Investment Banks Reject

99% of Candidates. Get A Playbook That Has Helped Thousands Break In.

Stop memorizing formulas and start thinking like a banker. Get Interview Ready with visual frameworks from a veteran of UBS LA (now Moelis LA), Golden Gate Capital, HIG, and a $2B hedge fund.

No academic theory, just 15+ years of deal and investing experience delivered in plain English.

Mike Kimpel

Founder, Finance|able • Columbia Business School Faculty

- Average IB Analyst Salary

- $150K-200K+

- Course Hours

- 20+

- Lessons

- 100+

- Students Trained

- 10,000+

Where Our Students Work

“Helped me get a bulge bracket offer”

“Used this course to directly answer multiple questions in my bulge bracket IB superday. Anybody who wants to break into IB needs to take this course to successfully ace your interviews.”

Dylan K.

J.P. Morgan

“Best Prep For Superdays”

“Coming from a non finance background, this course truly helped me get up to speed on valuation methodologies. Mike does an incredible job with explaining key concepts at a high level and challenging you along the way.”

Marcelo S.

Carlyle Group

“In Layman’s term”

“This was the first course that really explained valuation concepts to me, where I was able to understand them! Never experienced something like this.”

Michael P.

Barclays

“So thorough!”

“This course does a great job on expanding basic accounting principles in a way that is comprehensible and thorough. I was able to learn so much new content without getting overwhelmed!”

Rashmi M.

J.P. Morgan

The Wall Street Recruiting Game

Is Rigged Against You

Breaking into investment banking can feel impossible. You’re competing with candidates who have perfect GPAs and test scores and the acceptance rates are 1-3% at best.

Legacy finance training from large Wall Street training firms promises to ‘prepare you for IB’…then buries you in problems you didn’t know existed.

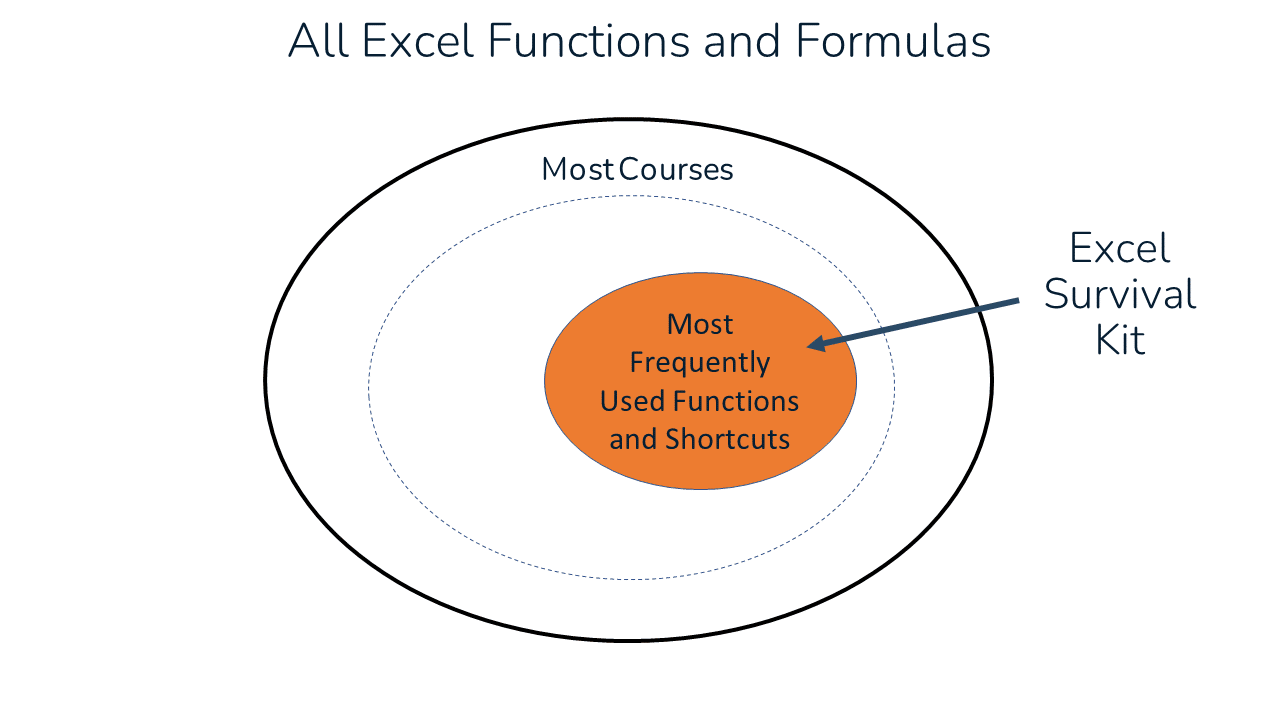

Problem #1: Information Overload

Legacy training firms sell you on sheer volume, burying you in ‘comprehensive’ content, which is really just a bloated curriculum padded with arcane edge-case scenarios you’ll never encounter. By the time you’re reaching for an advil, you’re $500 in and it’s too late.

They force you through 5-7 hour accounting courses upfront. Your brain is fried by the time you’re done, and you still can’t visually explain how the Three Statements Connect without frantically checking your notes.

