighted.

However, MOIC can be paired with dollars invested to quickly determine the absolute dollars returned to a Private Equity firm when the firm sells an LBO Investment.

As a result, MOIC (multiple of dollars returned) is often used in tandem with IRR (time-weighted). By using both metrics, we get a more holistic view of the potential return of an Investment.

Cheat Code: MOIC to IRR Calculation Conversion

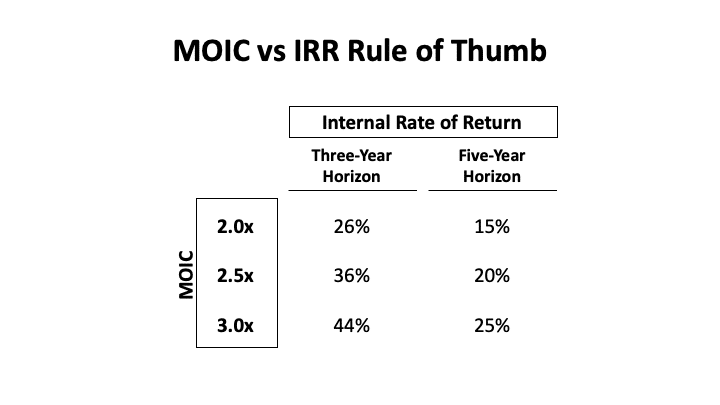

If you’re thinking, ‘How in the world will I do an IRR calculation in my head during an interview?’, don’t sweat it.

You don’t have to!

Fortunately, there are two solid rules of thumb for both Three-Year and Five-Year IRR calculations.

As we can see in the tables below, we can approximate an IRR based on the MOIC for a deal:

Table to Convert MOIC to IRR

Now that we’ve completed Step #6 of ‘Walk Me Through an LBO’, let’s wrap this up!

Wrap-Up

Having a solid answer to ‘Walk Me Through an LBO’ is a core part of prepping for Technical Interview Questions for Investment Banking, Private Equity, or Investment Management.

Hopefully, after reading through this, you have a much better understanding of both the 6-Step approach AND the underlying ideas behind the question.

If you follow the approach laid out above and deeply grasp the underlying concepts behind each step, you’ll be in great shape!

Interview Question Video: ‘Walk Me Through an LBO’

- If you’d like a video overview of this topic, check out our Walk Me Through an LBO video from our Founder, Mike Kimpel, with a complete walkthrough of how to answer the question.

- Also, check out our YouTube channel here for more Interview Question Reviews for common questions like Walk Me Through a DCF, How does $10 of Depreciation Flow Through the 3 Statements, and When to use EV/Revenue Multiples.

About the Author

Mike Kimpel is the Founder and CEO of Finance|able, a next-generation Finance Career Training platform. Mike has worked in Investment Banking, Private Equity, Hedge Fund, and Mutual Fund roles during his career.

He is an Adjunct Professor in Columbia Business School’s Value Investing Program and leads the Finance track at Access Distributed, a non-profit that creates access to top-tier Finance jobs for students at non-target schools from underrepresented backgrounds.

Frequently Asked Questions (FAQ)

A Leveraged Buyout (or ‘LBO’ for short) is a transaction where a Private Equity firm (‘PE’ or ‘Financial Sponsor’) purchases a Business using Debt to fund a significant portion of the Purchase Price.

An LBO is typically executed by a Private Equity firm (or ‘Financial Sponsor’). The firm funds a large portion of the Purchase Price with Debt, and the remainder is funded by the Private Equity firm’s Investors.

The key with this question is to begin at a high level, have a solid framework to keep you out of the weeds (see our article for a simple, 6-step Framework), provide succinct answers, and avoid showing off too much knowledge in your initial response.

Both questions above are essentially the same question as ‘Walk Me Through an LBO.’ An Interviewer will typically ask you to go into more detail than with the standard question in some cases.

Aiming for Investment Banking, Private Equity, or Investment Management? Check This Out!

- We have created the ultimate free resource for aspiring Finance Analysts with our Finance Analyst Starter Kit.

- We have Free, Plain Englisharticles and Animated Explainer Videos on:

- Who the core players are in the Finance world and how they operate.

- Core mental frameworks for learning Valuation and Returns Analysis.

- Reviews of common trouble topics based on our experience training thousands of students.

- Detailed walkthroughs of common Interview Questions.