Learn finance easily with a dynamic Mental Model that ties together core finance concepts like Business Valuation and Returns Analysis.

TL;DR

- You can shortcut your Finance learning with Mental Models that tie together multiple concepts.

- Two of the most common questions asked in Finance are: (1) “What’s the Business worth?” and (2) “Are we generating an attractive return?“.

- The common threads behind all Cash Flow Generating Assets (or CFGAs) are: (1) Purchased with Cash, (2) Generate Cash Flow for the Owner, and (3) Sold for Cash.

- Your House and a Business are both CFGAs and understanding this equivalency forms the basis of a powerful Mental Model that helps you answer a wide variety of Finance questions.

Want To Learn More About Finance?

Check out all of our (free) deep-dive articles in our Analyst Starter Kit:

Learn Finance Quickly…Not in 10 Years!

What if I were to tell you that you could shortcut 10 years of learning about Finance by reading just a few articles? Would you be interested?

In this article series, you can do just that!

I’ve had the unique privilege of seeing my own struggles as an Investment Banking, Private Equity, and Hedge Fund professional as well as the struggles of thousands of students I’ve taught who were aiming for top-tier Finance jobs.

Through those experiences, I’ve repeatedly witnessed the common stumbling blocks students face when learning core Finance concepts.

In my experience, the core issue is that students learn Finance as a set of independent concepts, but students often lack a unifying conceptual framework.

Over the course of most Finance professionals’ careers, they end up distilling their understanding into the same framework we’re about to learn here…but it usually takes the better part of a decade!

Read ahead to save yourself a bunch of time!

Learn Finance Faster With Mental Models

At my company Finance|able, we place a heavy emphasis on learning mental frameworks (i.e. Mental Models) that tie together seemingly disparate concepts that can be applied across a variety of situations.

When my past students have internalized these frameworks, they have a much easier time tackling tough problems both in interviews and on the job.

A title for this series I considered was…“How I wish someone had explained finance to me early in my career!”

But in the end, the title doesn’t matter as long as I can help you save a TON of time in your learning journey. Let’s hop in!

The Core Questions of Finance: Valuation and Returns

There are many questions you’ll be asked during a career in Finance. However, a significant proportion of them boil down to two root-level questions:

- What is this business worth?

- Are we generating an attractive return on our investment?

The formal names you’ll hear for these two questions are business Valuation and investment Returns Analysis.

There’s a good chance you’ve come across terms like Discounted Cash Flow Analysis, Internal Rate of Return, and so on.

We’re going to avoid these fancy terms and just keep it simple, so we can learn Finance without inordinate confusion at the outset of our journey.

Mental Model Introduction: Your House…as a Business

Take a second and put yourself in the shoes of a business owner.

Let’s say you started a thriving business and someone offers to buy it. How do you know what it’s worth?

In the first part of this article series, we’ll provide a foundational model for tackling this question. We’ll then explain how to assess whether your business offers a good return on your investment in later articles in this series.

To get us started, we’ll illustrate how the House you live in is a Business.

In fact, your House is a great mental anchor for how Businesses work, for how Business Valuation works, and for assessing investment Returns.

As we’ll see, at a root level, Cash (and Cash Flow) is what ties both Houses and Businesses together. Cash Flow also forms the basis for this Mental Model.

To fully tie together our Mental Model, we’ll eventually show how your House, Businesses, Bonds, and Stocks have the same underlying mechanics in future article in this series.

Cash (and Cash Flow) Are the Core

Let’s start with the idea of a ‘Business’ at the most basic level.

With any Business, you begin by buying a Business at a certain price (or for a start-up, you buy the items that will become your Business).

You then receive Cash Flows from that Business, which accrue to you as the Owner.

At some point down the road, you can sell the Business (hopefully at a value higher than the initial purchase price!) and make a profit (or ‘Gain‘) from the sale.

In finance-speak, a Business is a Cash Flow Generating Asset (let’s just call them ‘CFGAs’).

The 3 Core Characteristics of CFGA’s

As we’ll see shortly, Houses are also CFGAs.