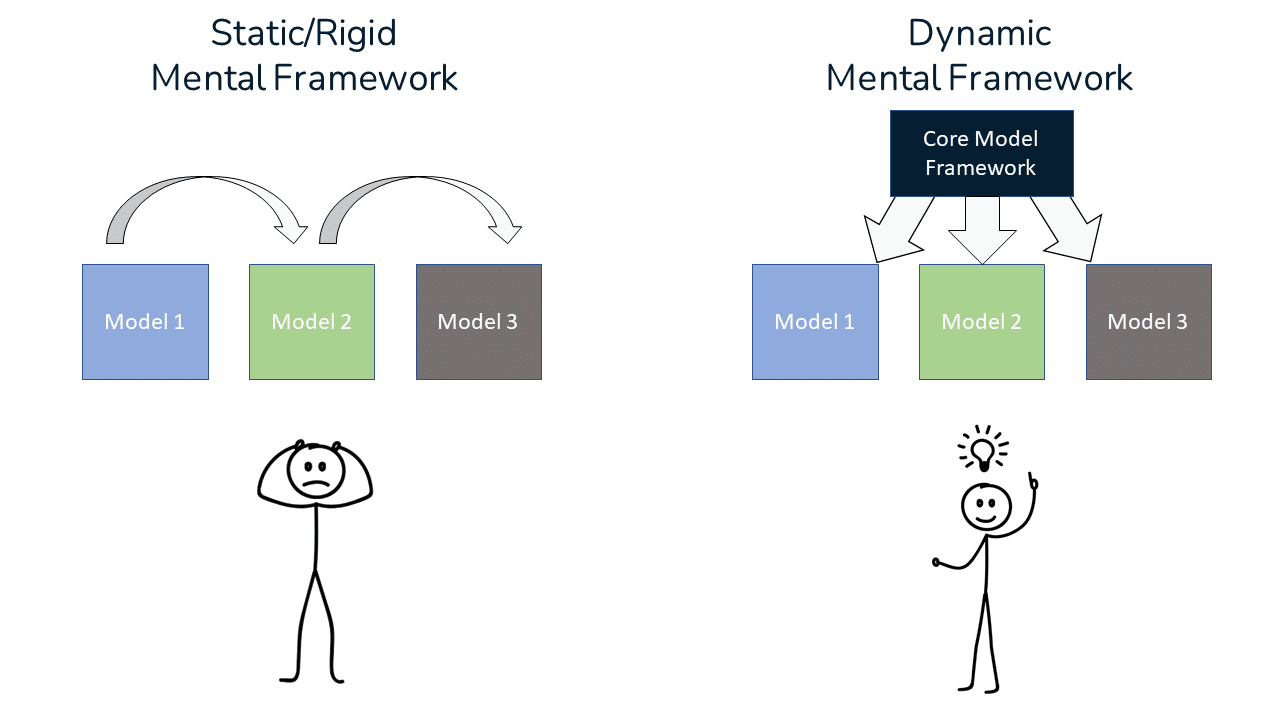

Problem #2: Static, Outdated Content

Most courses teach finance like it’s a 1995 textbook: flat, text-heavy slides narrated by a late-90’s style audio voiceover.

You can’t ‘see’ how the three statements connect by reading bullet points. You can’t internalize accretion/dilution by staring at formulas.

Your brain needs to SEE concepts in motion, not memorize static definitions.

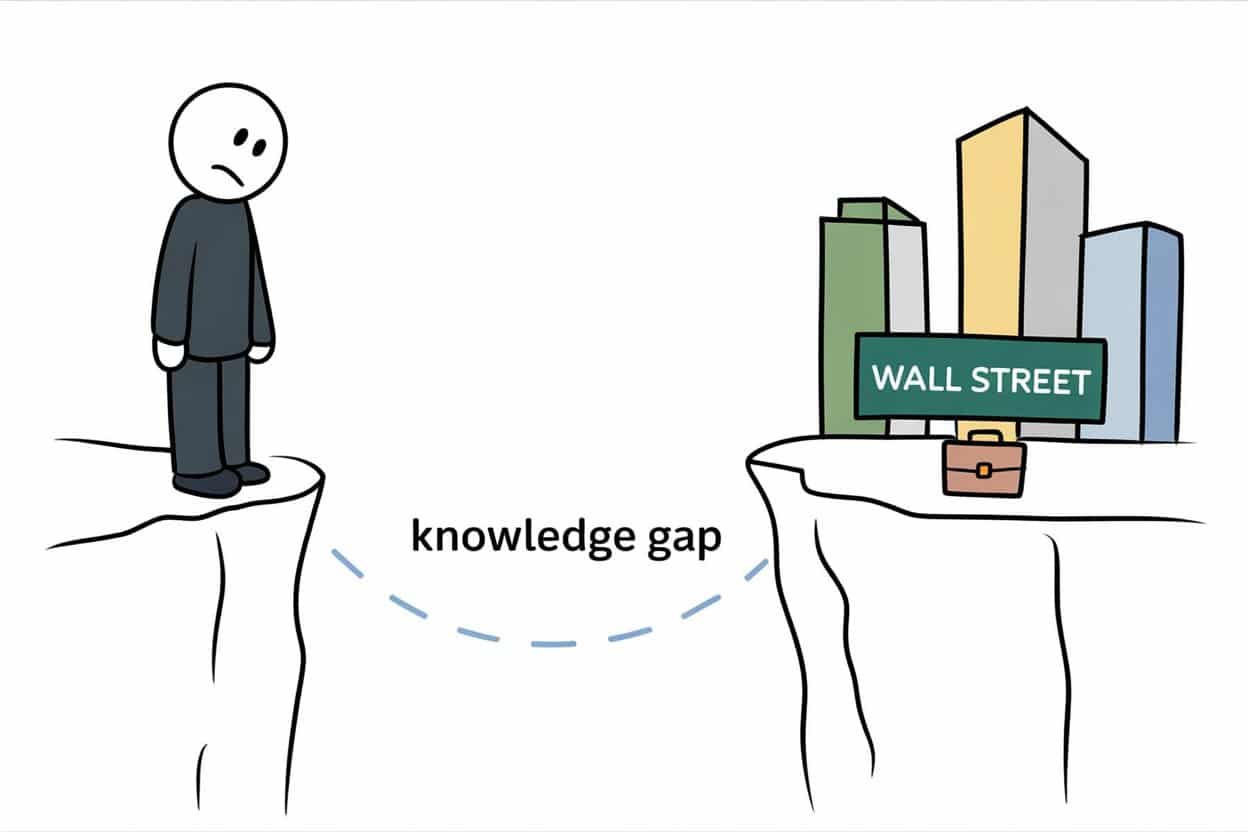

Problem #3: The Information Gap: Why Mechanical Training Falls Short

Most competitor courses are built by instructors whose experience ended after the Analyst years. They know the basic mechanical motions, but they never gained the seasoned professional’s perspective that shows you what truly matters and why.

