Learn to use the Treasury Stock Method like a pro so you can use it on the job in Investment Banking, Private Equity, and Investment Management.

In this article, you’ll see:

- Why professionals use the Treasury Stock Method.

- The 3-Step Process for the Treasury Stock Method.

- The difference between a Company’s Basic Share Count vs. the Fully Diluted Share Count.

- How Options, Restricted Stock, and Convertibles affect the Fully Diluted Share Count.

- An example of the Treasury Stock Method for Foot Locker.

Estimated reading time: 20 minutes

- TL;DR

- What is the 'Treasury Stock Method?'

- Want To Learn More About Finance?

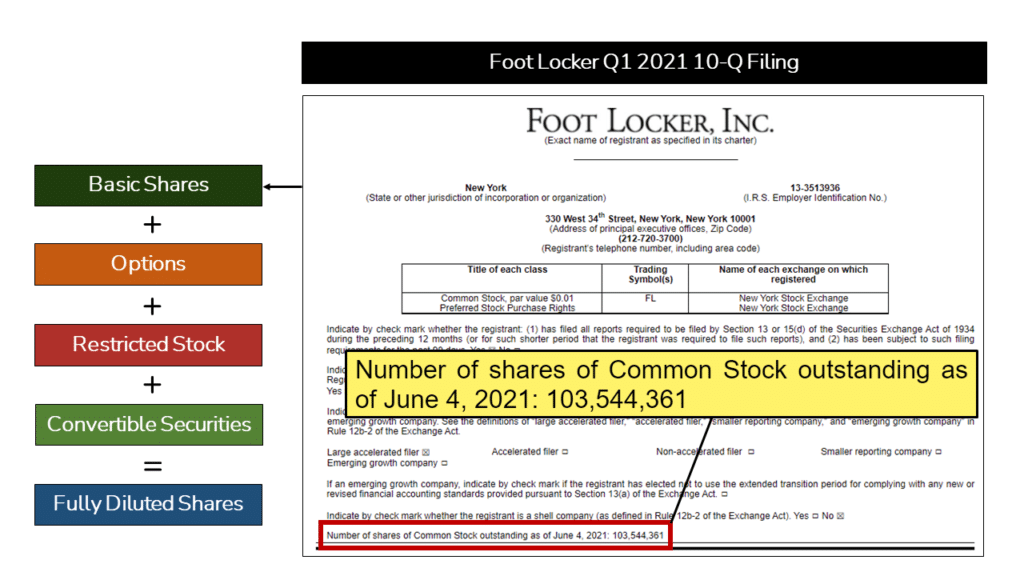

- Basic Shares vs. Fully-Diluted Shares

- The Impact of Options

- The Treasury Stock Method in 3 Steps

- The Treasury Stock Method: Restricted Stock and Convertibles

- Diluted Shares Calculation Example: Foot Locker

- Wrap-Up

- Related Links

- About the Author

- Frequently Asked Questions

TL;DR

- We need the Treasury Stock Method to calculate Fully Diluted Shares.

- The Basic Share Count reflects existing shares, whereas the Diluted Share Count reflects all existing shares plus potential new shares.

- The Treasury Stock Method allows us to convert Option Proceed dollar to new shares that we can add to the Basic Share Count.

- In addition to Options, we have to account for the impact of Restricted Stock and Convertible Debt and Equity.

- The Treasury Stock Method has 3 Steps which you can find in the Article below.

What is the ‘Treasury Stock Method?’

The Treasury Stock Method (‘TSM‘ or ‘Treasury Stock Approach‘) captures the full impact of Options when we calculate a Company’s Share Count.

Companies report their current (or ‘Basic’) share count, which reflects all existing shares.

However, when we want to calculate a Company’s Equity Value or Enterprise Value, we need to use the ‘Fully Diluted Share Count.’

The Fully Diluted Share Count includes potential shares from Options, Restricted Stock, and Convertible Securities.

In particular, the TSM allows us to add the impact of Options into the Fully Diluted Share Count.

As we’ll see, we follow a slightly different process for adding in the impact of Restricted Stock and Convertible Securities.

Professionals across Investment Banking, Private Equity, and Investment Management use the Treasury Stock Method every day to value Companies.

In particular, the Treasury Stock Method is critical for completing core analyses like Discounted Cash Flow (‘DCF’) and Leveraged Buyout (‘LBO’) models.

This article will show you how to calculate the number of shares outstanding using the Treasury Stock Method.

The rest of the article will dive deep to give you the fullest possible picture. However, if you want to hop straight to the 3-Step Process for the Treasury Stock Method, click here.

Want To Learn More About Finance?

Ramp up faster with all of our (free) deep-dive articles in our Analyst Starter Kit:

Basic Shares vs. Fully-Diluted Shares

As mentioned above, Companies have two share counts:

- Basic Share Count.

- Fully Diluted Share Count.

