‘What is an Investment Bank?’ is a common question with a lot of confusing answers. In this visual, Plain-English guide we’ll walk you through all the ins and outs of all you need to know about Investment Banking.

Estimated reading time: 17 minutes

- TL;DR

- Introduction: What is an Investment Bank?

- What is an Investment Bank? – The Big Picture View

- What is an Investment Bank? – Bulge Bracket vs Elite Boutique vs Middle Market

- Industry 'Coverage' Groups vs Product 'Execution' Groups

- Want To Learn More About Finance?

- What is an Investment Bank? – Blurry Lines Between Groups

- Wrap-Up: What is an Investment Bank?

- What Is An Investment Bank – Animated Explainer Video

- Related Links

- About the Author

- Frequently Asked Questions

TL;DR

- Investment Banks provide two main services: Advisory and Capital Raising (Debt & Equity).

- Investment Bankers are like Real Estate Agents who help clients with the buying and selling of businesses (instead of houses).

- Internally, most Investment Banks are broken into two categories of groups: Industry ‘Coverage’ Groups and ‘Product’ Execution Groups.

- The three primary categories of Investment Banks are: Bulge-Bracket, Elite Boutiques, and Middle-Market

Introduction: What is an Investment Bank?

To an outsider, the inner workings of Investment Banks can seem quite confusing.

Investment Banks have numerous (and often overlapping!) internal divisions whose functions vary across different banks.

It’s no wonder that many people are left scratching their heads when they first learn about the Investment Banking industry.

In this article, we’ll de-mystify the inner workings of Investment Banks!

What is an Investment Bank? – The Big Picture View

Let’s start with a simple definition of Investment Banking.

Investment Bankers are very similar to Real Estate Agents, but instead of helping clients buy (or sell) houses, they help with the buying and selling of entire Businesses.

Investment Bankers can also help clients raise Debt or Investor (‘Equity’) Capital.

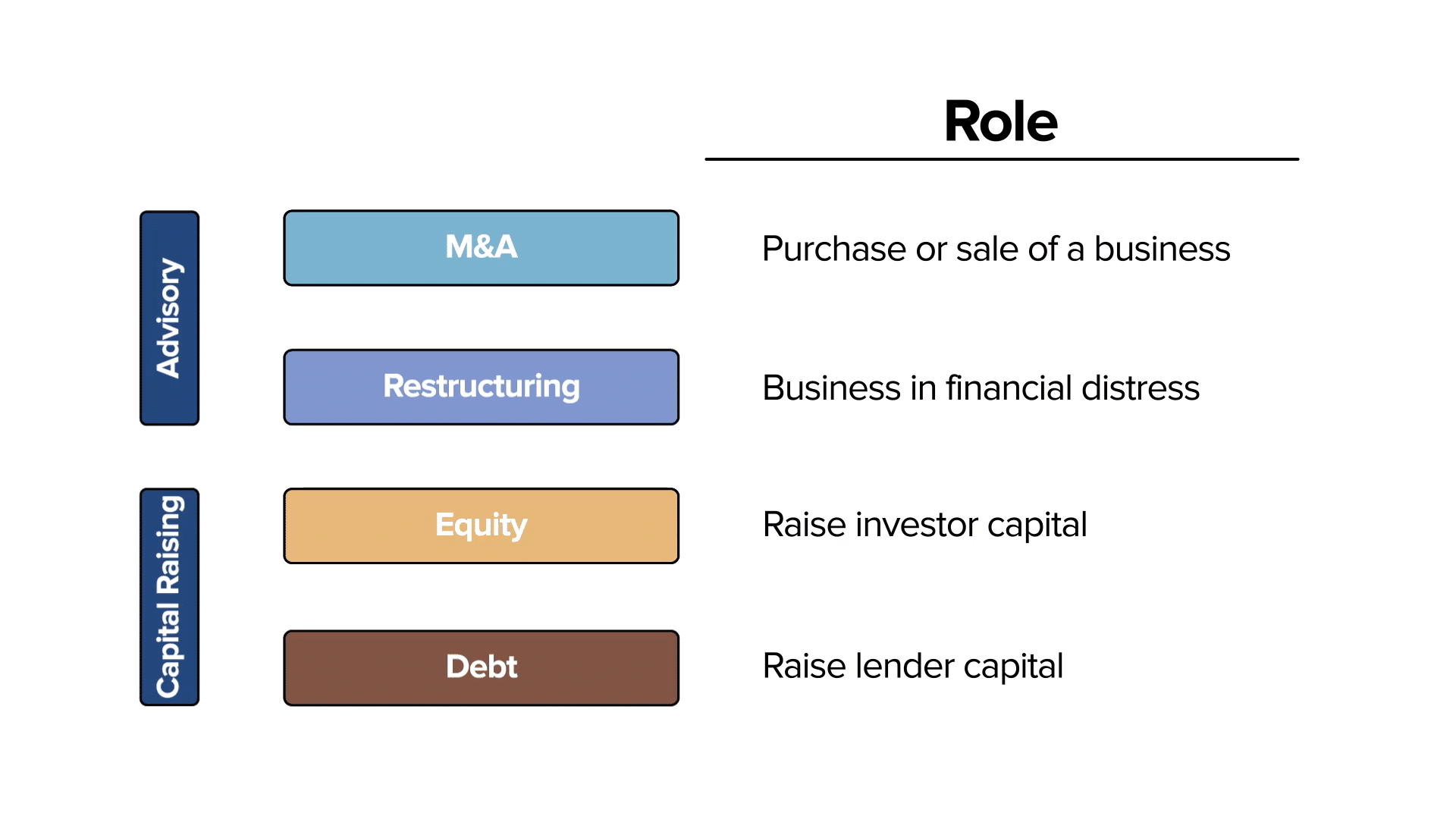

Below are the core services offered by an Investment Bank:

- Advisory

- Mergers & Acquisition (M&A) – advise clients on the purchase or sale of a business.

- Restructuring – advise clients when they run into financial challenges.

- Capital Raising

- Debt – market the client’s company to Lenders who offer money in the form of Loans or Bonds.

- Equity – market the client’s company to Investors who offer money in the form of Stock.