What you receive is purely first-order training: a collection of facts and formulas that miss the point. You’re given tools but not the context for using them.

This absence of senior insight prevents them from teaching the second- and third-order solutions that define an elite analyst.

That’s exactly why Mike built the Investment Banking: Interview Ready Package.

Dynamic Systems Approach

Go Beyond Formulas. Build the Visual Intuition to Tackle Any Concept in Interviews or on the Job.

Here’s what most courses get wrong: they teach you WHAT to know, but not HOW to think.

They give you formulas to memorize

We give you frameworks to internalize

Dynamic models that work for ANY situation

INTERVIEW READY FRAMEWORKS

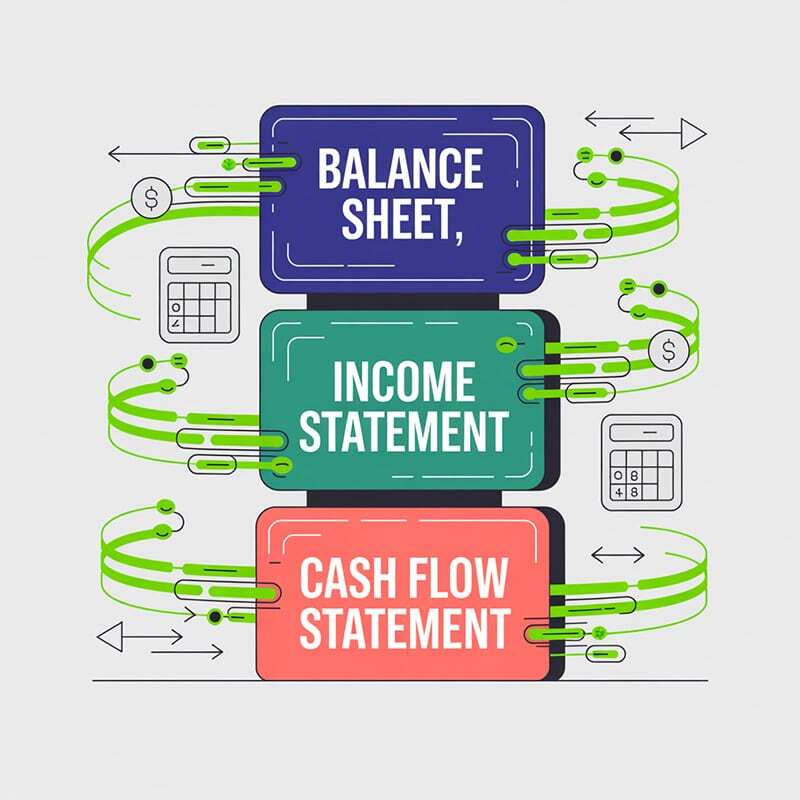

Accounting: The 3-Statement Connection Map + 4-Step Process

You don’t need to memorize hundreds of rules. You need a framework. We give you a simple Connection Map to visualize the flow, paired with a 4-Step Process that you can apply to any 3 statement impacts accounting question. You’ll go from dreading these questions to hoping they ask them.

Sample Interview Question:

‘Walk me through how $10 of PIK Interest flows through the three financial statements.’

Accounting: 2×2 Matrix Systems

Sources & uses of cash and gain/loss accounting are two areas where most candidates get tripped up. We replace the confusion with a set of proprietary 2×2 matrices that lock in the logic to make otherwise complex concepts easy.

Sample Interview Questions:

‘If deferred revenue increases by $10 million, does that increase or decrease our cash flow?’

‘If I pay off a $100 loan at $90, what’s the impact to the financial statements?’