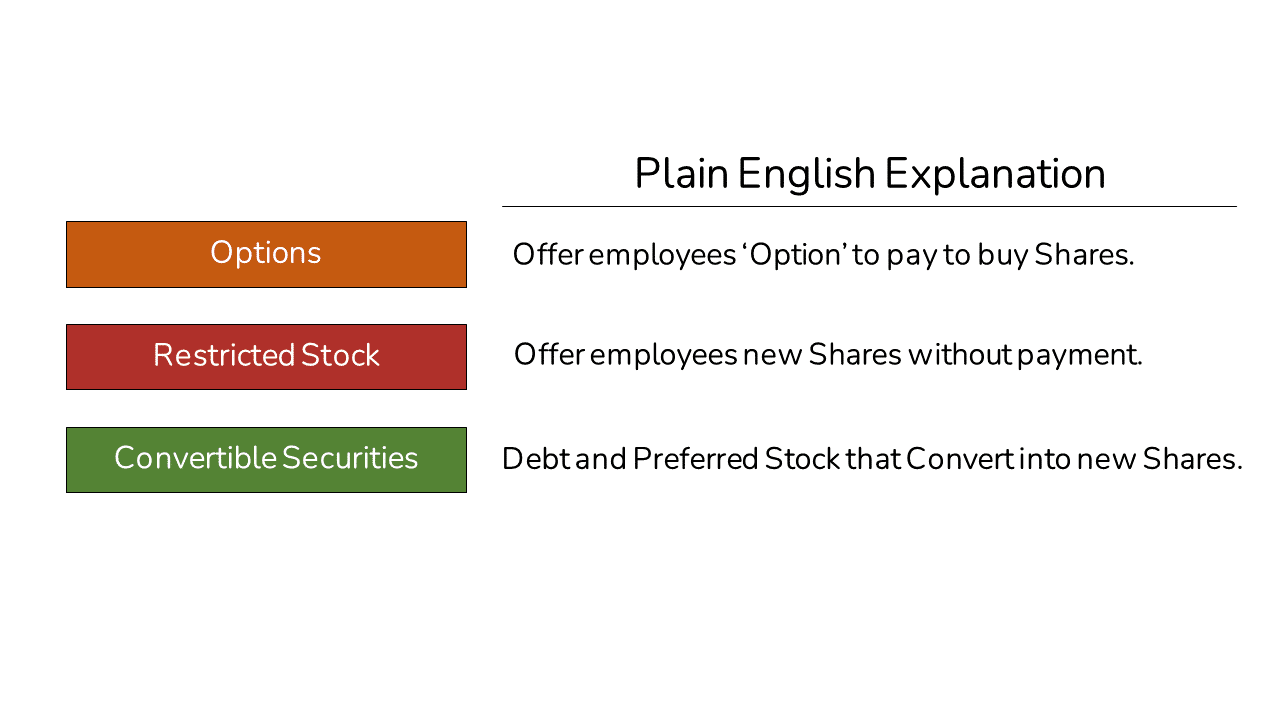

To go from Basic Shares to Fully Diluted Shares Outstanding (or ‘FDSO’), we need to add the impact of three instruments:

- Options.

- Restricted Stock.

- Convertible Securities.

Intro to Stock Options and Restricted Stock

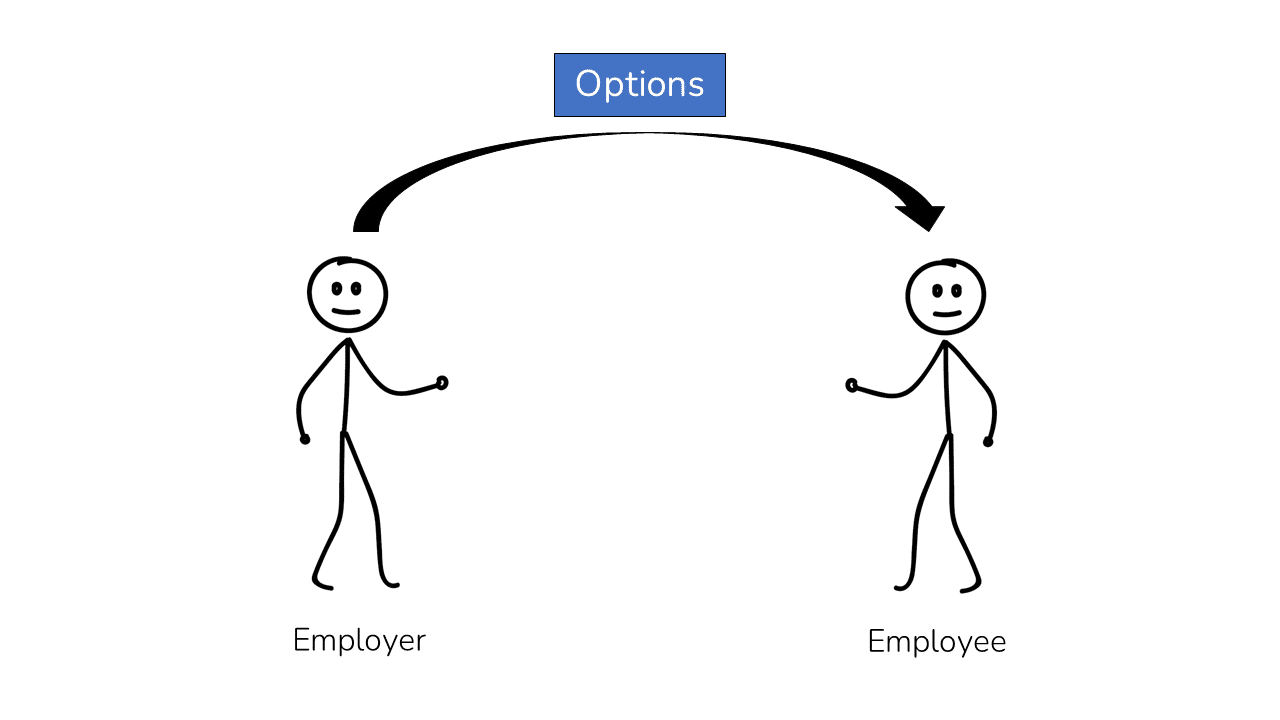

Many companies offer their employees compensation in the form of Stock Options and Restricted Stock.

Employees typically earn the Options and Restricted Stock over a period of time called the ‘Vesting Period.’

When the Options or Restricted Stock ‘Vests,’ the employee is entitled to receive them.

Stock Option Basics

Stock Options offer the employees the ‘Option’ to buy Shares of Stock at a specific price, called the ‘Strike Price’ (or ‘Exercise Price’).

In other words, to receive the underlying Shares, the employee must pay to ‘Exercise’ the Option.

In Finance, we use the Treasury Stock Method to add the new shares created when an employee exercises their Options.

Options vs. Warrants

Thus far, we have only mentioned Options and not Warrants.

There are differences between the two. But for the sake of the Treasury Stock Method, they are treated as one and the same.

If you’d like to dig deeper into Options vs Warrants, check out this article.

Restricted Stock Basics

Unlike with Options, when Restricted Stock vests, the employee receives new shares. They do not need to pay to receive the Shares.