What is an Investment Bank? – Bulge Bracket vs Elite Boutique vs Middle Market

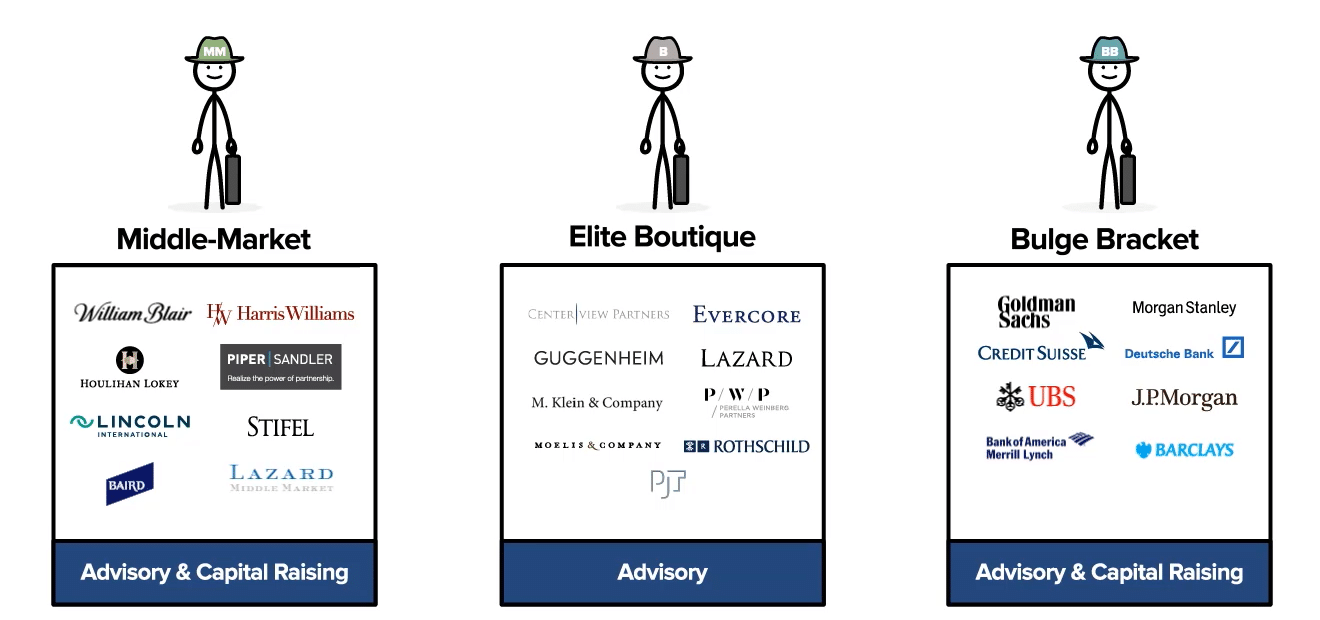

Investment Banks come in a variety of shapes and sizes. Banks range from one-person shops to firms with tens of thousands of employees.

At a high level though, there are three types of Investment Banking firms:

- Middle-Market (‘MM’) Banks – provide Advisory as well as Debt and Equity Capital raising services to small and medium-sized businesses.

- Elite Boutiques – typically offer only Advisory services and focus on medium and large-sized businesses.

- Bulge Bracket (‘BB’) Banks – large, ‘full-service’ banks that offer Advisory as well as Debt and Equity Capital raising services to medium and large-sized businesses.

Below we’ve listed examples of Investment Banks that fit into each of these major categories.

While you may find some corner cases that don’t neatly fit into these buckets, these three are the primary categories of Investment Banks.

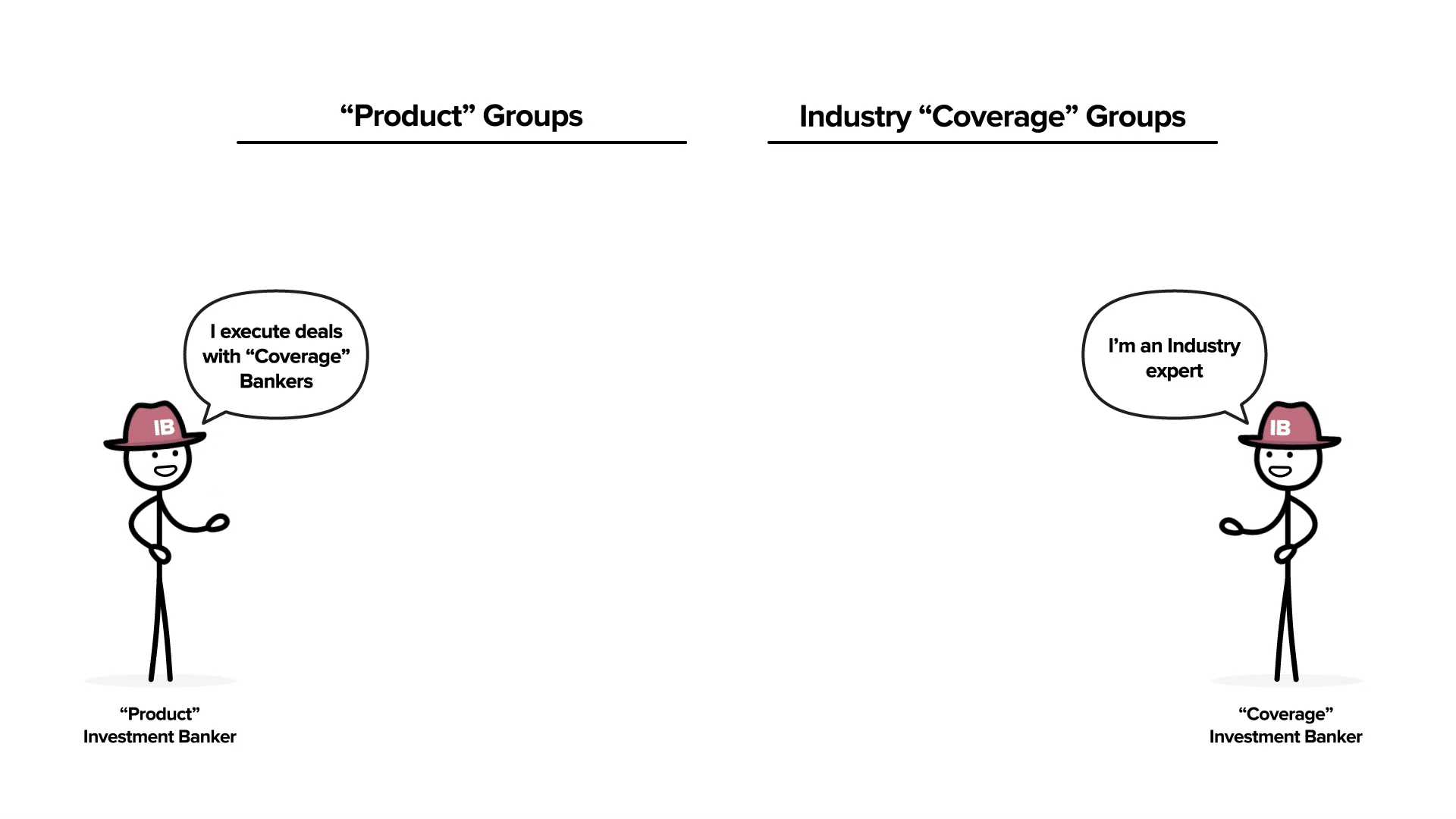

Industry ‘Coverage’ Groups vs Product ‘Execution’ Groups

Now let’s look at the internal Investment Bank department structure.

And in particular, what Investment Bankers do within each department.