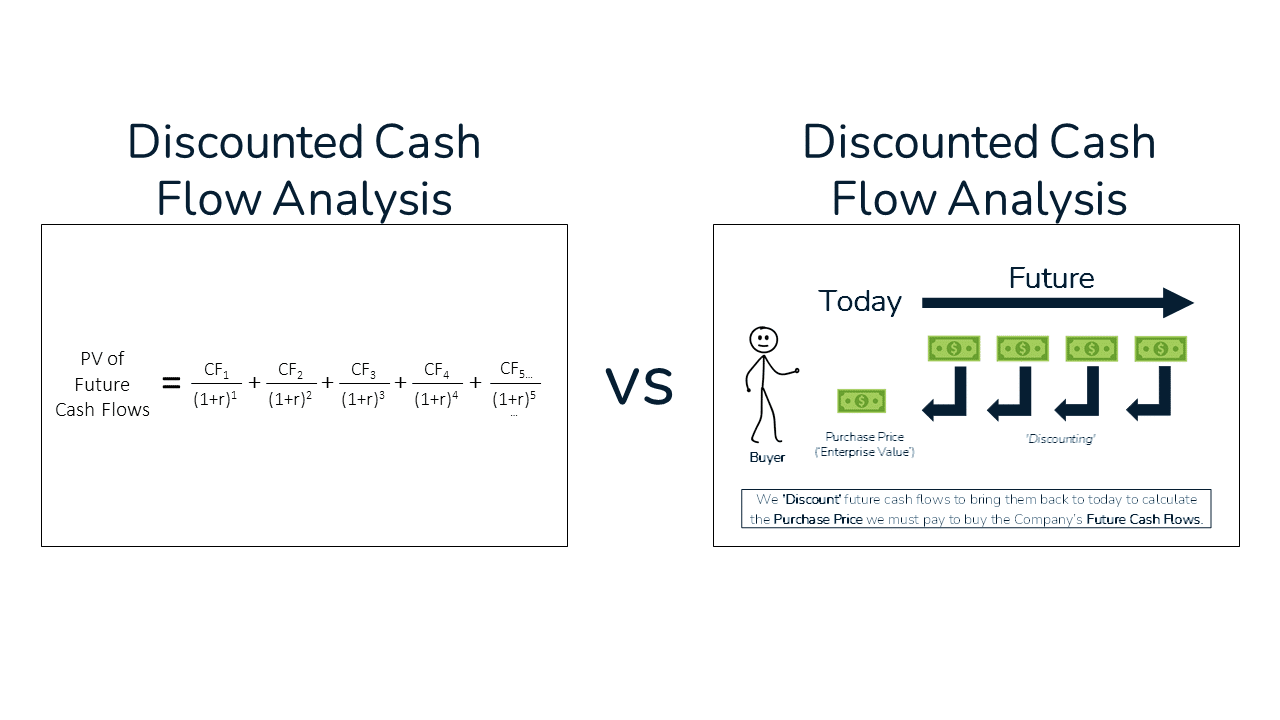

Valuation: The DCF to Multiples Bridge

Most courses teach discounted cash flow (DCF) and comparable multiples as separate islands. In reality, they are deeply connected. We teach you to interpret them side-by-side. We teach you to instantly diagnose discrepancies by linking DCF to Multiples in a single mental map.

Sample Interview Question:

‘Two companies are in the same industry, Company A and Company B, trade at 15x and 10x EBITDA, respectively. Please explain the discrepancy.’

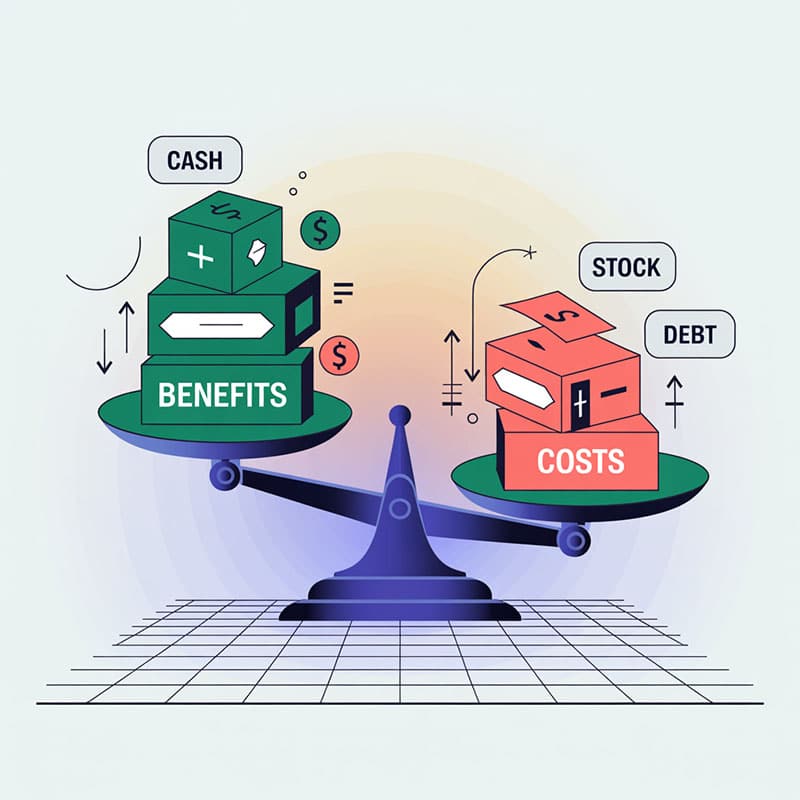

M&A: The Accretion/Dilution Scale

You don’t need Excel to know if an M&A deal works. You just need to weigh the factors. We teach you M&A accretion and dilution analysis through a simple visual scale with eight factors. If you can balance a scale in your head, you can run a merger model without a spreadsheet. No tricky math needed.

Sample Interview Question:

‘A company with a P/E of 20x acquires a company with a P/E of 10x using mixed funding (50% Debt / 25% Cash / 25% Equity). Assume 5% cost of debt, 1% cost of cash, and a 20% tax rate. Is the deal accretive or dilutive?’