As we’ll see shortly, both Options and Restricted Stock can add new shares to the Share Count.

As a result, they must be incorporated when calculating a Company’s FDSO.

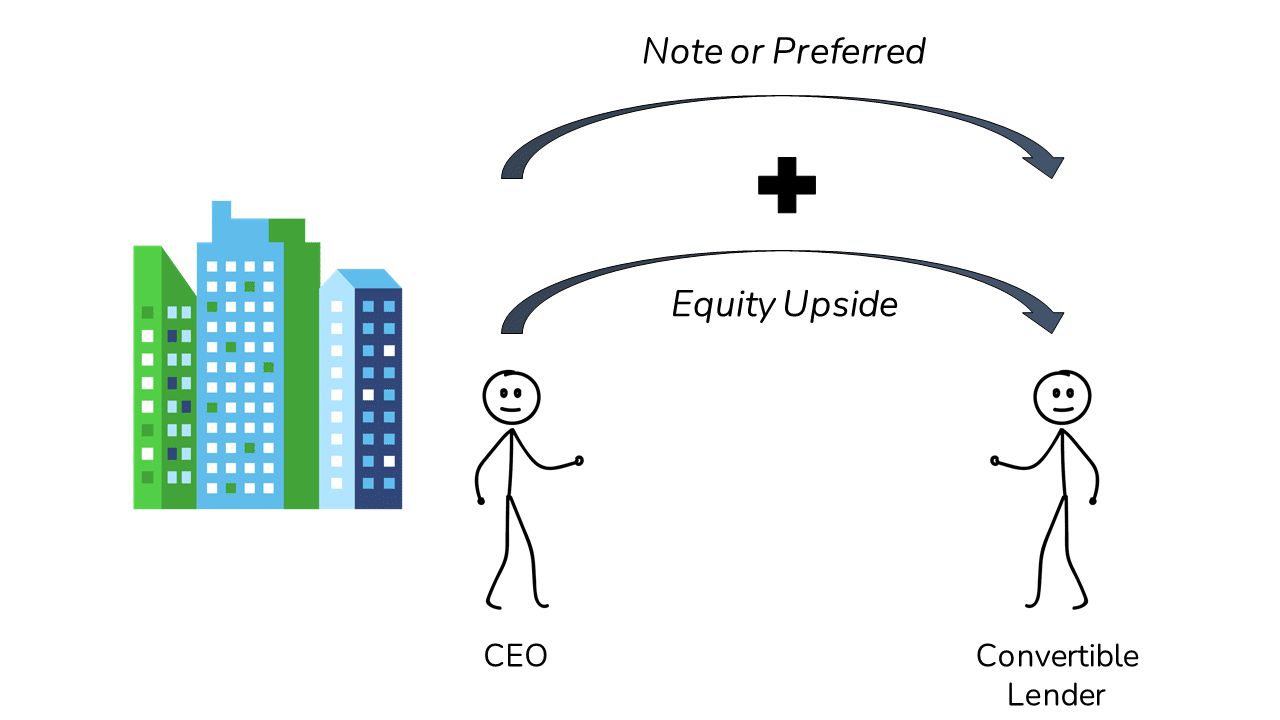

Convertible Debt and Equity Basics

In addition to Options and Restricted Stock, two additional instruments can create new shares: Convertible Debt and Convertible Equity.

To keep it simple, we’ll refer to them as ‘Convertibles’

Companies often issue Debt and Equity instruments that can convert into new Shares of Stock in the future.

The buyers of these securities receive additional upside in the Equity of the Business. So, they typically require a lower Interest or Dividend rate in return.

The lower rate can be desirable to Companies with limited Cash Flow but with large growth potential.

Now that we’ve laid out the basics, let’s dive into Options to see how they increase the Share Count.

The Impact of Options

As we said above, Employees receive Options as they Vest. Once an Option vests, it becomes ‘Exercisable.’

However, just because an Option is Exercisable doesn’t mean that it has value.

For the Option to have any value, the current Price Per Share of the underlying Company’s Stock must be above the Option’s Strike Price.

If the Share Price is above the Strike Price, the Option is ‘In-the-Money’ (or ‘ITM’).

But, if the Share Price is below the Strike Price, the Option is ‘Out-of-the-Money’ (or ‘OTM’).

Because only ITM instruments have value, we exclude OTM instruments from Treasury Stock calculations.

With the Treasury Stock Method, we assume that employees Exercise all their ITM Options.

When employees exercise their Options, they pay the Strike Price and receive shares in return and the Company receives the Option Proceeds payment.

But now we have a problem.

The Options exercise increases the number of Shares, but the Company also received dollars.

How do we add dollars to the Share Count?

Read on to find out.

Options and the Treasury Stock Method

This is where the Treasury Stock Method calculations come into play.

The Treasury Stock Method assumes that the Company takes all the option proceeds and repurchases shares in the Stock Market.

The Repurchased Shares offset the new shares created by the Option Exercise.

Now the Company can convert the Options proceeds into an equivalent number of repurchased Shares.

The total impact is:

- New Shares created at Exercise.

- less the Shares Repurchased by the Company.

In the section below, we boil this entire Treasury Stock Method into 3 simple steps.