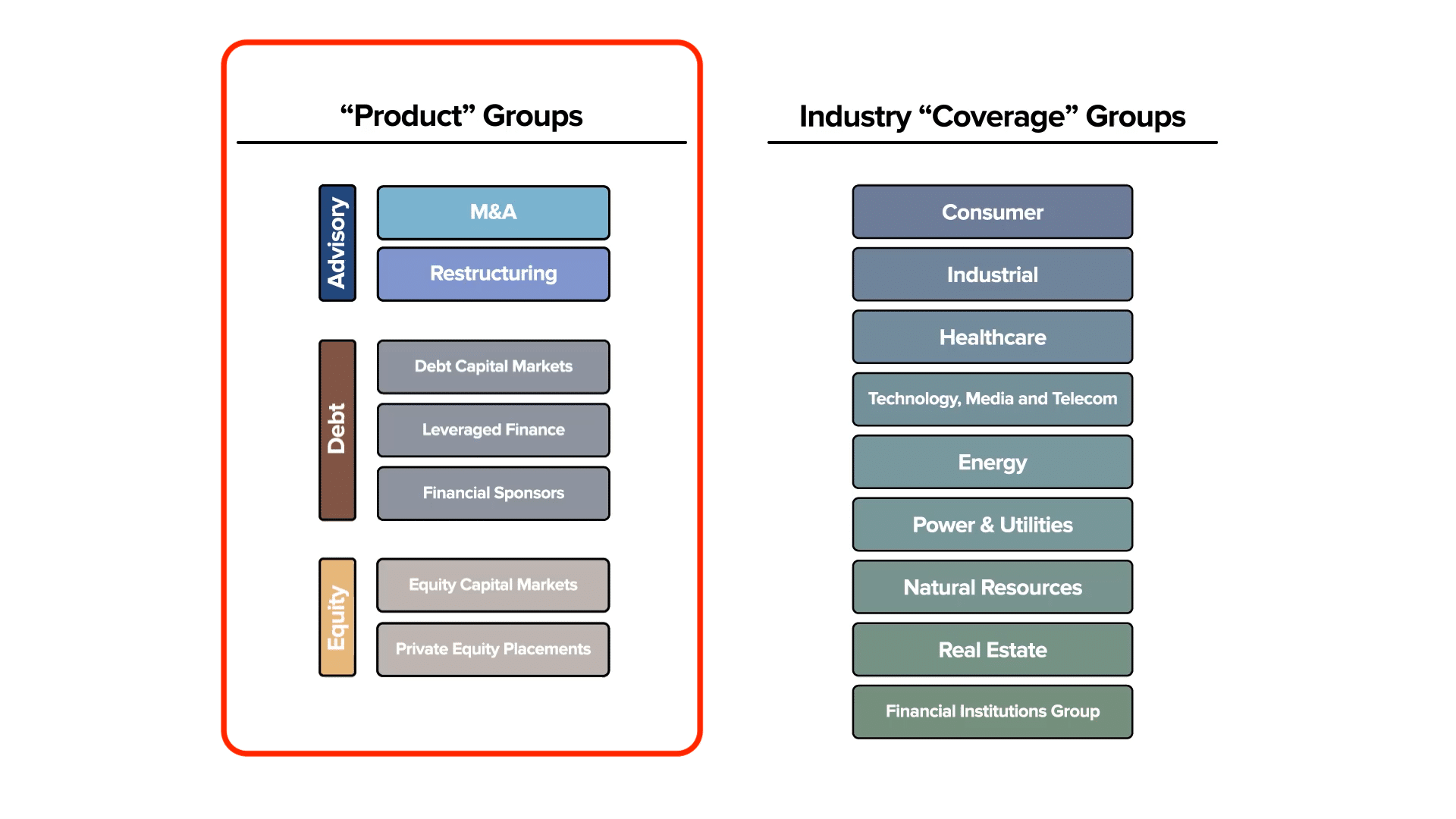

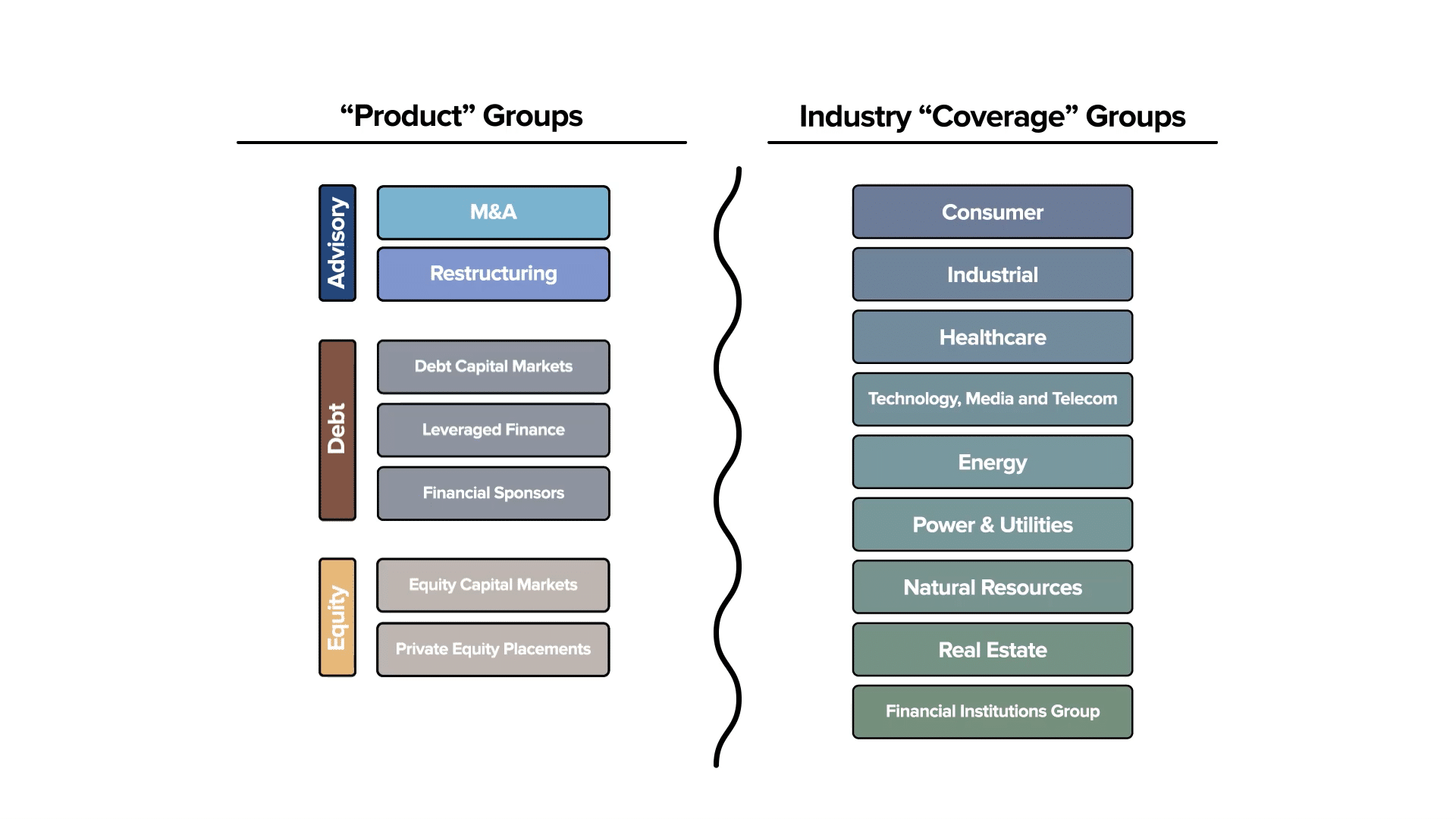

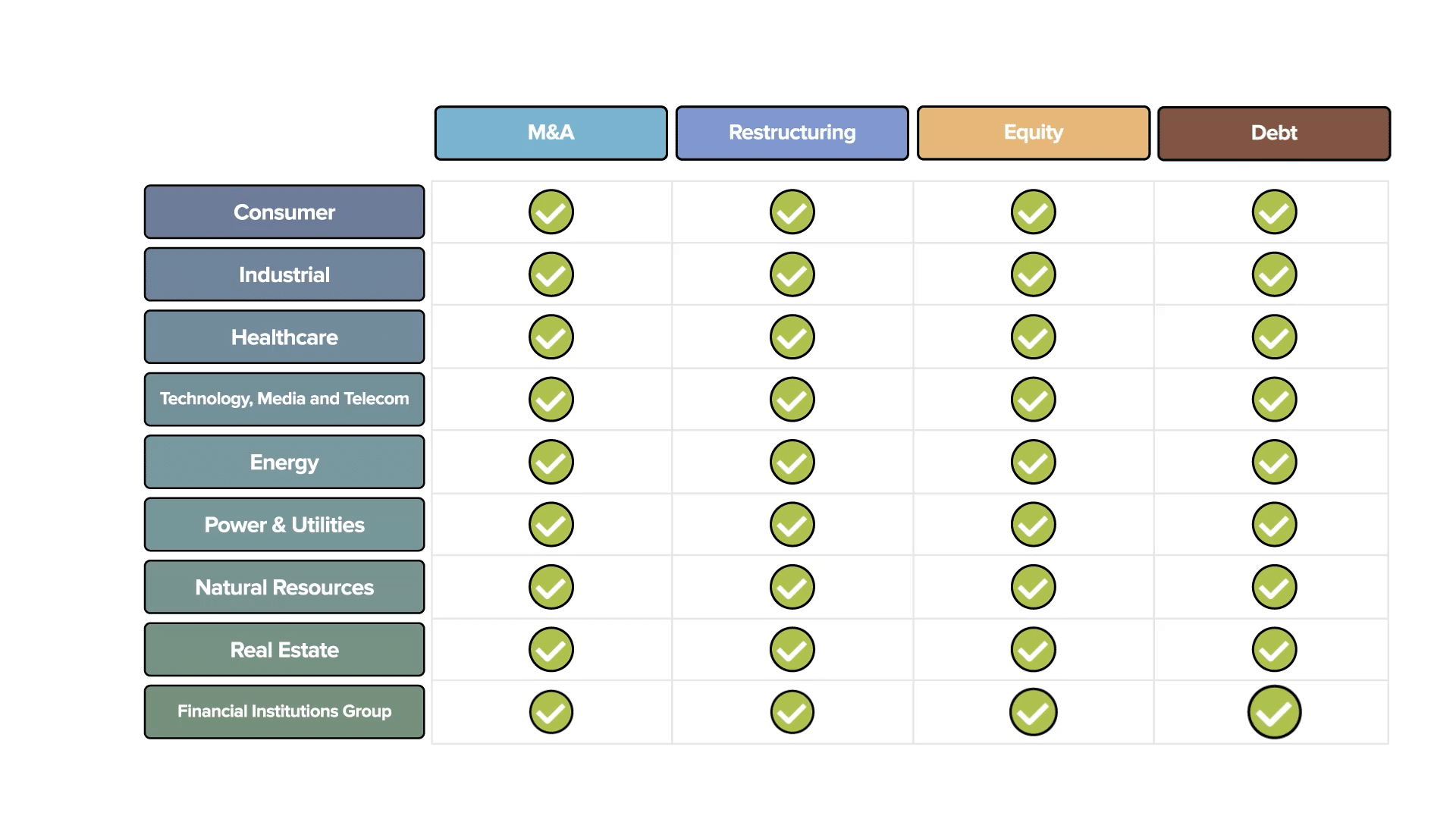

Internally, most banks are broken down into groups with a particular focus area. The two major categories of groups within an Investment Bank are:

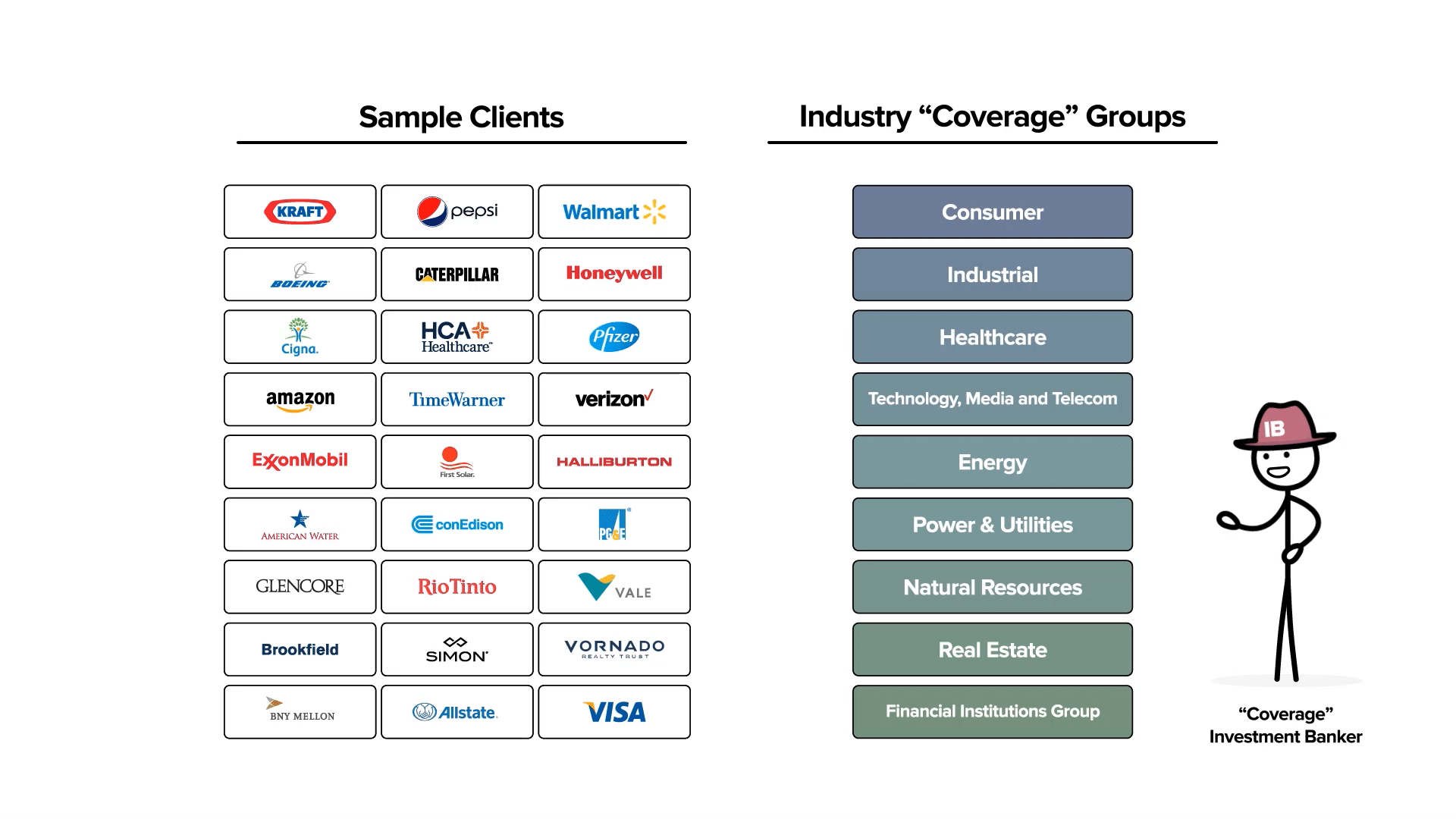

- Industry ‘Coverage’ Groups – sector specialists that focus on a particular industry (e.g., Industrials, Consumer, etc.) without specializing in one particular type of transaction.