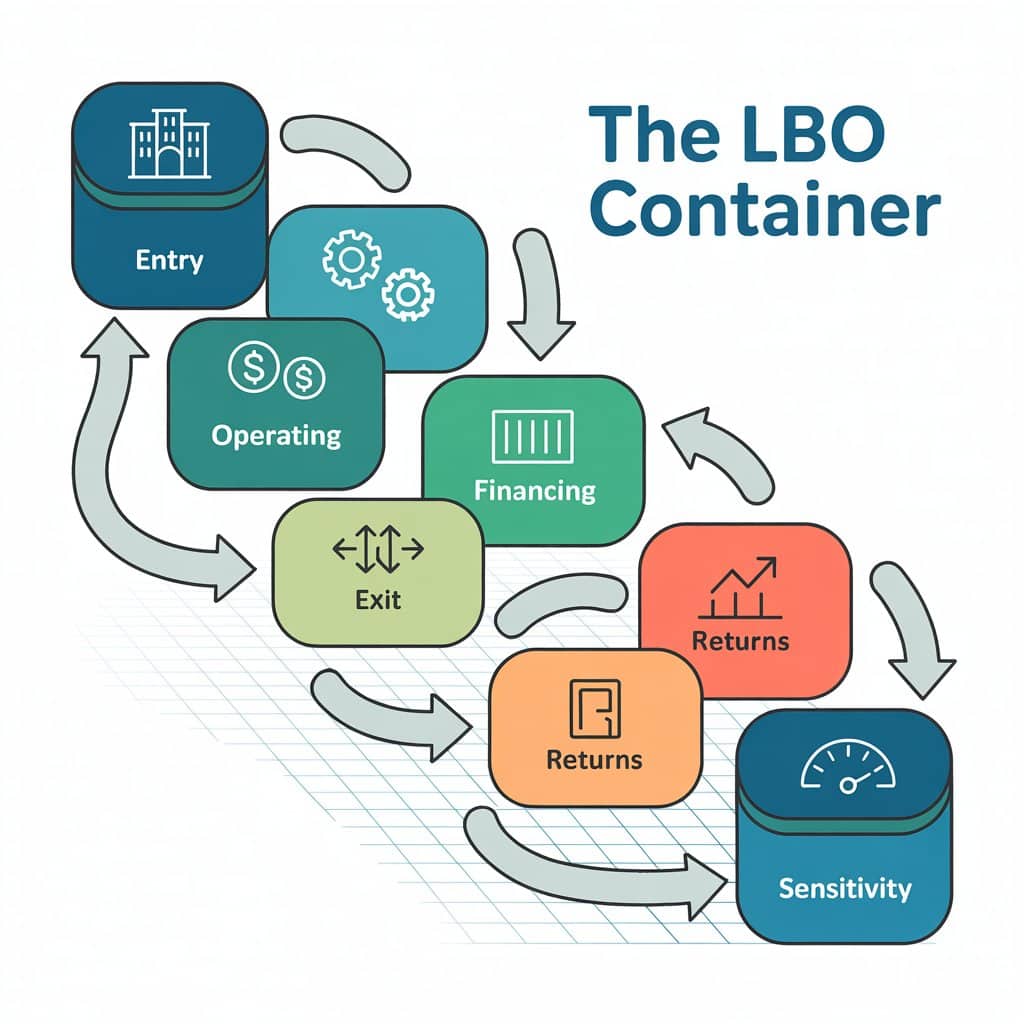

LBO: The 6-Step Core Framework

LBOs can feel overwhelming at first glance. To make it worse, most courses bury you in debt schedules and pro forma balance sheets until you lose sight of the big picture. We give you a 6-step container that organizes the chaos, which is the exact mental map senior professionals use to evaluate LBOs.

Sample Interview Question:

‘If you had to choose between a dollar of EBITDA expansion and a dollar of incremental cash flow over the life of an LBO, which would you choose and why?’

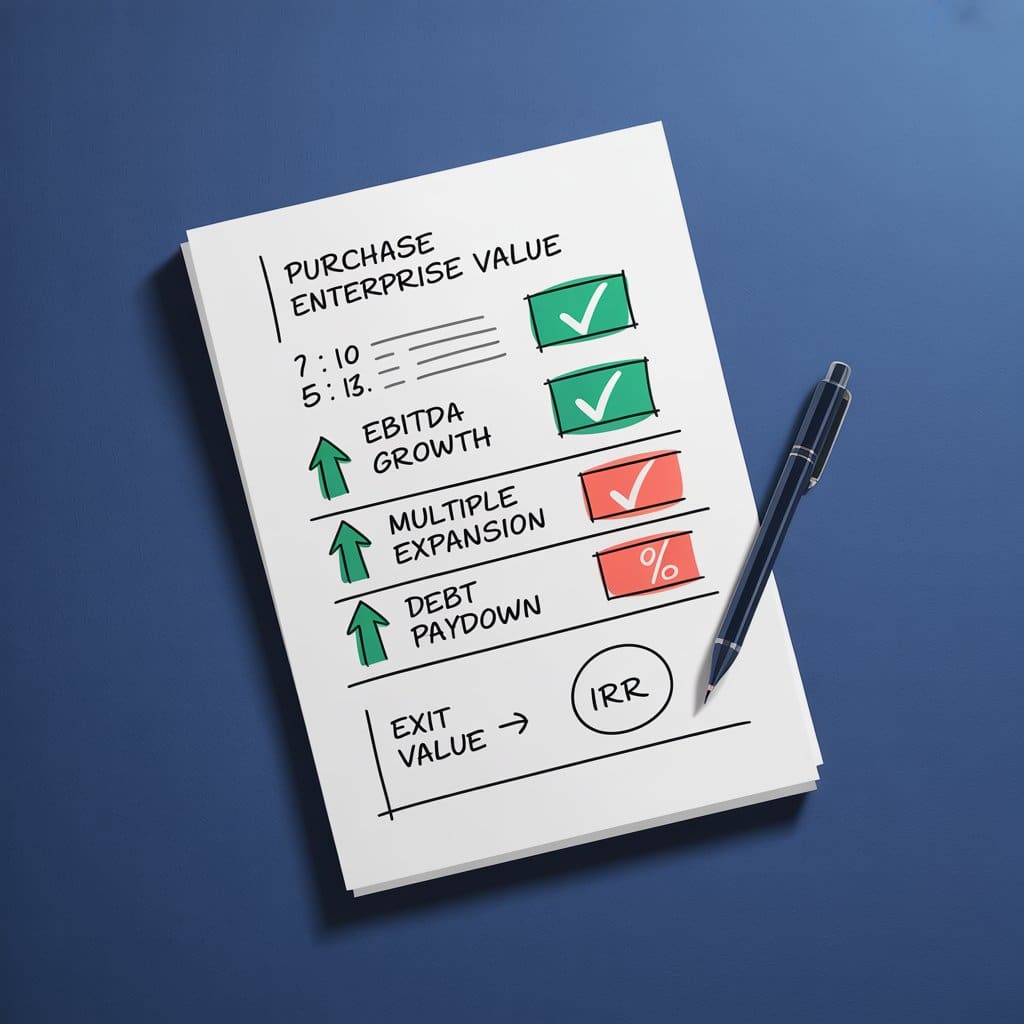

LBO: Step-By-Step Paper LBO Flow

The ‘Paper LBO’ is a high-pressure test where you must calculate a full LBO with just a pen and a paper. We give you a simplified, handful-of-steps process to organize your thoughts and work through the math on the page so you can tackle these exercises with confidence.