The Treasury Stock Method in 3 Steps

To calculate the impact of Options using the Treasury Stock Method, we can use the following steps:

3 Steps of the Treasury Stock Method in Detail

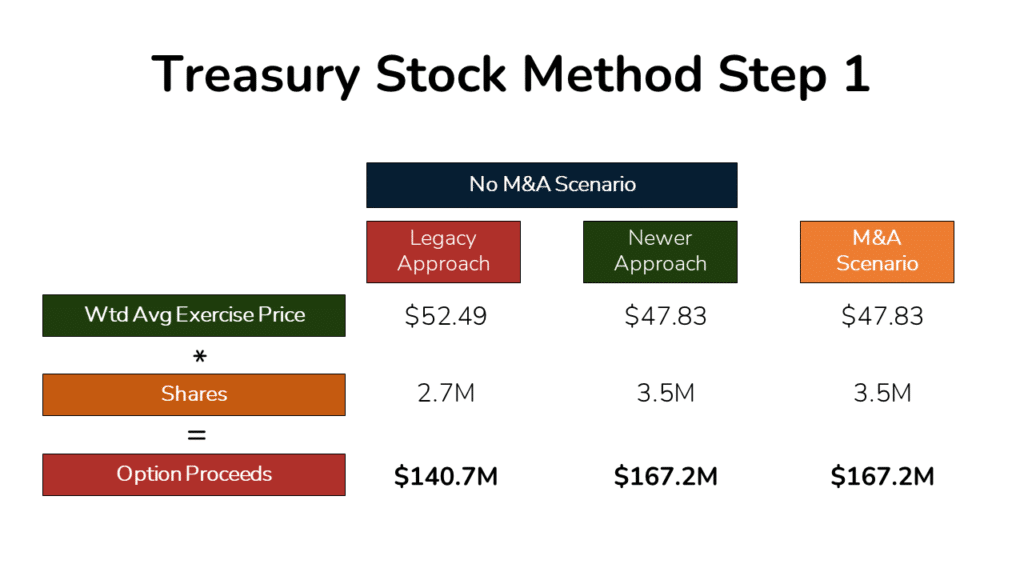

- Calculate the Option Proceeds for all In-The-Money Options.

First, we calculate all of the money received by the Company when employees exercise their options. We calculate this by multiplying the number of new shares from In-The-Money Options by the ‘Strike Price’ (or ‘Exercise Price’).

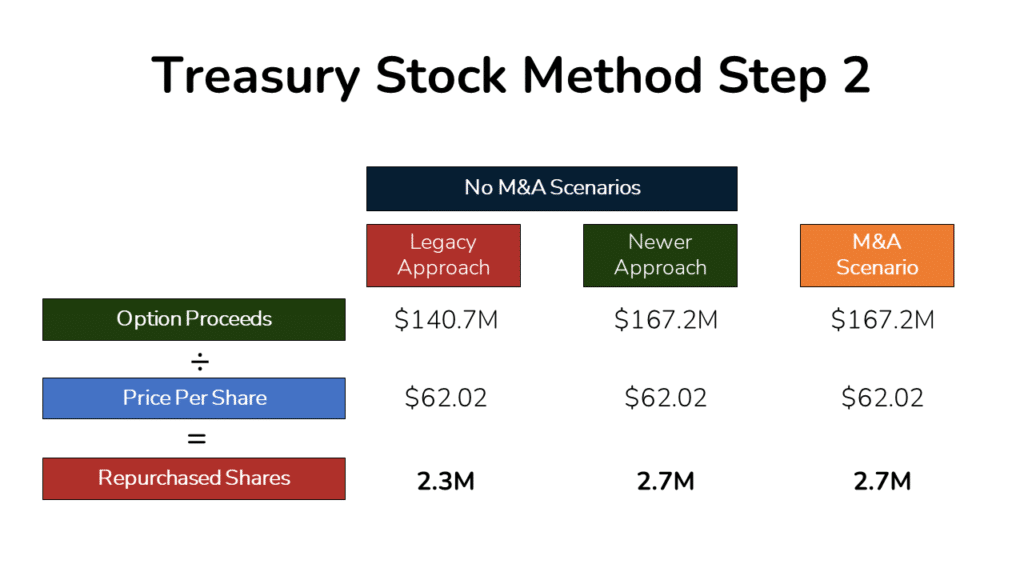

The total dollar value created (or ‘Option Proceeds’) is what the Company receives, but the dollars have to be converted into an equivalent number of shares. - Assume the Company Repurchases Shares with the Option Proceeds.

In this step, we assume that the Company aims to offset the new shares created by buying as many new shares as possible with the Option Proceeds. To reflect this we divide the Option Proceeds by the Price Per Share (or the Offer Price in an M&A Scenario).

The result will be the total number of Shares Repurchased by the Company. - Calculate the Net New Shares by subtracting the Repurchased Shares from Incremental Shares created by the Option exercises.

Finally, we need to calculate the Net New Shares created from the Option Exercises. To do this we take the total number of new shares created (from Step #1) when the employees exercise their Options. And then we deduct the Shares Repurchased (from Step #2).

This results in the Net New Shares that need to be added to the Share Count when calculating from Basic Share to Fully Diluted Shares.

The Treasury Stock Method: Restricted Stock and Convertibles

We must mention here that the ‘Treasury Stock Method’ refers only to the Options mechanics above.

But in this article, we aim to show you the full picture of how to calculate the Fully Diluted Share Count.

To complete the picture, we need to add the impact of Restricted Stock and Convertibles.

Restricted Stock Impact

As we said before, Restricted Stock Units (or ‘RSUs’) operate a little differently than Options.

As a result, the Restricted Stock Units dilution impact is a bit different.

Unlike with Option vesting, employees immediately receive their shares when RSUs vest.

Because of this, the Basic Share count already includes the impact of any vested RSUs.

So, we don’t need to add Vested RSUs to the Share Count.

As we’ll see later in the article, there are some instances where you include Unvested Shares.

There are also RSUs with performance conditions called Performance Stock Units (or ‘PSUs’).

We’ll dig into both of these items in a bit. For now, let’s move on to Convertibles.