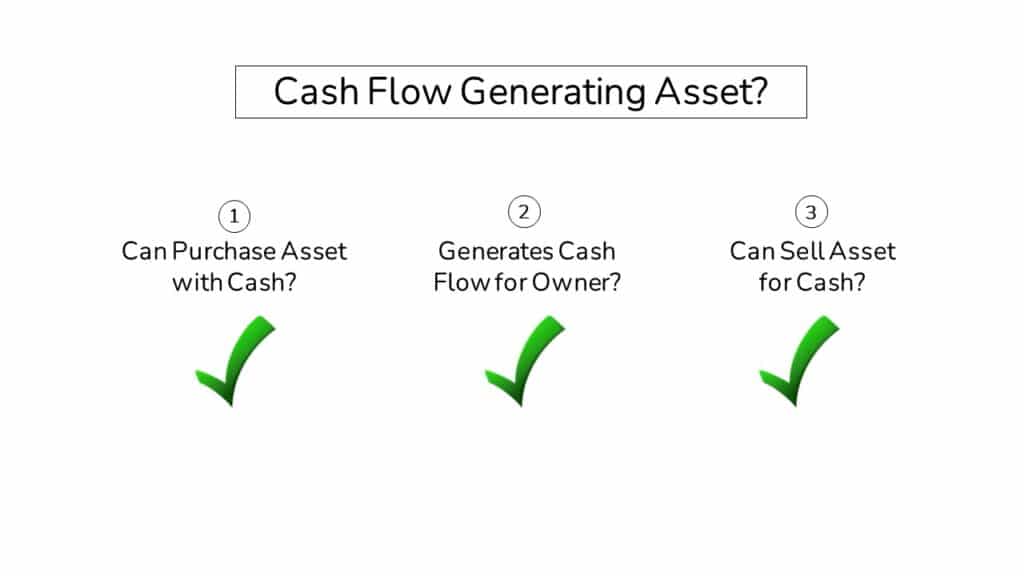

What ties ALL CFGAs together is that they have the following 3 Core Characteristics:

- Cash is used to Buy the Asset.

- The Asset generates Cash Flow that accrues to the Owner, which generates a Return (or ‘Yield’).

- The Asset can be Sold for Cash, which creates a Gain or Loss for the Owner when they sell.

In short, Cash is central to everything!

Understanding that Cash (and Cash Flow) underlie all CFGA’s will help you to learn Finance much more effectively as you’ll see shortly.

For now, let’s see if we can apply these same 3 Core Characteristics of CFGAs to the House you live in.

Your House as a Business

People don’t usually think of their house as a ‘Business’, but it really is. All you have to do is rent out your house and it becomes a ‘Business‘.

Let’s have a look at how the 3 Core Characteristics we mentioned above apply to your House.

Core Characteristic #1: Can Purchase in Cash

To buy a House, you have to pay a Purchase Price (✓) in Cash. This payment makes you the Owner of that House.

Core Characteristic #2: Generates Cash Flow for the Owner

You then rent the House out and collect rental payments. You also have to pay any expenses to maintain the house (e.g. maintenance, lawn care, garden care, etc.).

The profit generated every month creates Cash Flow (✓) that accrues to you as the Owner.

That Cash Flow earned creates an annual Return (or Yield) on your investment.

We could go way down the rabbit hole on Yield. But, for now, just think of Yield as the cash generated within a period divided by your original investment.

So, if you buy a house for $100 and it generates $10 per year of Cash Flow, your Yield is 10% ($10 Cash Flow / $100 Investment).

Core Characteristic #3: Can Sell For Cash

After a while, let’s say you decide to go travel the world.

To fund the trip, you decide to Sell (✓) your property to raise some Cash.

If you’re lucky, your House will increase (or ‘Appreciate’) in value relative to your initial purchase price. In that case, you’ll be able to sell the house for a higher price than what you originally paid. At the time of the sale, you would generate a ‘Gain’!

If you aren’t so lucky, the value of your House might decline (or ‘Depreciate’) in value. In that case, you would generate a Loss…and might need to change your travel plans!

Your House vs a ‘Traditional’ Business

Let’s say that instead of a House, you decide to buy a local pizza parlor Business.

Let’s now see if a Business also exhibits the 3 Core Characteristics of CFGAs.

You’d start the process by paying the Purchase Price (✓), likely in Cash, to buy the business. In the Finance world, we would say you paid for the ‘Enterprise Value’ of the Business…which is just a fancy term for the Purchase Price of the entire business.

As people come in and enjoy your pizza, the money you generate (minus your expenses) creates Cash Flow (✓).

This Cash Flow accrues to you as the Owner. Similar to the House example, the Cash Flow generates a return (or Yield) on your investment.

Finally, selling a traditional Business is similar to selling a House.

If the value of your business has grown, then buyers will be willing to pay a higher price (or Enterprise Value) at Sale.

As a result, you’ll generate a Gain upon the Sale (✓) of the Business. If you sold the Business at a lower price than what you originally paid, you would generate a Loss.

In short, a Business exhibits exactly the same 3 Core Characteristics of CFGAs as a House.

In the next two articles in this series, we’ll explore Business Valuation in detail to see what could make the sale price higher or lower.

A House is a Business…So What?

So, we can now see that both Houses and Businesses share the same 3 Core Characteristics of CFGAs.

Understanding the common threads that tie together Houses and Businesses as CFGA’s forms the foundation of the Mental Model that we will build out over the remainder of this article series.

It will help you to navigate more complex topics like Business Valuation and Returns Analysis with ease!

Further, we now have a familiar Mental Anchor (a House) to refer back to when analyzing Businesses.

It’s easy to get deep into the weeds when you first learn Finance concepts and get totally lost, but this can help bring you back from the abyss. 🙂

In the next article, we’ll learn how future Cash Flows are the basis for nearly all Business Valuation. In the meantime, let us know if you have any comments or questions below.

Quick Note: If you’ve enjoyed this article and are aiming for a career in Finance, check out our World of Finance: Buyside vs Sellside article and explainer video to learn more about how Investment Banks, Private Equity Funds, and Hedge Funds work.

2 Comments