- ‘Product’ Execution Groups – execute a particular type of transaction (e.g., Mergers & Acquisitions, Leveraged Finance, Equity Capital Markets, etc.).

As we’ll see shortly, the delineations between these two categories aren’t always clear cut, but these two categories are a solid foundation for understanding how Investment Banks work.

Industry ‘Coverage’ Investment Banker Responsibilities

Although coverage group naming conventions do vary, the categories in the image above show the most common names for product groups as well as sample clients for each group.

‘Coverage’ Bankers in these groups focus on a single sector so that they can be an expert advisor to their clients.

To succeed as an Industry Banker, you need to understand ALL the trends across an industry.

Industry Bankers use their expertise to build relationships with company CEOs within their coverage universe.

Junior Bankers in these groups follow industry trends and keep a close eye on everything from secular trends and core company fundamentals to valuations and recent merger and acquisition activities in their sector.

Junior Bankers in a ‘Coverage’ Group go very deep within an industry.

However, they are often less likely to play an active role in the nuts and bolts (modeling, process management, material creation, etc.) of executing deals.

As we’ll see shortly though, this can vary quite a bit, depending on the bank.

Want To Learn More About Finance?

Check out all of our (free) deep-dive articles in our Analyst Starter Kit:

‘Product’ Execution Investment Banker Responsibilities

‘Product’ Bankers focus on executing a particular type of transaction (e.g. M&A, Restructuring, etc.), which is what they do all day every day.

These bankers are often brought in after a deal is signed (i.e., the client has agreed to work with the bank).

While they typically aren’t experts in a particular industry, they are deeply knowledgeable about the intricacies of executing deals which makes their input highly valuable.

Junior Bankers in a ‘Product’ Group are typically responsible for creating and managing all of the analyses and presentations that support the deal process.

Typical tasks can range from internal memos to detailed multi-tab financial models that lay out a company’s projected performance in significant detail.

Junior Bankers in these groups often receive a more ‘Technical’ experience, which can lead to better exit opportunities when the banker leaves the firm.

Because of the better exit opportunities, these groups (particularly M&A and Financial Sponsors) are often highly sought after.

Again though, the internal group structure of particular Investment Banks does vary, which can dramatically change the type of experience for Junior Bankers in ‘Product’ Groups.

Let’s dive into the details below for each type of Product Banker.

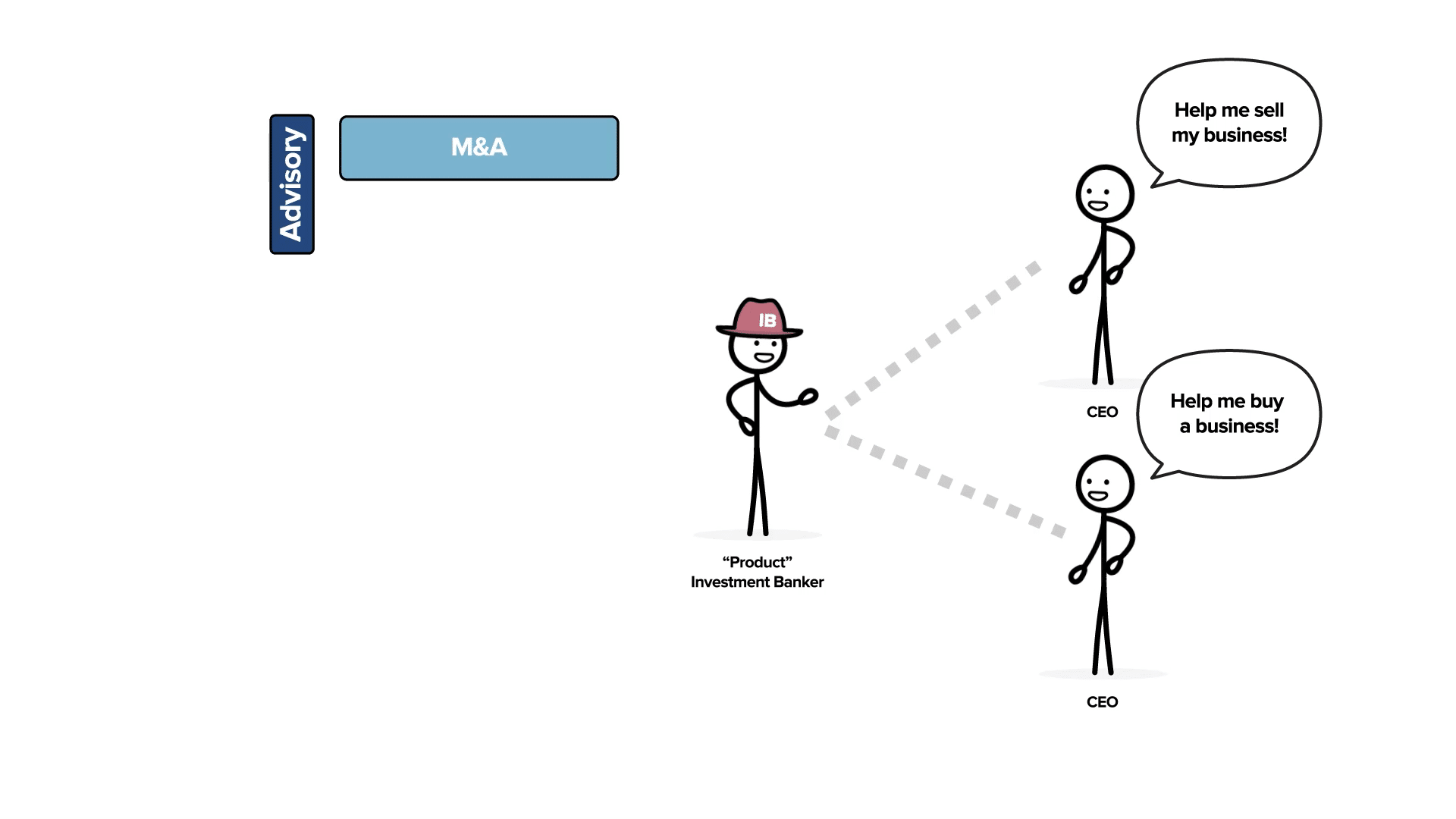

Product Group #1: M&A Advisory

The first type of Product Banker is a Mergers & Acquisitions (or M&A for short) Banker.

This group is often viewed as the sexiest group within an Investment Bank because they work on industry-transforming deals that end up on the front page of publications like the Wall Street Journal.