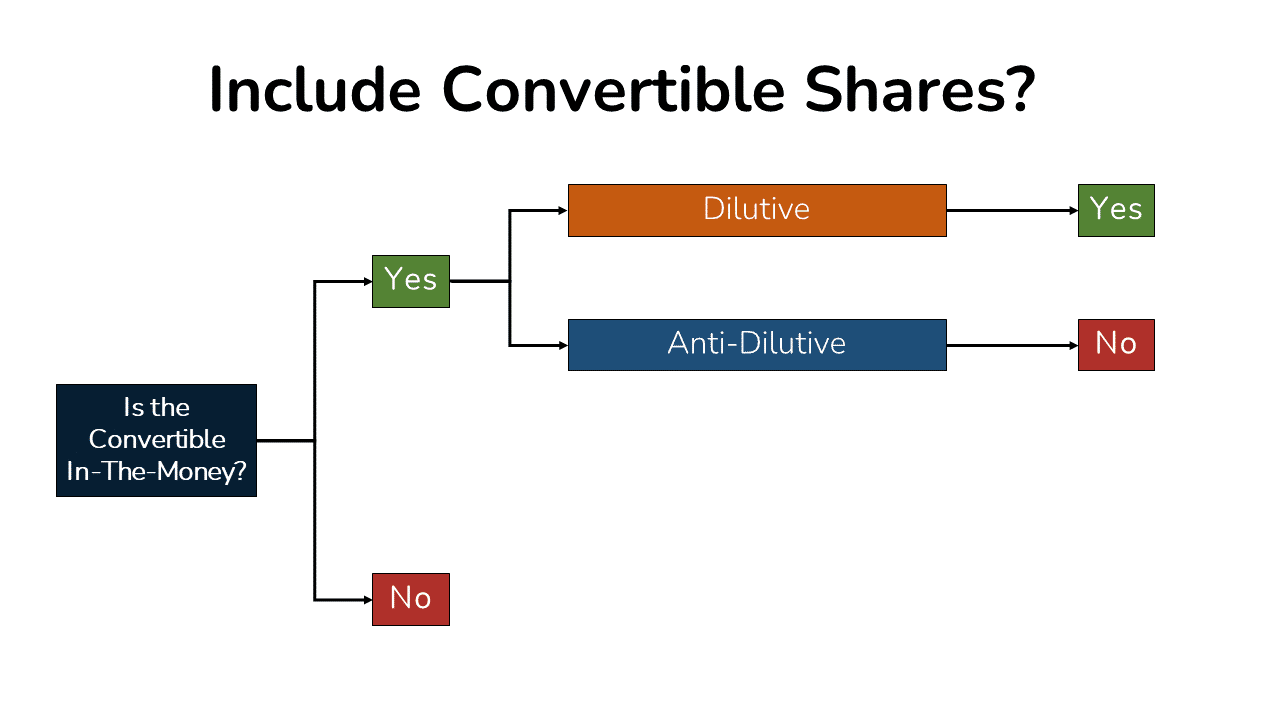

Convertibles – One-Step vs. Two-Step

There are two different ways to add the impact of Convertible Securities (again ‘Convertibles’) to the Share Count depending on whom you ask.

The two methods are:

- One-Step If Converted Method: Include if the Price Per Share is above conversion price (or the Convertible is ‘In-The-Money’).

- Two-Step If Converted Method: Include if the Price Per Share is above conversion price AND the transaction isn’t Anti-Dilutive.

A Simple Convertible Debt Example

To begin, let’s assume we have Convertible Debt with a Face Value of $1,000 with the Option to convert into 20 Shares of Stock.

In that case, the Conversion Price would be $50 Per Share ($1,000 / 20 Shares).

One-Step Process

The simple approach practitioners would often employ in practice is to include shares from the Convertibles if the Price Per Share of the Company exceeds $50 Per Share.

Two-Step Process (the ‘If-Converted Method’)

However, there’s a more involved (but technically correct) two-step method.

We’ll keep this high-level here, but if you want to dig deeper into the If-Converted Method, check out this Article.

The If-Converted Method looks at the conversion impact of the Convertible versus the impact to Earnings Per Share for the Business post-conversion.

This is because a Company must pay Convertible Security holders either Dividends or Interest.

Scenario 1: Dilutive

If the Company’s Earnings Per Share go down after the conversion (i.e., the deal is Dilutive), then the current shareholders are worse off.

In this First Scenario, we assume the Convertible holders would Convert. So, we add the new shares to the Share Count.

Scenario 2: Anti-Dilutive

This happens when the Company is paying a large payment (Interest or Dividend) to current Convertible holders.

In other words, after removing the heavy Convertible Debt or Interest or Dividends payments following the conversion, the current shareholders benefit.

In this Second Scenario, we assume the Convertible holders would not Convert. So, we do not add the new shares to the Share Count.

In summary, the order for the Two-Step If-Converted Method is:

- Calculate the Conversion Price to see if the Convertible is In-The-Money.

- If the Convertible is In-The-Money AND the conversion is Dilutive, we include the impact of the new shares.

Let’s now look at a real-life example of the Treasury Stock Method!

Diluted Shares Calculation Example: Foot Locker

Let’s use the Treasury Stock Method (or ‘TSM‘) to complete the Fully Diluted Shares calculation for Foot Locker as of their Q1 2021 filing (June 9, 2021).

To find the filings referenced below, you can visit sec.gov website or use a more advanced tool like bamsec.

Below are the items we’ll need:

Diluted Shares Example: Finding Basic Shares for Foot Locker

First, we need to find Foot Locker’s Basic Share Count.

We can always find the Basic Share Count on the front page of the latest filing.

The latest filing will be either the 10K (Annual Report) or 10Q (Quarterly Filing) at different points in the year.

Below we can see the latest Basic Share Count is 104 million on the front page of the 10Q filing:

Treasury Stock Method: Finding Options for Foot Locker

Next, we need to apply the Treasury Stock Method to find the impact of Foot Locker’s Options on the Share Count.

As we can see below, Foot Locker has Options data in its latest 10Q filing.

If the 10Q didn’t have any Options data, we would need to go back to the 10K filing to find the data.

The disconnect between the 10K and 10Q dates is viewed as OK because this is the best possible answer given the information available.