How Finance|able Compares to Legacy Training

| Feature | Finance|able | Legacy Training |

|---|---|---|

| Learning Method | Motion-based visual systems | Static slides + audio |

| Mental Models | Dynamic, visual frameworks to tackle any problem | Memorize Formulas |

| Interview Prep Focus | Embedded after every chapter + psychology tactics | Separate Guides |

| Interview Focus | Master core concepts for interviews | Training from 20 Years Ago |

| Teaching Style | Real person on camera (Mike) | Audio voiceover on slides |

‘We continue to be baffled by financial analyst programs that boast about 5-10+ hours of content in a single course…in a world where attention spans are shrinking by the minute.’

As Mark Twain said: ‘I apologize for such a long letter, I didn’t have time to write a short one.’

Don’t worry, you won’t need 70+ hours to master IB fundamentals with our courses. We’ve done the hard work of distilling what actually matters.

— Mike Kimpel, Founder, Finance|able

Why This Works:

Legacy Wall Street training firms will teach you the formulas. We teach you how to THINK like a banker.

Most courses build around one company case. Our dynamic frameworks work for ANY company, tech, healthcare, industrials, doesn’t matter.

You’ll hold these mental maps in your head during interviews. You won’t fumble through memorized facts when the VP twists the question. You’ll think dynamically, answer confidently, and land the offer.

Interview-Ready in Weeks

The Investment Banking Interview Ready Package gives you everything you need to ace your interviews.

INTERVIEW-READY

Master every core concept in record time. Answer technicals with confidence, not memorization. Walk into your interviews with unshakeable confidence.

- Three-statement connections? You’ll see the motion in your head.

- Accretion/dilution scenarios? You’ll think in terms of the scale.

- Paper LBO? Use the step-by-step flow.

Handle curveball questions by thinking dynamically, not freezing when the question isn’t in the guide everyone memorized.

And with embedded interview questions after every single chapter so you know exactly where you stand.

“Used this course to directly answer multiple questions in my bulge bracket IB superday. Anybody who wants to break into IB needs to take this course to successfully ace your interviews.”

— Dylan K., Analyst

J.P. Morgan

Everything You Need to Get Interview Ready

7 comprehensive courses to take you from zero to interview ready

1. IB Interview Prep: Start Here

Your roadmap to interview success. Mike walks you through the prep timeline, networking strategies, and behavioral frameworks used by students who land BB/EB/MM offers.

2. Accounting Fundamentals

See debits and credits flying across the screen with real-time animations. Learn how the three statements connect, not through memorization, but through easy-to-follow visual mental models.

3. Valuation Fundamentals

Learn a first-principles based approach to Discounted Cash Flow Analysis (DCF) and how to interpret it side-by-side with Multiples. Navigate any variation of interview questions and explain your answers in Plain English, while others just recite memorized definitions.

4. M&A Fundamentals

Stop memorizing corner case-scenarios for all-stock deals. We give you one mental model that allows you to analyze any accretion/dilution problem in your head, no matter how the deal is funded. Visualize the scale, weigh the factors, and solve it instantly.

5. LBO Fundamentals

Learn the 6-Step Core Framework that organizes the chaos of a buyout into a simple step-by-step process where you simply can’t get lost. You will understand the mechanics so deeply that you’ll be running circles around your peers in technical interviews.

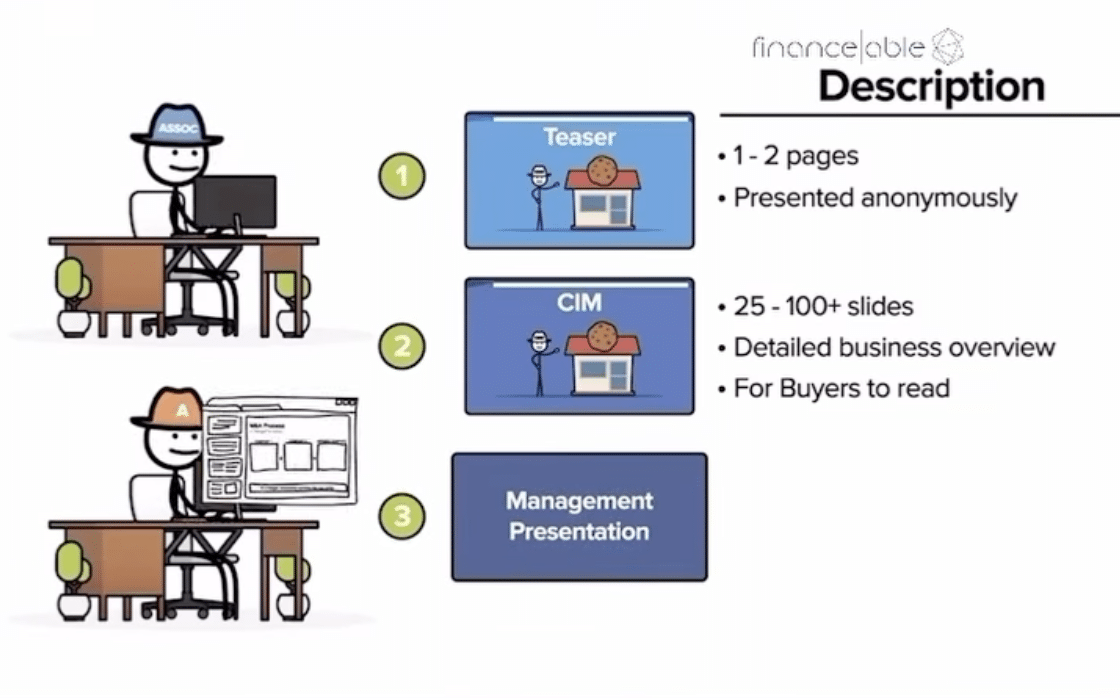

6. Sell-Side M&A in Real Life

Get a massive advantage by understanding how the M&A process works on the job. You’ll learn the deal process from front to back, pitch books to closing docs, so you can speak to the job in a way none of your peers will be able to.