M&A Bankers typically work on one of two types of projects:

- Buy-Side M&A – advise clients on the purchase of a business.

- Sell-Side M&A – advise clients on the sale of part or all of the client’s business.

M&A is a non-stop, high-intensity profession. As a result, this group is often one of the hardest working groups within a bank.

Product Group #2: Restructuring Advisory

The next Product Banker is a Restructuring Banker. These bankers are brought in when a company is in financial distress.

While there’s quite a bit of nuance behind what these bankers do, but to keep it simple, we can equate this back to the Real Estate analogy from earlier in the article.

If the value of a home declines below the value of the Mortgage, we would say that the home is ‘underwater.’

When the value of a business declines below the value of its Debt, we would call the firm ‘distressed’.

In short, Restructuring Bankers work with companies that are in financial ‘distress’ and help them find an amicable agreement between the various investors and lenders involved with the company.

Product Group #3: Debt Bankers

The next category of Product Banker is a Debt Banker. These bankers help companies raise Debt Capital.

Depending on the financial profile of the client, they will work with one of three Debt groups:

- Debt Capital Markets (‘DCM’) – serves high-quality (or ‘Investment Grade’) companies with low levels of Debt.

- Leveraged Finance (‘Lev Fin’) – serves lower-quality companies (or ‘High Yield’) with higher levels of Debt.

- Financial Sponsors – serves Private Equity Funds as they raise Debt Capital to fund acquisitions.

How Debt Investment Bankers Raise Money for Clients

Very briefly, there are many large (or ‘Institutional‘) lenders whose sole job is to lend money to companies.

However, it doesn’t typically make sense for a company to maintain relationships with thousands of lenders who might lend them money down the road.

Instead, companies go to Debt Bankers who act as an intermediary between their company and the lenders.

Debt Bankers maintain relationships with these lenders and help companies market themselves to the lenders to attract interest.

The bankers will then manage the process of ‘building a book’ of interested lenders who then lend money to the client company. The Investment Bank manages this process from start to finish and collects a fee in return.

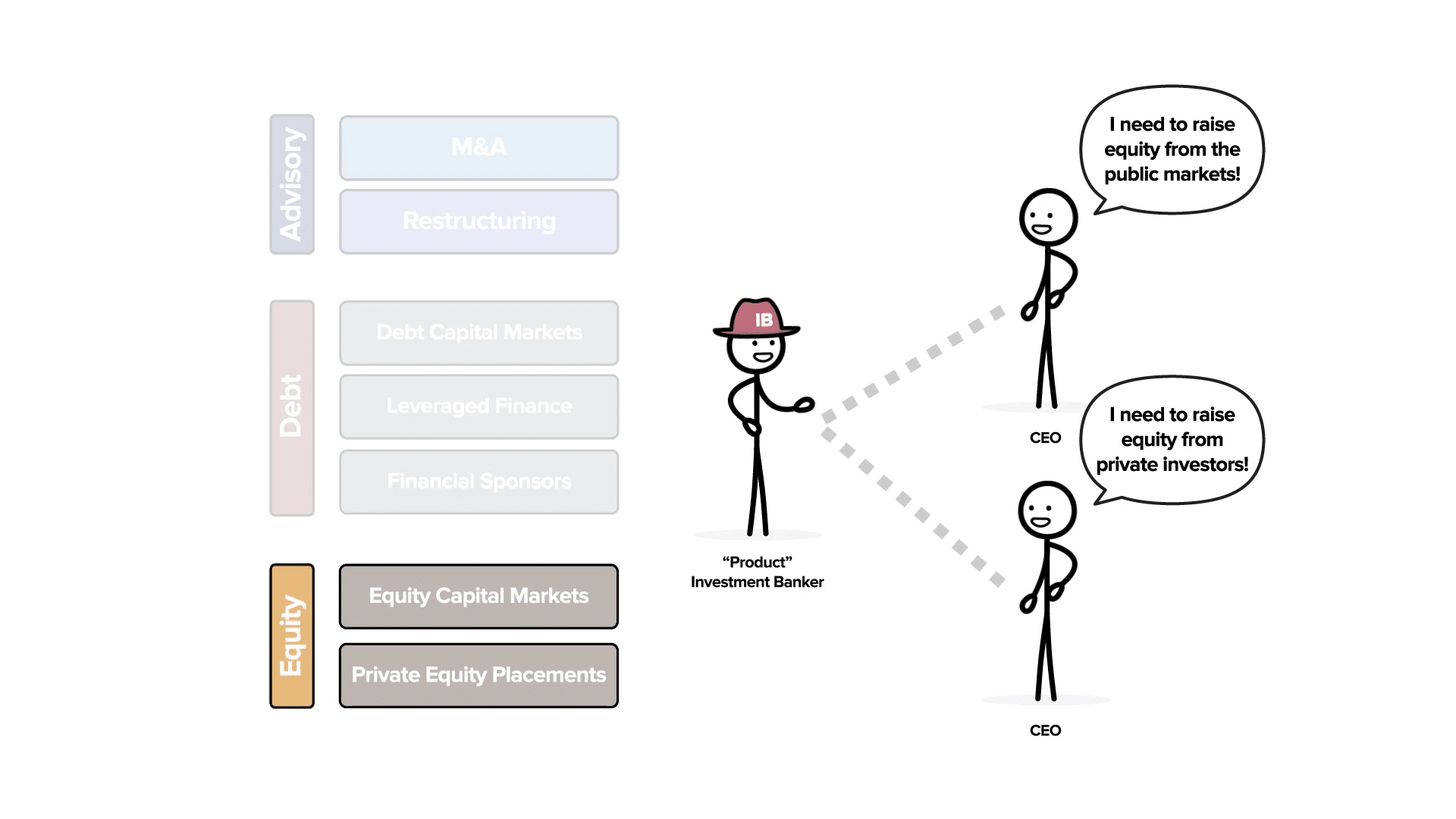

Product Group #4: Equity Bankers

When a company wants to raise investor money, they come to our final group of Product Bankers which are the Equity Bankers.

Similar to the Debt Bankers in the previous section, individuals in these groups maintain relationships with investors of all sizes and help clients manage the process of raising capital from those Investors.

Equity Groups within an Investment Bank typically break down in terms of the type of Investor capital that they raise.

Equity Group #1: Equity Capital Markets

If a company is raising common equity (or ‘Stock’) from the Public Markets, they will typically work with the Equity Capital Markets (‘ECM’) Group.

This group specializes in helping companies list their shares for the first time through what is called an Initial Public Offering (or ‘IPO’).

They can also help companies navigate the tricky process of additional equity (a ‘Secondary Offering’) after their IPO is complete.

Equity Group #2: Private Equity Placements

On the other hand, if a company is looking to raise capital from Private investors, they will then turn to the Private Equity Placements group.

Bankers in this group cultivate relationships with large investors around the world with significant amounts of money in reserve.

Private Equity Placement Bankers work to connect their clients with these investors and help them to tell their story so they can raise investor funding.

What is an Investment Bank? – Blurry Lines Between Groups

Now we get to the frustrating part of this explanation for newbies.

All of the above is a solid framework for understanding the inner workings of an Investment Bank.

However, there are quite a lot of variations across different banks in the distinctions between the groups laid out above and, as a result, the lines between the groups are often a bit blurry.