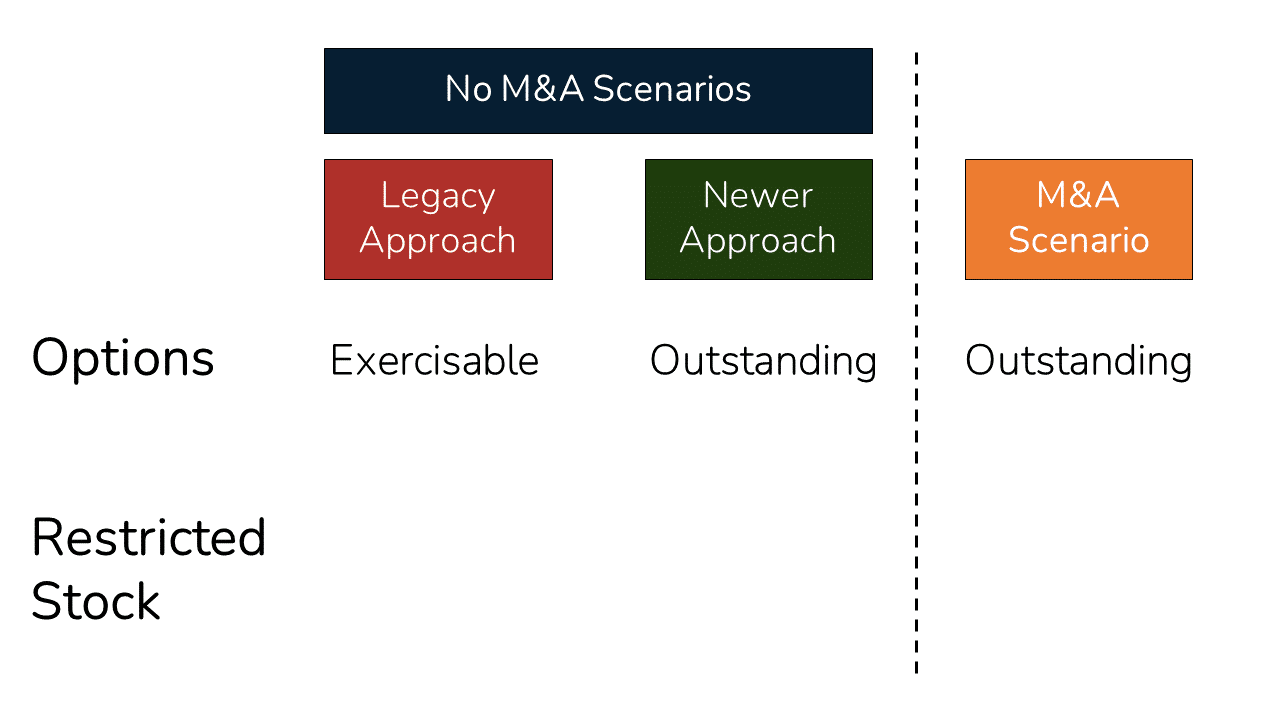

Exercisable or Outstanding Options

Note that in the filing, Foot Locker has three Options Counts:

- Outstanding – reflects all Options employees can earn in the future, including unvested Options.

- Exercisable – reflects all Options that are currently vested.

- Available For Future Grant – reflects all potential future Options that Foot Locker could issue in the future. We can usually ignore this.

Depending on the situation, we may use Exercisable or Outstanding options.

Non-M&A Scenario: Options

In the past, for a normal-course (i.e., non-M&A) analysis, we would use Exercisable Options.

In recent years, many practitioners use Outstanding Options in Non-M&A scenarios to be conservative.

This conservatism arises because Equity is a much larger component of compensation than in the past.

This is especially true in the Technology sector where Stock Options are often a large part of employee compensation.

Said differently, just a few years of additional Option vesting can make a BIG difference in the Share Count.

M&A Scenario: Options

In an M&A scenario, we always use Outstanding shares based on the assumption that Foot Locker would need to pay its employees if the Company was sold.

Using the data from Foot Locker’s filings, we can now work through the 3 Step TSM Process to calculate the net new shares from Options.

Treasury Stock Method – Step 1

First, we need to calculate the Option Proceeds from Option Exercises.

Below we can see the results of those calculations:

Treasury Stock Method – Step 2

Second, we need to calculate the Shares the Company can Repurchase using the Option Proceeds.

Below we can see the results of those calculations:

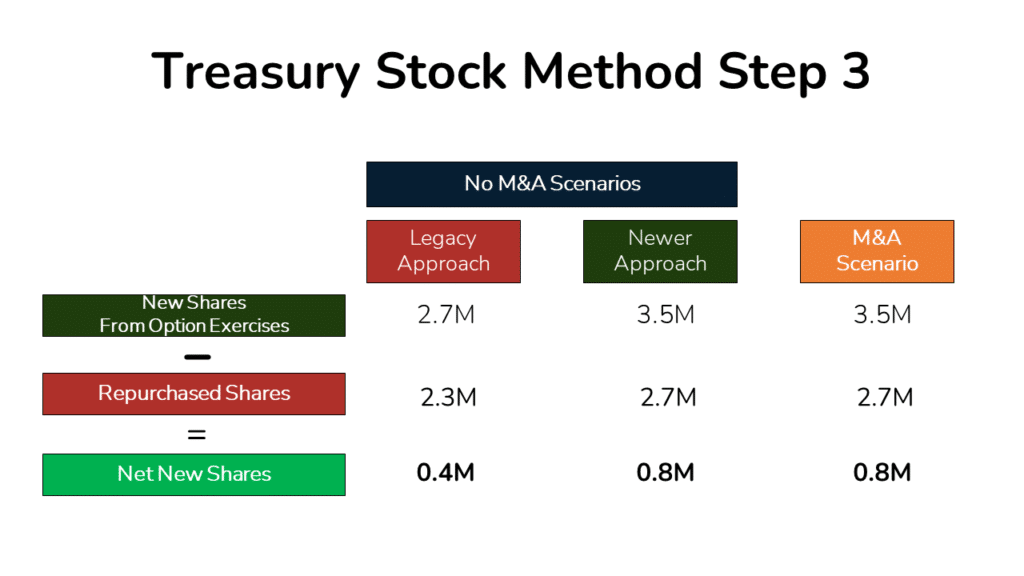

Treasury Stock Method – Step 3

Third, we need to calculate the Net New Shares by deducting the Repurchased Shares from the new Shares created by the employee Option Exercises.