7. Accounting Deep Dive

Master the curveball topics that trip up other candidates, like Lease Accounting and Gains & Losses. We simplify confusing topics enabling you to answer these complex questions with absolute clarity.

8. IB Interview Fine-Tuning

Tackle the advanced accounting and valuation questions that are particularly common in Elite Boutique interviews. Plus, we break down the intimidating Paper LBO into a repeatable 6-step process so you can calculate returns on a napkin without blinking.

PLUS: You Also Get

- Blockchain Verified Certificate of Completion (add to LinkedIn)

- Lifetime access (with $375 option)

- All future course updates

- Interview prep materials embedded throughout

Total Value: $800 if purchased individually

Bundle Price: $375 lifetime / $249 yearly

Your Savings: $425 lifetime / $390 yearly

Certificate of Completion Included

Certificate of Completion

Investment Banking Interview Ready Package

Finance|able • Instructed by Mike Kimpel

Add to LinkedIn, include in networking outreach, and demonstrate structured, practitioner-led preparation.

Why the certificate matters

Top-tier banks receive hundreds of applications from lookalike candidates. Your certificate signals:

-

Structured preparation:

You invested in a comprehensive, practitioner-built curriculum, not random YouTube playlists.

-

Practitioner mentorship:

Mike’s background across IB, PE, and hedge funds, and nine years at Columbia, backs your story.

-

Interview-ready commitment:

You’ve invested in comprehensive, structured preparation for your IB interviews.

How students use it:

- • Add to LinkedIn’s ‘Licenses & Certifications’ section with the verification link.

- • Mention in outreach emails: ‘I completed Finance-able’s IB Interview Ready Package to ensure I’m geared up for IB interviews.’

- • Reference in interviews when telling your preparation story.

Invest in Your IB Career Today

Two options. Same comprehensive training. You choose what works best.

YEARLY ACCESS

$249/year

- Full access for 12 months

- All 8 Interview Ready courses included

- Certificate of completion

- All future updates during access period

- Stream on any device

- Interview prep materials

LIFETIME ACCESS

$375 one-time

- Unlimited lifetime access

- All 8 Interview Ready courses included

- Certificate of completion

- All future updates forever

- Stream on any device

- Interview prep materials

- Best value for serious students

The Math Is Simple:

IB Analyst Year 1 Comp: $150-200K+

Investment: $375 one-time

ROI: 400x in Year 1 alone

This might be the best investment you ever make.

Target or Non-Target, Our Students Get Offers

“Helped me get a bulge bracket offer”

“Used this course to directly answer multiple questions in my bulge bracket IB superday. Anybody who wants to break into IB needs to take this course to successfully ace your interviews.”

Dylan K.

J.P. Morgan

“Best Prep For Superdays”

“Coming from a non finance background, this course truly helped me get up to speed on valuation methodologies. Mike does an incredible job with explaining key concepts at a high level and challenging you along the way.”

Marcelo S.

Carlyle Group

“BEST CONTENT TO PREP FOR IB”

“Have worked two summers in M&A (one in PE and one with MM IB). This simulation teaches you everything you need to know to put you miles ahead of your class.”

Myles O.

“Best Accounting Introduction Course”

“Coming from a non traditional academic background, this was for me the best course on the market. Anyone interested in deepening their understanding and beginning their professional development should start here!”

Jonathan A.

“In Layman’s term”

“This was the first course that really explained valuation concepts to me, where I was able to understand them! Never experienced something like this.”

Michael P.

Barclays

“So thorough!”

“This course does a great job on expanding basic accounting principles in a way that is comprehendible and thorough. I was able to learn so much new content without getting overwhelmed!”

Rashmi M.

J.P. Morgan

“Most easy to understand valuation course I’ve ever used!”

“This course helped me prepare for interviews. It is so easy to follow, engaging, and makes valuation an easy concept to grasp. I watched this before an interview to remind myself about the fundamentals and it helped me so much!”

Financ|eable Student

“Hands down the best way to learn!”

“Mike’s simple, step-by-step teaching process helped simplify intimidating LBO concepts and made learning much more digestible compared to other courses I have taken.”

Connor N.

Bank of America

Learn From Someone Who’s Worked in Every Major Area of Finance (IB/PE/HF)

Finance changed my life…full stop.

I wasn’t supposed to make it on Wall Street. Non-target school, no family connections, had to figure it all out myself.

But once I got in, UBS Investment Banking, Golden Gate Capital, HIG Capital, a hedge fund that grew to $2B, I saw something clearly:

The way finance is taught is broken.

Static slides. Formula memorization. Zero focus on how the job actually works.

I spent 15 years building pitch books, running deals, analyzing companies across every industry you can imagine. I taught at Columbia Business School for nearly a decade and have trained 10,000+ students across a variety of roles, including as Managing Partner at Wall Street Prep.

And I kept hearing the same thing: ‘This is the first time someone explained it so I actually GET it.’

That’s why Finance|able exists. To teach finance the way it SHOULD be taught, visually, practically, and in Plain English.