Blurry Line #1: Product Groups vs Industry Groups

The first blurry line is between Product Groups and Industry Groups.

Some Investment Banks maintain full separation between Product Groups and Industry Groups as illustrated below.

However, many other Investment Banks combine Product Groups and Industry Groups.

For example, Goldman Sachs’s Industry Groups often do quite a bit of their own execution, in particular for M&A.

As an example, if you work in Goldman’s highly sought-after Technology, Media and Telecom (‘TMT’) Group, you’ll both cover industries and execute M&A deals, even though TMT isn’t a Product Group.

By contrast, at Morgan Stanley, Product Groups are largely separate from Industry Groups.

For example, Morgan Stanley’s M&A group leads M&A execution even though Morgan Stanley has many Industry Groups.

In short, we can use our original explanation as a starting point for understanding what each group does within a bank.

However, many banks combine Product Group and Industry Coverage Group functions and there’s little rhyme or reason as to why.

Bulge Bracket Banks vs Middle-Market Banks Group Structure

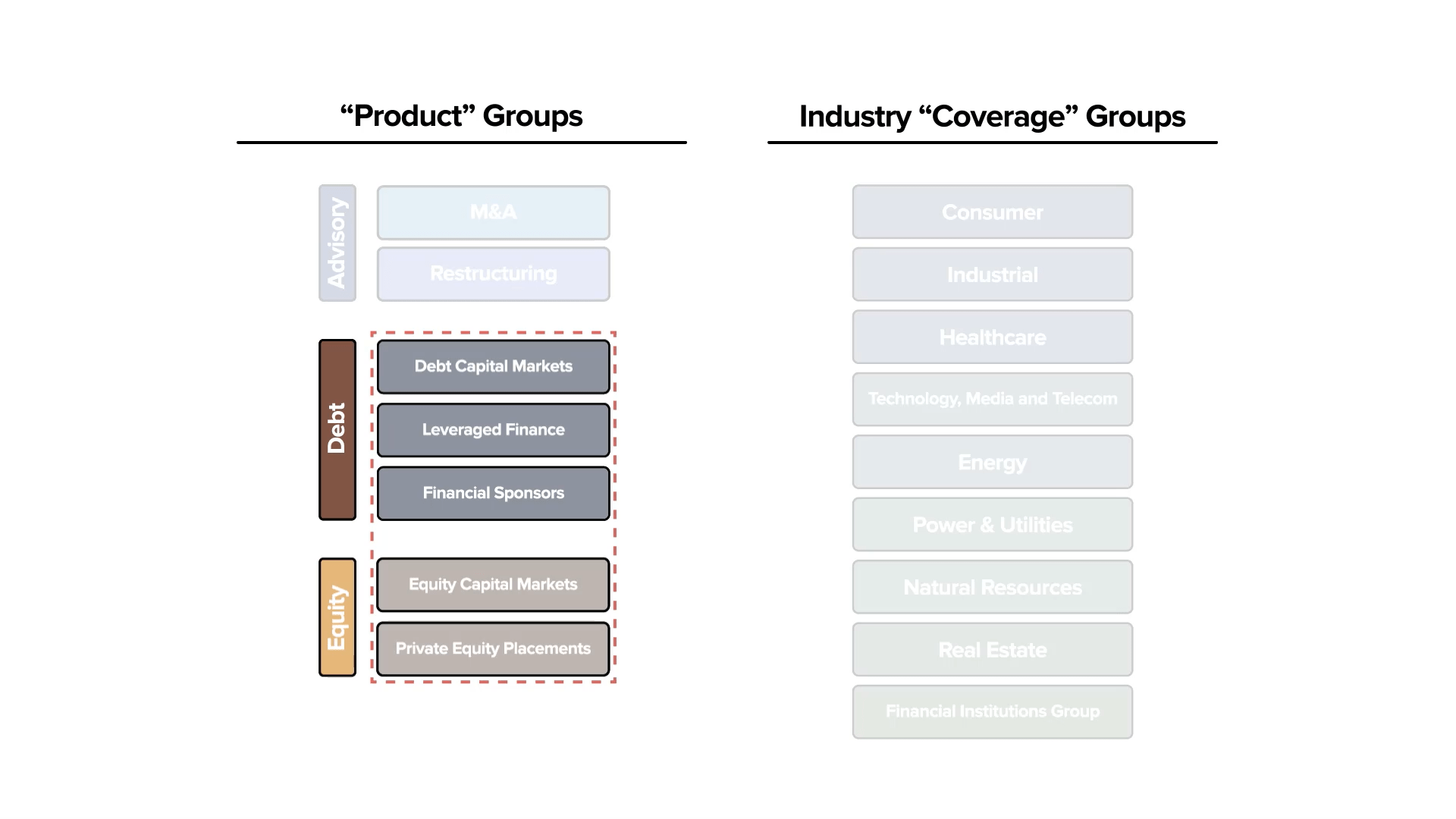

Despite having just muddied the waters, there are a few things that remain relatively constant across firms.

Most Bulge Bracket and Middle-Market Banks keep a few of their groups completely separated.

The groups that typically remain standalone include: Debt Capital Markets, Leveraged Finance, Financial Sponsors, Equity Capital Markets, and Private Equity Placements.

Beyond these groups, there’s quite a bit of variation of how much deal execution is done within Industry Groups do within each bank.

Elite Boutiques: Industry Groups vs Generalists

Because Elite Boutique Banks tend to focus on advisory, their breakdowns are typically around the two core Advisory offerings: M&A and Restructuring.

Several Elite Boutique Banks break M&A down by Industry, similar to the Industry Coverage Groups we saw above.

In firms with this structure, the bankers within an Industry Group typically focus on M&A solely within that particular industry.

In firms with this structure, Restructuring is typically a standalone group.

Conversely, some Elite Boutique banks offer their Junior Bankers a more Generalist role.

In firms with this approach, Junior Bankers work on M&A and Restructuring transactions across industries.

Despite this approach, as bankers move up in the ranks, they tend to specialize in a particular Industry.