Below we can see the results of those calculations:

In the end, depending on the approach, the Option exercises created between 0.4-0.8 million new shares that must be added to the Share Count.

Now that we’ve pinned down Options, let’s move on to Restricted Stock.

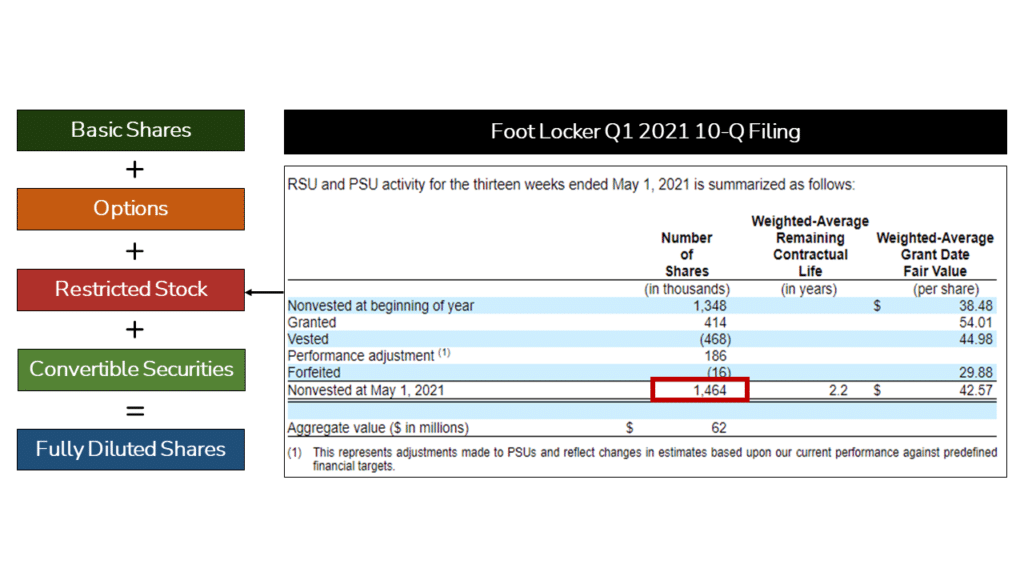

Diluted Shares Calculation Example: Finding Restricted Stock for Foot Locker

We also need to include the impact of Restricted Stock in the Share Count as well.

In the image below, we can see the Restricted Stock disclosure for Foot Locker.

Restricted Stock Units vs. Performance Stock Units

Foot Locker has two types of Restricted Stock:

- Restricted Stock Units (‘RSUs’) – vest based on the progression of time.

- Performance Stock Units (‘PSUs’)– vest based on the progression of time and the achievement of specific Company goals.

Basic RSUs have been common for some time. But in recent years, far more Companies issue PSUs.

Vested vs. Unvested Shares

Unlike what we saw with Options, there’s only one total for RSUs which is Nonvested (also called ‘Unvested’) Restricted Stock.

There is only one total because all vested shares (especially traditional Restricted Stock) become shares upon vesting and are already included in the Basic Share count.

Similar to what we just saw with Options, the approach to RSUs has changed over time.

Non-M&A Scenario: Restricted Stock

In the past, for non-M&A scenarios, we would ignore Restricted Stock altogether since traditional Restricted Stock enters the Share Count right away.

Today, many practitioners include all Unvested Restricted Stock.

They include all Restricted Stock to ensure they capture the full potential impact to the Share Count for the same reasons discussed above with Options.

M&A Scenario: Restricted Stock

For M&A analyses, similar to what we saw with Options, we assume that all unvested Restricted Stock vests with an Acquisition.

Diluted Shares Calculation Example: Finding Convertibles for Foot Locker

A brief search of Foot Locker’s 10Q filings shows that the Company doesn’t have any Convertibles.

So we can ignore Convertibles here.