Not because I’m a genius. Because I’ve been in the trenches. And I know what you actually need to succeed.

A Unique Perspective

Investment

Banking

Private

Equity

Mutual

Fund

Hedge

Fund

Professor + Professional Trainer

I have accumulated a unique range of experiences as a practitioner and teacher across the core areas of top-tier Finance.

In Finance|able’s courses, I tie these experiences together to help students see each situation from buy-side, sell-side, and operating roles using time-tested methods from over a decade and a half working and teaching on Wall Street.

You’ll learn to be much more than just Mechanics with our training.

Mike’s Background:

Investment Banking

UBS LA (run by Ken Moelis)

Private Equity

Golden Gate Capital ($15B AUM) – Principal

Private Equity

HIG Capital ($42B AUM) – Vice President

Hedge Funds

Long/short equity fund (grew to $2B)

Columbia Business School

Adjunct Faculty (9 years)

Wall Street Prep

Managing Partner

Total AUM Across Firms: $49B+

Professional Experience

| Investment Banking | |

| Private Equity | |

| Hedge Fund | |

| Mutual Fund | |

| Operating |

Teaching Experience

| Adjunct Professor | |

| Private Equity: Megafund | |

| Private Equity: Small Cap → Upper MM | |

| Investment Bank: Bulge Bracket | |

| Investment Bank: Elite Boutique | |

| Investment Bank: Middle Market | |

| Hedge Fund | |

| Mutual Fund |

Your Brain Learns Better When It SEES Concepts in Motion

Most finance courses teach you like it’s 1995 with static slides, audio voiceovers, and walls of text.

Research shows that visuals and animations are far more effective when you’re dealing with holistic systems.

When you SEE debits and credits flying across the screen in our accounting course, your brain builds a mental map. The concept sticks.

When you WATCH the accretion scale tip from benefits to costs in real-time, you internalize how M&A deals work. You don’t just memorize, you understand.

This isn’t just ‘pretty animations’ for the sake of design. It’s empirically-backed learning that ensures you learn faster and retain more than with other programs.

And when you’re sitting in that Goldman Sachs superday and the VP twists the question?

You don’t panic. You don’t freeze. You don’t fumble through memorized facts.

You see the framework in your head. And you answer with confidence.

“I’ve never experienced something like this before.”

Recurring feedback

“Your accounting course is fun.”

Yes, we made accounting fun.

“Where did you learn all that?”

What interviewers ask our students

See The Difference For Yourself

Don’t take our word for it. Watch actual samples from the course and see why students call our approach ‘unlike anything else.’

Sample Lesson #1: The Three Financial Statements

Watch how income statement, balance sheet, and cash flow statement connect dynamically, not through static formulas.

Sample Lesson #2: DCF Basics

Instead of memorizing formulas, you’ll see the DCF process in motion.

“When you mentioned that there’s nothing out there like this, I thought you meant you just had a better understanding of accounting than others, but the Financ|eable platform is actually one of a kind. The mini quizzes and visuals are amazing and they’re a perfect way to learn.”

Early Financ|eable User

Frequently Asked Questions

Q: How is this different from Wall Street Prep or Breaking Into Wall Street?

A: Three major differences:

(1) Visual, animated learning. You see concepts in motion rather than staring at static slides from the 90s.

(2) Unrivaled Practitioner Experience. The only curriculum holistically crafted by an instructor with a background in IB, PE, and Hedge Funds, showing you exactly what matters and why.

(3) Dynamic Frameworks. You gain the ability to tackle any scenario through logic, rather than relying on memorized facts and corner-case rules.

Q: I’m from a non-target school. Will this help me compete?

Absolutely. The vast majority of our prior students come from non-target schools and regularly beat out candidates from target schools (e.g., Wharton, Harvard, etc.) for roles at Goldman Sachs, Morgan Stanley, Evercore and many others.

But this isn’t just for the underdog. It works for everyone.

This visual learning approach levels the playing field for everyone, replacing ‘pedigree’ with a deeper level of ability than you’ll gain with any other prep program.

Q: Do I need any prior finance knowledge?

A: No. All of our courses are built with beginners in mind. The only assumption we make is that you can handle basic arithmetic, we take care of the rest.

We explain everything in Plain English without the jargon walls, creating a learning experience that students actually enjoy rather than dread.

Q: Will this prepare me for both BB and boutique banks?

A: Yes. The frameworks work universally, Goldman Sachs, Morgan Stanley, Lazard, Evercore, Houlihan Lokey, doesn’t matter.

The fundamentals are the same. The interview styles may vary slightly (some banks love paper LBOs, others focus on case studies), but the technical foundation is identical.

Q: Do I get lifetime access?

A: With the $375 option, yes, lifetime access to all courses, any updates we make, and any new content we add to the bundle.

The $375/year option gives you 12 months of access with the ability to renew annually.

IB Recruiting Timeline: Next Wave Starts in 4-6 Weeks

For undergraduates: Junior year spring recruiting begins January-April for summer analyst roles. This year however some recruiting will occur in December.

For MBA students: Fall recruiting kicks off October-November for summer associate roles.

If you’re recruiting this cycle, starting prep now gives you the runway you need to be competitive.

The students who land offers at Goldman, Morgan Stanley, and Evercore? They started prepping 6 weeks or more before interviewing. They didn’t wait until the week before superdays.

Ready to Land Your Dream IB Role?

Join thousands of students who’ve used Finance|able to break into top-tier finance careers.

Learn from someone who’s actually been there, UBS, Golden Gate Capital, HIG Capital. Visual frameworks, dynamic mental models, and interview-ready training.

You don’t need a perfect background. You don’t need connections. You just need the right training and the drive to succeed.

Let’s get you interview ready.

Questions? [email protected]