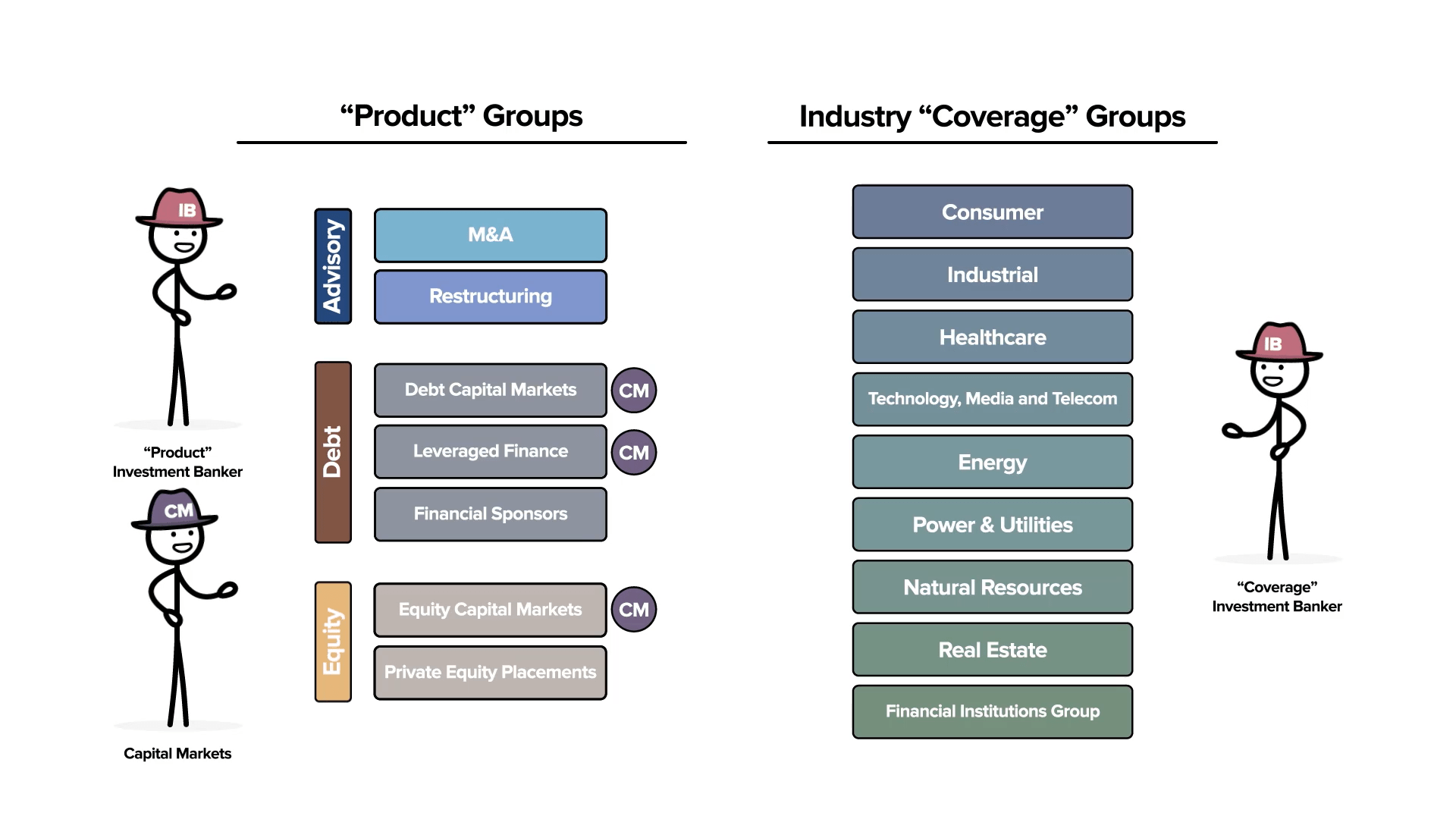

Blurry Line #2: Capital Markets vs Investment Banking

Another point of confusion is the distinction between Capital Markets and Investment Banking.

You will often hear both mentioned in discussions around Investment Banking, but it’s not clear how their role is different…if at all.

First, Capital Markets is typically under the Investment Banking umbrella.

However, the bankers in these groups are solely focused on raising capital from external Investors and Lenders. Capital Markets bankers act as the direct interface between the bank’s clients and the Debt and Equity markets.

Because of their market-facing role, Capital Markets Groups are often described as a separate entity, but they are just another part of Investment Banking.

Wrap-Up: What is an Investment Bank?

Given the blurry lines mentioned above, the inner workings of Investment Banks can be very confusing to outsiders.

However, just remember that Investment Banks primarily offer both Advisory and Capital Raising services for businesses.

And Investment Banks are categorized into three buckets: Bulge-Bracket Banks, Elite Boutiques, and Middle-Market Banks.

Bulge-Bracket and Middle-Market Banks offer the full spectrum of Advisory and Capital Raising services.

Bulge-Bracket Banks focus on Medium/Large-Sized clients whereas Middle-Market Banks serve Small/Medium-sized clients.

In contrast, Elite Boutiques typically focus on Advisory services for Medium/Large-sized clients.

Finally, while the functions of Industry ‘Coverage’ Groups and ‘Product’ Execution Groups may overlap depending on the bank, in the end, each bank is typically offering some combination of Advisory and Capital Raising services.

We hope that by breaking down the basic groups within Investment Banks, their core services, and the types of firms, we have given you a better understanding of how these firms operate.

Let us know in the comments below if you have any questions!

What Is An Investment Bank – Animated Explainer Video

If you enjoyed this article, check out our Animated Explainer Video on What Is An Investment Bank?

You can find more videos just like this on our YouTube Channel.

Related Links

- Walk Me Through a DCF in 5 Steps – The Ultimate Guide (2021)

- Hedge Funds vs Mutual Funds Made Easy – Definitive Guide (2021)

- Walk Me Through an LBO in 6 Steps – The Ultimate Guide (2021)

About the Author

Mike Kimpel is the Founder and CEO of Finance|able, a next-generation Finance Career Training platform. Mike has worked in Investment Banking, Private Equity, Hedge Fund, and Mutual Fund roles during his career.

He is an Adjunct Professor in Columbia Business School’s Value Investing Program and leads the Finance track at Access Distributed, a non-profit that creates access to top-tier Finance jobs for students at non-target schools from underrepresented backgrounds.

Frequently Asked Questions

Investment Bankers operate in two major areas: Advisory and Capital Raising for Corporate Clients.

In many ways, they are very similar to a Real Estate agent. However, Investment Bankers advise on transactions with Businesses (as opposed to Houses).

Investment Bankers advise their clients on the purchase and sale of companies (‘Mergers and Acquisitions’ or ‘M&A’)and help clients if they run into Financial Distress.

Bankers also help clients raise Investor (‘Equity’) and Lender (‘Debt’) capital.

Investment Bankers are typically paid a small percentage of the purchase/sale value in an M&A transaction or a percentage of the money raised in an Equity or Debt deal.

Investment Bankers are very similar to Real Estate agents.

Real Estate agents advise their clients on the purchase and sale of a house.

They often also help their clients to secure funding from lenders (the ‘Mortgage’) to fund the purchase of their house.

Investment Bankers do all of the above but with the purchases and sales of entire Businesses (instead of houses).

Businesses of all sizes from start-ups to large corporations are the primary clients of Investment Banks.

Investment Banks also offer services for large investment firms like Private Equity Funds, Hedge Funds and Mutual Funds.

The admissions process for a job in Investment Banking is incredibly competitive with acceptance rates below 5% for most top-tier firms.

The two primary entry points into the Investment Banking Career Path are at post-undergraduate (‘Analyst’) level and at the post-MBA (‘Associate’) level.

To break in you’ll typically need to attend a top-tier school targeted by Investment Banks or do extensive networking from a ‘Non-Target School.‘

Investment Banks enable purchase and sale transactions of Businesses of all sizes that can re-shape entire industries.

They also help ensure a smoothly functioning Capital Market with their Capital Markets and Sales and Trading divisions.

The Investment Banking Career Path can be highly lucrative with Junior Investment Bankers at top-tier firms often making $150-200K (USD) per year right out of undergrad.

Senior Bankers can make over $1 million with top-performing bankers clearing $5-10 million or more per year.

2 Comments