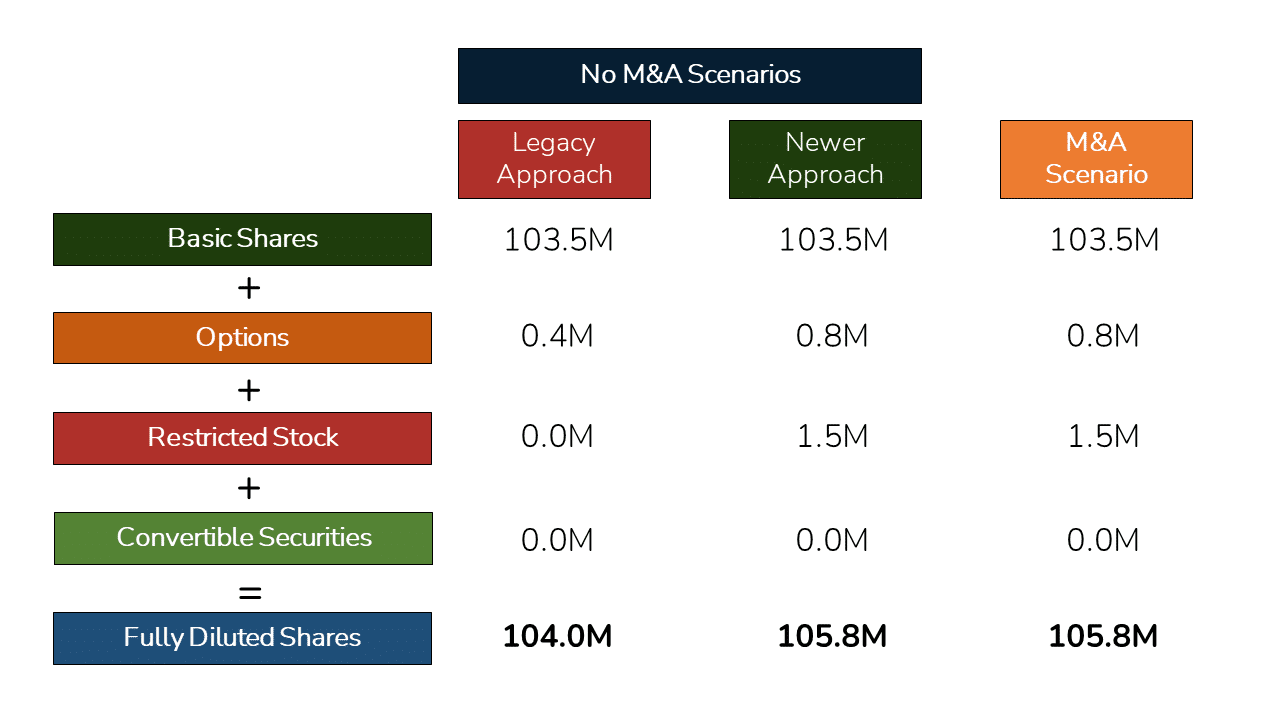

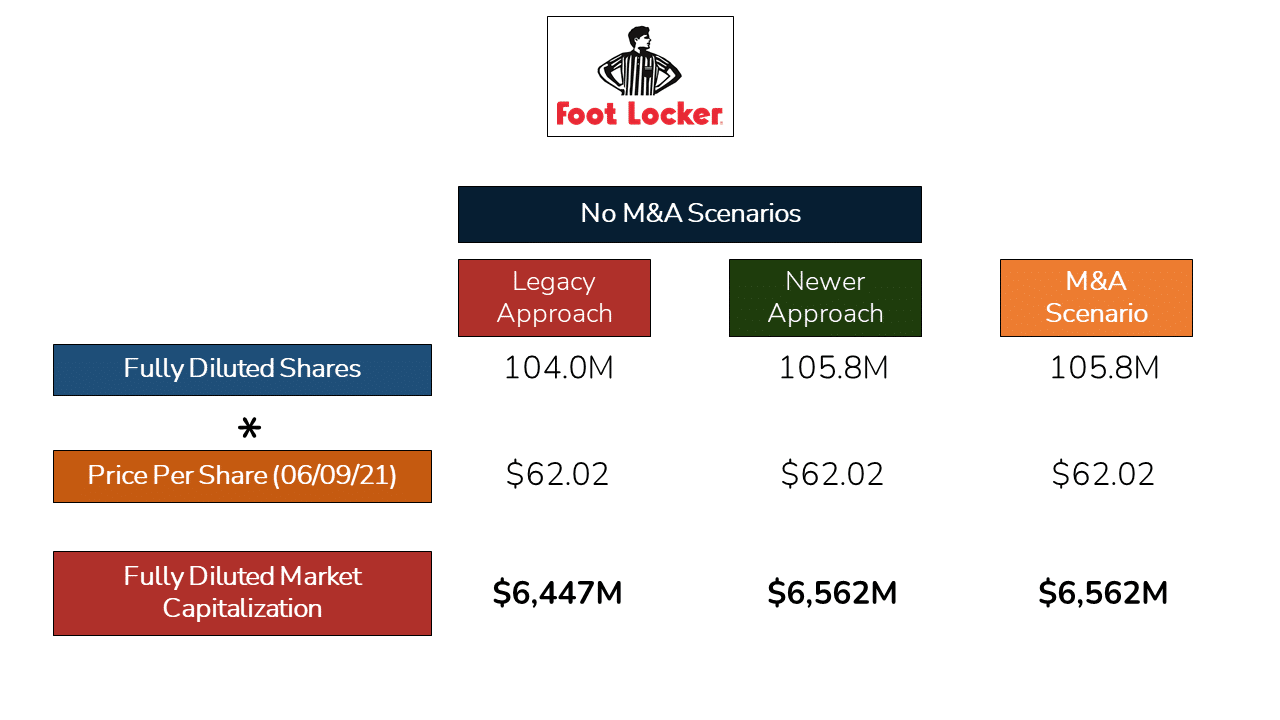

Diluted Shares Calculation Example: The Range of Outcomes

Depending on the approach you take, you’ll arrive at a different answer for the Share Count, as you can see below:

The difference in Share Count based on each approach can have a large impact on a Company’s value.

Below we use the different Share Counts above to calculate the Fully Diluted Market Cap (Stock Price x Shares Outstanding).

As you can see, the difference in Fully Diluted Market Cap (or ‘Equity Value’) for Foot Locker is over $100 million.

Wrap-Up

Hopefully, you have a much better understanding of the Treasury Stock Method and the underlying idea behind the entire process for calculating a Company’s Share Count.

You can follow our 3-Step Process for the Treasury Stock Method to calculate Fully Diluted Shares for any Company.

The Treasury Method is critical to master for on the job success.

Investment Banking, Private Equity, and Investment Management professionals use the Treasury Stock Method every day.

Let us know if you have any questions in the comments below. We’d love to hear from you!

Related Links

About the Author

Mike Kimpel is the Founder and CEO of Finance|able, a next-generation Finance Career Training platform. Mike has worked in Investment Banking, Private Equity, Hedge Fund, and Mutual Fund roles during his career.

He is an Adjunct Professor in Columbia Business School’s Value Investing Program and leads the Finance track at Access Distributed, a non-profit that creates access to top-tier Finance jobs for students at non-target schools from underrepresented backgrounds.

Frequently Asked Questions

The Treasury Stock Method is an approach that allows us to convert the Option Proceed dollars into an equivalent number of shares used to calculate Fully Diluted Shares for a Company.

When an employee exercises Options, the Option exercise adds new shares to the Basic Share Count. In return, the employer receives money, but there’s a disconnect because we cannot add dollars to the Share Count. The Treasury Stock Method allows us to convert the Option Proceeds dollars into an equivalent number of shares to bridge the gap.

Basic Shares reflect the current shares in existence. Diluted Shares reflect all potential shares from Options (using the Treasury Method), Restricted Stock, and Convertible Securities.

When shares are Diluted, the share count increases. The increased share count lowers the value available for each shareholder.

Diluted Shares Outstanding reflect the Basic Share Count plus any potential shares. The drivers of potential shares are typically Options, Restricted Stock, and Convertible Debt or Convertible Preferred Stock.